Thesaurus : Doctrine

► Full Reference: E. Maclouf, "Entités industrielles et Obligation de compliance" ("Industrial Entities and Compliance Obligation"), in M.-A. Frison-Roche (ed.), L'Obligation de Compliance, Journal of Regulation & Compliance (JoRC) and Dalloz, "Régulations & Compliance" Serie, 2025, to be published

____

📕read a general presentation of the book, L'Obligation de Compliance, in which this article is published

____

► Summary of this article (done by the Journal of Regulation & Compliance - JoRC) : This article looks at the topic Industrial Entities and Compliance Obligation from the perspective of Management Science and sets out to resolve the paradox of industrial organisations expressing the ambition of progress for the benefit of people, a humanist ambition that is contradicted by the effects produced by this industrialisation itself, which are harmful to that same humanity. The Compliance Obligation, insofar as it is based on the Monumental Goals and is anchored in Industrial Organisations, aims to resolve this paradox.

The science of human organisations aims to allocate nature's scarce resources as efficiently as possible by getting individuals to cooperate, this engineering producing natural, industrial and social disasters, which are themselves more or less anticipated. The Compliance Obligation holds out the hope of better preventing them (Negative Monumental Goal) and managing them, or even improving people's lives (Positive Monumental Goal) by going beyond traditional disciplines and developing Ex Ante. However, Industrial Organisations may also reject the weight of the constraints that this creates for them, calling for deregulation instead. The debate is currently open.

Furthermore, by moving from the mechanical logic of conformity to the dynamic logic of the Compliance Obligation, companies find themselves in a situation of systemic uncertainty and must decide on the strategy to be implemented, resulting in a managerialisation of the Law and implying many new decisions to be taken. The notion of "project" is therefore back at the heart of Industrial Organisations, and more specifically that of "Humanist Project", as embodied by the Compliance Obligation, in a new Organisation where everyone plays their part in the Value Chain.

The author draws on the work of Raymond Aron and the Rueff-Armand report to show that the dynamism and strength of Industrial Organisation can support a Humanist Project that is politically developed and fits in with the Economic Rationality of Industrial Organisations. This is all the more necessary as this Regulatory Framework cannot come from the sum of individual actions alone (employees, consumers, investors), as the interests of the company, of the sector, of society, of nature cannot be served by this addition alone, and the claim that the whole is self-regulated by the expression of a single one of these players (who are themselves both inside and outside the industrial organisation) is unsustainable.

The Author shows that new entities are therefore being created to regulate Industrial Entities in the public interest through the Compliance Obligation, which inserts an Obligation into the Industrial Organisation modifying its project: the French so-called "Sapin 2" law is a perfect example of this, encouraging appropriate strategic responses from Industrial Organisations, which have modified their managerial procedures to integrate new strategic projects and involve stakeholders.

Finally, because the Compliance Obligation is anchored in Monumental Goals, it can be the basis of the Company's Project and the Players' Project of the players, which leads us to return to the basis of the Organisations Theory, which entrusts to the corporate bodies the power and the mission of defining such a project through corporate deliberations which will then be, in the aforementioned approach of Industrial Rationality, broken down into Objectives and Plans. This is a reminder that Profit is not a Company's Goal: it is the sine qua non of its survival, which is different. A Rational Organisation determines its Project and for ensuring it, to achieve it, it must not run the risk of going bankrupt. The Compliance Obligation is developing between this difference and the link between the Project and this necessity to have some profit which is just a Condition. Furthermore, in order to establish this project, the organisation must resolve oppositions (conflictuality) through the complex interplay of players (Jean-Pierre Dupuy).

Industrial organisations must respond to the Compliance Obligation. In particular, they do this by developing norms, or by contributing to the development of public norms, and by themselves expressly aiming Goals such as the fight against suffering in the workplace or equality between men and women as falling within the scope of the Compliance Obligation. This framing work is an essential part of the organisation's strategy, and environmental concerns can thus be integrated to a greater or lesser extent into this or that perspective. All this goes beyond the mere logic of conformity.

The Compliance Obligation thus enables the production of what the Author calls "adaptive responses by individuals in the face of Systemic Crises and their causes", countering the Anomie which is also a monumental problem in today's society, which has lost its bearings and is suffering from Uncertainty. This Compliance Obligation enables Industrial Entities to integrate into Society, if necessary by coercion, by becoming the vectors of human rights and social and environmental expectations. But the success of this Compliance Obligation presupposes a certain appropriation of the Goals by the scales companies, which taints the Compliance Obligation itself with Uncertainty.

___

🦉This article is available in full text to those registered for Professor Marie-Anne Frison-Roche's courses

________

Compliance and Regulation Law bilingual Dictionnary

Banks are regulated because they do not engage in an ordinary economic activity, as their are likely to create systemic risk. In the real economy indeed, banks play the role of providing credit to entrepreneurs who operate on the markets for goods and services. These credits are mainly financed through deposits made by depositors and, to a lesser extent, by shareholders (i.e., capitalists). That is how liberalism and capitalism are bound up. However, banks also have the power to create money by the book entries they make when they grant loans ('book money'). As such, the banks share with the State this extraordinary power to exercise monetary authority, which some describe as sovereign power. It is possible that the digital eventually calls this power into question, since the Regulation currently hesitates to seize control over new instruments that are called "virtual currency" and that are used as proper "currency" or as an ordinary instrument for cooperative relation.

Banks' prominent sovereign character justifies, first and foremost, that the State is granted the power to choose the institutions which benefit from the privilege of creating book money- in this regard, the banking industry has always been a monopoly. Hence, Banking Regulation is first an ex ante control to enter the profession, and also a careful monitor of the people and institutions that claim they are in.

In addition, banks and credit institutions lend more money than their own funds can allow: the whole banking system is necessarily based on the trust that each creditors place within the bank, including depositaries who leave their funds at the banks' disposal for it to use them. That is where Bank Regulation intervenes to establish what is called 'prudential ratios', i.e., ratios that ensure the soundness of the institution by determining the amount of money that banks can lend based on the equity and quasi-equity they actually have.

Moreover, banks are constantly monitored by their supervisory Regulator, the Central Bank (in France, the Banque de France) that ensures the safety of the whole system by setting the State as the lender of last resort. This can, however, incentivize a large financial institution to take excessive risks based on its reliance on the fact that the State will save it eventually- that is what the 'moral hazard' theory systematized. All monetary and financial systems are built on these central banks that are independent from governments, which are far too reliant on political strategies and which cannot generate the same trust that a Central Bank inspires. Since the missions of central banks have increased over the years, and since the notions of Regulation and Supervision have come together, we tend to consider that Central Banks are now fully fledged Regulators.

Besides, Banking Regulation has become all the more central since banking is no longer primarily about loaning but rather about financial intermediation. Banking Regulation and Financial Regulation are mixing. In Europe , European Central Bank is in the center.

Blog

La presse britannique, par exemple The Guardian, se fait l'écho de la position britannique offensive en matière de régulation financière.

La régulation épousant les contours de son objet, la régulation financière et bancaire est nécessairement en grande partie mondiale. En outre, la régulation est certes une question pratique mais aussi le résultat d'une théorie. Or, les britannique sont souvent précurseurs en la matière.

Ils ont d'autant plus les moyens de faire passer leurs idées que ce sont des britanniques qui occupent les postes-clés dans la régulation mondiale. Ainsi, c'est Monsieur Mark Carney, Gouverneur de la Banque d'Angleterre, qui préside en outre le Conseil de la Stabilité Financière, organisme mondial qui élabore des normes visant à éviter les crises systémiques.

Ainsi, les décisions mondiales sont prises par les Etats, à l'occasion des G20. Une réunion du G20 va se tenir à la fin du mois de novembre en Australie, en présence de tous les institutions financières internationales.

Mais la doctrine britannique se diffuse depuis longtemps. Comme souvent, elle est claire, nette et pédagogique : les Etats ne doivent plus toujours payer, alors même que les banques doivent être secourues. La solution est alors que les créanciers privés qui apportent des fonds à une banque systémique en péril doivent recevoir en échange des titres et non plus demeurer dans la situation confortable du créancier qui attend que la banque, souvent refinancée par ailleurs par l'Etat, soit revenue à meilleure fortune.

Cela montre en premier lieu que la faillite des banques redevient plus "ordinaire", la règle de l'Etat débiteur en dernier ressort s'éloignant, du fait de l'aléa moral qu'elle contient par nature et de l'épuisement financier des Etats. Cela illuste en second lieu que la régulation bancaire devient de plus en plus un droit des procédures collectives, plus ou moins spécifiques.

Oct. 2, 2025

Thesaurus : Doctrine

► Full Reference: A.-C. Rouaud, "L’intensité de l’obligation de vigilance selon les secteurs : le cas des opérateurs financiers" (The intensity of the obligation of vigilance depending on the sector: the case of financial operators), in M.-A. Frison-Roche (dir.), L'Obligation de Compliance, Journal of Regulation & Compliance (JoRC) an Dalloz, coll. "Régulations & Compliance", 2024, forthcoming

____

📕read the general presentation of the book, L'Obligation de Compliance, in which this contribution is published

____

► English summary of this contribution (done by the Journal of Regulation & Compliance - JoRC) : The author develops the case of financial operators and shows that if they are subject to very heavy obligations of vigilance, it is above all because of the systemic risks of the markets, obligations which are consubstantial with their activities, because these operators are often in charge of market infrastructures or operating services, which make them all belong to the category of regulated professions.

Despite this uniqueness, the obligation of vigilance has many facets, ranging from policing and customer surveillance to warning and protection, which can be very limited, as the fight against money laundering aims to protect the system (kyc).

In addition, this obligation to exercise vigilance serves different goals, which explains the diversity of sanctions, because the intensity of the obligation also varies. The fight against systemic risk is certainly a common goal, but there are also concerns about protecting specific categories, such as investors (from a more European perspective).

However, the general interest is now being renewed, as market protection is coupled with a concern for Sustainability. This is reflected in the variability of sanctions, ranging from disciplinary sanctions, handled by the financial markets regulatory bodies, to the obligation to put in place compliance programmes against which breaches are sanctioned per se. Private enforcement is developing in tandem with public enforcement, with a transformation of the litigation risk for companies, which is highly sensitive to extraterritoriality and the scope of soft law.

________

Sept. 4, 2025

Thesaurus : Doctrine

► Référence complète : M. Françon, "L’intensité du devoir de vigilance dans le secteur bancaire", in M.-A. Frison-Roche (dir.), L'Obligation de Compliance, Journal of Regulation & Compliance (JoRC) et Dalloz, coll. "Régulations & Compliance", 2025, sous presse.

____

📕lire une présentation générale de l'ouvrage, L'Obligation de Compliance, dans lequel cet article est publié

____

► Résumé de l'article (fait par le Journal of Regulation & Compliance - JoRC) : L'auteur développe le cas des opérateurs bancaire et d'assurance. Il insiste sur le fait qu'en matière bancaire et d'assurance, la vigilance consiste dans une obligation de traiter des informations, au besoin préalablement collectées, en vue de prévenir la survenance d'un risque systémique.

L'identification et la prévention du risque est une obligation de moyens renforcée qui, dans ce cadre, connaît des variations d'intensité. L'obligation est ancienne, alors que le devoir de vigilance est récent. Ce décalage dans le temps s'explique parce que la vigilance obligée est consubstantielle à l'activité même du banquier et de l'assureur et du fait du caractère systémique du secteur depuis toujours, ce qui produit une imbrication du droits dur et souple.

Les variations de l'intensité de l'obligation de vigilance tiennent quant à elles au fait qu'il y a deux types d'obligations : celles qui sont imposées dans l'intérêt de l'activité et du client et celles qui le sont dans l'intérêt de la stabilité du système. Les secondes sont beaucoup plus fortes que les premières. Elles pèsent aussi bien sur le banquier que sur le client. Ainsi les obligations en matière de blanchiment ont pour seul but l'intérêt général, le client ne pouvant se prévaloir des manquements de la banque (Com. 28 avril 2004). D'ailleurs, en matière de gel des avoirs, l'obligation de vigilance devient de résultat.

Dans l'intérêt général lui-même, l'intensité varie en fonction des buts poursuivis, engendrant des vigilances "standard, simplifiée, renforcée", en fonction du risque sous-jacent. En outre, des droits interférents font varier l'obligation, notamment la protection des droits à la protection des données personnelles, ou le droit à la non-immixtion du banquier. Enfin, interfèrent les obligations de vigilance pesant sur les tiers, y compris situés hors de l'Europe.

________

🦉Cet article est accessible en texte intégral pour les personnes inscrites aux enseignements de la Professeure Marie-Anne Frison-Roche

________

________

Sept. 4, 2025

Thesaurus : Doctrine

► Full Reference: M. Lamoureux, "L’obligation de vigilance des opérateurs énergétiques", in M.-A. Frison-Roche (dir.), L'obligation de Compliance, Journal of Regulation & Compliance (JoRC) and Dalloz, coll. "Régulations & Compliance", 2024, to be published

____

📕read the general presentation of the book, L'obligation de Compliance, in which this contribution is published

____

► English summary of this article de l'article (done by the Journal of Regulation & Compliance - JoRC): Firstly, the author shows, despite the diversity of energy activities (electricity by its very nature involves fewer international value chains, oil by its very nature involves more), the operators in this sector are sufficiently unique to justify their being considered globally in terms of vigilance obligation. Currently in French case law, they are directly concerned, not only because they have been summoned before the French courts in duty of vigilance cases, but also, and above all, because they are a sign of the intensity of the vigilance expected of them.

The first part of the article develops the characteristics of energy operators, which influence the intensity of the obligation of vigilance. Their uniqueness stems precisely from the enterprises themselves, which are 'giants', subject to the obligation to draw up vigilance plans, firms often vertically integrated, in a sector concentrated on multinationals with very substantial resources and present throughout the value chain, whose activity involves infrastructures.

The second part of the article justifies this intensity of the obligation of vigilance by the risks specifically linked to the activities of these energy operators. Indeed, even if it is true that their activity is very heterogeneous, the risks are very significant, in that on the one hand they build diverse and gigantic infrastructures, are involved in extractive activity, and on the other hand have a long-term impact on the environment. Firms are being asked to be vigilant themselves about these infrastructures and impacts. The administrative police have been doing this for a long time in this sector.

But the third part of the article shows precisely that this is nothing new: the culture of risk prevention is already very present in these enterprises, not least because of the very strong presence of the State and regulations. There is a culture of 'regulatory conformity'. In fact, climate vigilance relies mainly on these operators.

Energy operators are therefore at the centre, not only because they generate risks, but also because they hold many of the solutions for achieving the Monumental Goals targeted by the vigilance system: they are making a decisive contribution to the fight against climate change because they have the means to do so. This is one of the reasons why the major operators have all adopted a raison d'être.

________

Aug. 29, 2025

Publications

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐subscribe to the Video Newsletter MAFR Surplomb

🌐subscribe to the Newsletter MaFR Droit & Art

____

► Full Reference: M.-A. Frison-Roche, Compliance Law and Systemic Litigation, Working Paper, August 2025.

► Full Reference: M.-A. Frison-Roche, Compliance Law and Systemic Litigation, Working Paper, August 2025.

____

📝 This bilingual Working Paper is the basis of the article published in French "Droit de la compliance et contentieux systémique"

____

► Summary of this Working Paper: Legal systems have changed, and Compliance Law, in its uniqueness, reflects this change and plays a powerful role in it. New sets of compliance rules, particularly at European Union level, covering data protection (GDPR), anti-money laundering (AMLA), climate balance protection (CS3D) and banking and financial system sustainability (Banking Union), have been developed and imposed on large companies, which must implement them: alerts, mapping, assessment, sanctions, etc. These new regulatory frameworks only make sense in relation to their ‘Monumental Goals’: to detect systemic risks ex ante and prevent crises so that the systems in question do not collapse, but ‘last’. All the legal instruments in the corpus are normatively rooted in these monumental goals, which are the core that unifies Compliance Law (I).

The judge is the guardian of this new and highly ambitious regulatory framework, which relies on the practical ability of companies to implement it (II). Courts ensure that the legal technical provisions are applied in a teleological manner in each of these compliance blocks and that the regulations support each other, because all compliance regulations serve the same systemic goal: to ensure that the systems (banking, financial, climate, digital, energy, etc.) do not collapse, but sustains, and that present and future human beings are not crushed by them, but rather benefit from them. This unity is still little perceived because so meticulous regulations pulverise this profound unity of Compliance Law into a myriad of changing provisions. Entrusting the ‘regulatory mass’ to algorithms increases this fragmentation, making the whole even more incomprehensible and therefore impossible to handle. On the contrary, recognising the judge's place, i.e. at the centre, makes it possible to master this new branch of law. But the judge's sole function is not to restore clarity to a body of law covered by the dust of its own technicality.

There is a transfer to Litigation of the systemic object of Compliance Law. Indeed, the litigation that emerges from the new Compliance Law is itself fundamentally new, by transitivity. Indeed, the purpose of Compliance Law is to make systems sustainable (or resilient, or robust, depending on the terminology used). This results in litigation that is itself ‘Systemic Litigation’ (III), most often brought by an organisation against a systemic operator. The place and role of each party are transformed (IV).

____

🔓read the developments below⤵️

Dec. 10, 2024

Thesaurus : Doctrine

► Référence complète : Giuliani G. Castellano, " Don’t Call It a Failure: Systemic Risk Governance for Complex Financial Systems", Law & Social Inquiry, vol. 49, n°4, novembre 2024, pp. 2245-2286

____

► Résumé de l'article :

____

🦉Cet article est accessible en texte intégral pour les personnes inscrites aux enseignements de la Professeure Marie-Anne Frison-Roche

________

Dec. 7, 2024

Law by Illustrations

► Référence complète : M.-A. Frison-Roche., "Description d'un risque systémique : Description d'un risque systémique : 🎬𝑲𝒆𝒓𝒗𝒊𝒆𝒍 - 𝒖𝒏 𝒕𝒓𝒂𝒅𝒆𝒓 - 𝟓𝟎 𝒎𝒊𝒍𝒍𝒊𝒂𝒓𝒅𝒔", billet décembre 2024.

🎞️voir le film-annonce

___

Dans le documentaire proposé en novembre 2024 par la chaîne Max, le propos est de décrire ce qui est présenté comme l'engrenage déclenché par le comportement solitaire d'un trader, Jérôme Kerviel, sur l'ensemble de la banque Société générale.

On y voit et on y écoute tous les protagonistes s'exprimer en français, doublés en anglais, le quartier de La Défense faisant le fond du décor, pour préserver le marché financier d'une crise systémique.

____

June 22, 2024

Thesaurus : Soft Law

► Référence complète : Autorité de contrôle prudentiel et de résolution (ACPR), Les assureurs français face aux risques liés à la perte de biodiversité : Enjeux et enseignements pour les organismes et leur supervision, Étude, juin 2024.

____

________

May 27, 2024

Conferences

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

____

► Full Reference: M.-A. Frison-Roche, "Le Contentieux Systémique Emergent du fait du système numérique ("emerging systemic litigation arising from the digital system"), in Les contrôles techniques des risques présents sur les plateformes et les contentieux engendrés (Technical controls on the risks present on platforms and the disputes that arise), in cycle of conferences-debates "Contentieux Systémique Émergent" ("Emerging Systemic Litigation"), organised on the initiative of the Cour d'appel de Paris (Paris Cour of Appeal), with the Cour de cassation (French Court of cassation), the Cour d'appel de Versailles (Versailles Court of Appeal), the École nationale de la magistrature - ENM (French National School for the Judiciary) and the École de formation des barreaux du ressort de la Cour d'appel de Paris - EFB (Paris Bar School), under the scientific direction of Marie-Anne Frison-Roche, May 27,2024, 9h-10h30, Cour d'appel de Paris, Cassin room

____

🧮see the full programme of this event

____

____

🔲see the slides (in French), basis of this conference

____

🌐read on LinkedIn the summary of this conference les slides

____

🎤read the presentation of the second conference in this manifestation: "Un contentieux systémique in vivo : le cas dit des sites pornographiques" ("a Systemic Litigation in vivo: the case of pornographic prestations platforms")

____

____

____

► Summary of this conference: This speech is a prelude to the three more specific speeches and aims to show how the digital system, by its very nature, produces and will produce "Systemic Litigation".

Systemic Litigation" is defined by "cases" (a procedural notion) brought before judges, who may be judges of first instance, or possibly emergency judges, in which the interests, or even the future, of a system are involved beyond the dispute between the parties.

This Systemic Case may be brought before a specialised judge, including the juridictional body of a Regulatory or Supervisory Authority, but also before a judge of ordinary Law, on the basis of a special text but possibly on the basis of a text of ordinary Law. This can lead to a fragmentation of litigation, even though the unity of the system remains, or even is at stake, in the present and in the future.

The "digital system" is an example of the "natural" production of Systemic Litigation which arise as a result of the Digital System alone, in particular because of the systemic risks inherent in this system, and the fact that their prevention and management are internalised in the operators who have built and manage the system (Compliance Law). The issue is therefore one of Interregulation.

Platforms in particular give rise to Systemic Litigation because of the specific nature of certain risks, for example disinformation, terrorism, destruction of rights (copyright being just one example), the risk of minors having access to content that is destructive for them, and so on.

Digital Systemic Litigation has only just begun.

It is essential that judges are prepared for this and that they face up to it together through dialogue.

________

May 22, 2024

Interviews

► Full reference: M.-A. Frison-Roche, "Compliance et management : la médiation plutôt que la sanction ?" ("Compliance and management: mediation rather than punishment?"), interview conducted by Jean-Philippe Denis as part of a series of interviews on Compliance Law, in Fenêtres ouvertes sur la gestion (Open windows on management), broadcast by J.-Ph. Denis, Xerfi Canal, recorded December 12, 2023, released on May 22, 2024

____

🌐consult the December 2023 presentation of the interview on LinkedIn

____

🌐read the MAFR. Law, Compliance, Regulation of April 2024 based on this interview

____

🧱consult the general presentation of this series of interviews on Compliance Law

____

🎥view the full interview on Xerfi Canal

____

► Starting point: Since 2016, Marie-Anne Frison-Roche has been building Compliance Law, notably through a collection co-published in French with Editions Dalloz and co-published in English with Editions Bruylant:

🧱lire la présentation de la collection en langue française, Régulations & Compliance ➡️click HERE

🧱read the presentation of the series in English, Compliance & Regulation ➡️click HERE

____

► Summary of interview:

Jean-Philippe Denis. Question: To put it bluntly, isn't Compliance Law expressed by the BNP Paribas fine?

Marie-Anne Frison-Roche. Answer: It is still through this fine that Compliance is often perceived. How regrettable...

____

Jean-Philippe Denis. Q.: At least, that's how the Politician realised there was a subject....

Marie-Anne Frison-Roche. A. : This is true, and not just for politicians and firms since this case has had an impact on European public opinion. This matter has therefore become known for the violence of the sanctions, and the intervention of heads of State to reduce their consequences. But we're talking about sanctions. Meanwhile, others talk about compliance through soft law, soft co-regulation, charters and soft commitments, the contours of which are sometimes uncertain. Today, adjustments are made regarding the Monumental Goals of preserving the systems on which this Compliance Law is based, and tools are used on this basis, tools with which lawyers are very familiar: contracts. Through contracts, enterprises structure their compliance obligations.

____

Jean-Philippe Denis. Q.: You point out that Compliance Law is becoming more civilised and that more people are resorting to mediation.

Marie-Anne Frison-Roche. A.: Yes, Compliance Law is becoming more civilised, and civil law is becoming increasingly important, particularly through Contract Law, with stipulations being inserted to prevent human rights or environmental infringements. As Compliance Law operates on an ex-ante basis, the enterprise will organise dialogue with stakeholders, in particular when vigilance plans are drawn up, Vigilance mechanism being the spear head of Compliance Law. If the situation becomes litigious and the matter is referred to the courts, the civil courts, whose role is growing, will themselves organise mediation. Mediation, which is now part is an instrument for bringing the parties together and finding solutions.

________

April 4, 2024

Publications

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

____

► Full Reference: M.-A. Frison-Roche, "Le rôle du juge dans le déploiement du droit de la régulation par le droit de la compliance" ("Synthesis: The role of the Judge in the deployment of Regulatory Law through Compliance Law"), Synthesis in Conseil d'État (French Council of State) and Cour de cassation (French Court of cassation), De la régulation à la compliance : quel rôle pour le juge ? Regards croisés du Conseil d'Etat et de la Cour de cassation - Colloque du 2 juin 2023, La Documentation française, "Droits et Débats" Serie, 2024, pp. 173-182

____

____

🚧read the bilingual Working Paper which is the basis of this article, with additional developments, technical references and hyperlinks

____

► Presentation of this concluding article: It is remarkable to note the unity of conception and practice between professionals who tend to work in administrative jurisdictions and professionals who tend to work in judicial jurisdictions: they all note, in similar terms, an essential movement: what Regulatory Law is, how it has been transformed into Compliance Law, and how in one and even more so in the other the Judge is at the centre of it.

Judges, as well as Regulators and European officials, explain this and use different examples to illustrate the far-reaching changes it brings to the Law and to the companies responsible for increasing the systemic effectiveness of the rules through the practice and dissemination of a Culture of Compliance.

The role of the judge participating in this Ex Ante transformation is renewed, whether he/she is a judge of Public Law or a judge of Private Law, in a greater unity of the legal system.

____

► English Summary of this article: The tug-of-war between 'Compliance' and 'conformity', which is exhausting us, obscures what is essential, i.e. the great novelty of a branch of law that assumes a humanist vision expressing the ambition to shape the future so that it is not catastrophic (preventing systems from collapsing), or even better (protecting human beings in these systems).

The article begins by describing the emergence of Compliance Law, as an extension of Regulatory Law and going beyond it. This new branch of law takes account of our new world, brings its benefits and seeks to counter these systemic dangers so that human beings could be their beneficiaries and are not crushed by them. This branch of Ex Ante Law is therefore political, often supported by public Authorities, such as Regulatory Authorities, but today it goes beyond sectors, as shown by its cutting edge, the Obligation of Vigilance.

The "Monumental Goals" in which Compliance Law is normatively anchored imply a teleological interpretation, leading to an "empowerment" of the crucial operators, not only States but also companies, responsible for the effectiveness of the many new Compliance Tools.

The article goes on to show that Judges are increasingly central to Compliance Law. Lawsuits are designed to make companies more accountable. In this transformation, the role of the judge is also to remain the guardian of the Rule of Law, both in the protection of the rights of the defence and in the protection of secrets. Efficiency is not what defines Compliance, which should not be reduced to a pure and simple method of efficiency, which would lead to being an instrument of dictatorship. This is why the principle of Proportionality is essential in the judge's review of the requirements arising from this so powerful branch of Law.

The courts are thus faced with a new type of dispute, of a systemic nature, in their own area, which must not be distorted: the Area of Justice.

____

📝read article (in French)

________

March 29, 2024

Organization of scientific events

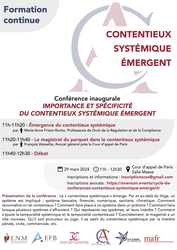

► Full Reference: Importance et spécificité du Contentieux Systémique Émergent (Importance and specificity of the Emerging Systemic Litigation), in cycle of conference-debates "Contentieux Systémique Émergent" ("Emerging Systemic Litigation"), organised on the initiative of the Cour d'appel de Paris (Paris Cour of Appeal), with the Cour de cassation (French Court of cassation), the Cour d'appel de Versailles (Versailles Court of Appeal), the École nationale de la magistrature - ENM (French National School for the Judiciary) and the École de formation des barreaux du ressort de la Cour d'appel de Paris - EFB (Paris Bar School), under the scientific direction of Marie-Anne Frison-Roche, March 29, 2024, 11h-12h30, Cour d'appel de Paris, Masse room

____

► Presentation of the conference-debate: The "Systemic Litigation" is emerging. Through and beyond the dispute, a system is involved: the banking, financial, digital, health and climate systems. How can such litigation be recognised? How do you make room for a system in a court of law? What can be done when several systems are in conflict? Who represents these systems and their interests? How can the temporality of systems and litigation be reconciled? In practical terms, the magistrate has a new role. Whether they are prosecutors or judges, they deal with systemic litigation in criminal, civil, commercial and other areas.

____

🎤see the detailed presentation of the first speech of 🕴️Marie-Anne Frison-Roche : L'émergence du Contentieux Systémique (The Emergence of Systemic Litigation)

____

🧮Programme of this event:

Inaugural Conference

IMPORTANCE ET SPÉCIFICITÉ DU CONTENTIEUX SYSTÉMIQUE ÉMERGENT

(IMPORTANCE AND SPECIFICITY OF THE EMERGING SYSTEMIC LITIGATION)

Cour d’appel de Paris (Paris Court of Appeal), Masse room

🕰️11h-11h20. 🎤L’émergence du contentieux systémique (The Emergence of the Systemic Litigation), by 🕴️Marie-Anne Frison-Roche, Professor of Regulatory and Compliance Law, Director if the Journal of Regulation & Compliance (JoRC)

🕰️11h20-11h40. 🎤L’office du magistrat du parquet dans le contentieux systémique (The role of the Public Prosecutor in Systemic Litigation), by 🕴️François Vaissette, Avocat général près la Cour d’appel de Paris (Advocate General at the Paris Court of Appeal)

🕰️11h40-12h30. Debate

____

🔴Registrations and information requests can be sent to: inscriptionscse@gmail.com

🔴For the attorneys, registrations have to be sent to the following address: https://evenium.events/cycle-de-conferences-contentieux-systemique-emergent/

⚠️The conference-debates are held in person only, in the Cour d’appel de Paris (Paris Court of Appeal).

____

🧮Read below a detailed presentation of this event⤵️

________

March 29, 2024

Conferences

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

____

► Full Reference: M.-A. Frison-Roche, "L’émergence du Contentieux Systémique" ("Emergence of the Systemic Litigation"), in Importance et spécificité du Contentieux Systémique Émergent (Importance and specificity of the Emerging Systemic Litigation), in cycle of conferences-debates "Contentieux Systémique Émergent" ("Emerging Systemic Litigation"), organised on the initiative of the Cour d'appel de Paris (Paris Cour of Appeal), with the Cour de cassation (French Court of cassation), the Cour d'appel de Versailles (Versailles Court of Appeal), the École nationale de la magistrature - ENM (French National School for the Judiciary) and the École de formation des barreaux du ressort de la Cour d'appel de Paris - EFB (Paris Bar School), under the scientific direction of Marie-Anne Frison-Roche, March 29, 2024, 11h-12h30, Cour d'appel de Paris, salle Masse

____

🧮see the full programme of this event

____

🧮see the programme of the entire cycle Contentieux Systémique Émergent

____

🌐consult on LinkedIn the report of this speech (in French)

____

🌐consult on LinkedIn a general présentation of this event, which links to a presentation and a report of each speech (in French)

____

____

🔲see the slides used to support this intervention (in French)

____

🚧read the bilingual Working Paper which is the basis of this speech

____

► English Summary of the conference: We are seeing the emergence of what should be referred to as a category of its own: the "Systemic Litigation". This concept, proposed in 2021📎

These systems may be of different kinds: banking, financial, transport, health, energy, digital, algorithmic or climatic. Their presence in cases brought to the attention of judges, the variety and difficulties of which will be seen in later contributions, leads to basic questions relating to the emergence of Systemic Litigation: firstly, how can Systemic Litigation be defined? Secondly, what makes this category of litigation emerge? The answers to these two questions have essential practical consequences.

The new solutions must be based on a classic distinction, used in particular in criminal and administrative proceedings, which are more objective, but also in civil proceedings, notably by Hébraud, namely the distinction between the "party to the dispute/litigation" and the "party to the proceedings". Depending on whether it is accepted that the system should be considered as a "party to the litigation", which would allow it, through an entity that is legitimate in expressing it, to allege claims and formulate demands against an adversary, or as a "party to the proceedings", a much broader category, which would allow the judge to hear the interests of the systems involved without individuals being able, on behalf of a system, to formulate claims against or for the benefit of a party to the litigation.

This makes it possible to innovate while preserving the measure of which the judge is the guardian.

________

March 28, 2024

Publications

🌐suivre Marie-Anne Frison-Roche sur LinkedIn

🌐s'abonner à la Newsletter MAFR Regulation, Compliance, Law

____

► Référence complète : M.-A. Frison-Roche, L'émergence du Contentieux Systémique, document de travail, mars 2024.

► Référence complète : M.-A. Frison-Roche, L'émergence du Contentieux Systémique, document de travail, mars 2024.

____

🎤 Ce document de travail a été élaboré pour servir de base à la 1ière intervention, relative à "L'émergence du Contentieux Systémique", dans la conférence-débat sur Importance et spécificité du Contentieux Systémique Émergent , qui s'est tenue à la Cour d'appel de Paris le 29 mars 2024.

____

📝Il est aussi la base de l'article qui s'en suivra.

____

► Résumé du document de travail : Nous voyons émerger ce qu'il convient d'émerger un "Contentieux Systémique". Cette notion, proposée en 2021, vise l'hypothèse dans laquelle un système est "impliqué" dans une "cause" particulière soumise au juge. Il ne faut confondre présence d'un système et analyse systémique d'un phénomène. Le terme de "cause" doit être entendu au sens procédurale, tel que l'article 5 du Code civil l'utilise. Précisément, la prohibition portée par l'article 5 du Code civil ne s'applique pas parce qu'un système ainsi impliqué appelle des réponses et des solutions de fait et non pas nécessairement des solutions générales et abstraites : la solution de nature et de portée systémique que la présence d'un système dans une cause appelle peut être une solution de fait, même si elle irradie l'ensemble du système en cause. Mais précisément parce que la présence d'un système dans la cause entraîne souvent une question elle-même systémique, le juge s'il veut respecter l'article 4 du Code civil y répondre, non pas seulement a minima en n'éludant pas la question, par exemple celles des risques systémiques, mais encore pleinement en apporter des solutions systémiques, par exemple des remédiations pour préserver à l'avenir la solidité et la durabilité des systèmes impliqués dans le cas.

Ces systèmes peuvent être de différente nature : bancaire, financier, transport, sanitaire, énergétique, numérique, algorithmique ou climatique. Leur présence dans des cas portés à la connaissance des juges, dont la variété et les difficultés seront vus dans des contributions ultérieures, amènent à des questions de base relative à l'émergence du Contentieux Systémique : en premier lieu, comment peut-on définir le Contentieux Systémique ? En second lieu, qu'est-ce qu'il fait émerger cette catégorie de contentieux ? Des réponses apportées à ces deux questions découlent des conséquences pratiques essentielles.

Les solutions nouvelles doivent être conçues suivant que l'on admet que le système doit être considéré comme une "partie au litige", qui lui permettrait par une entité étant légitime à l'exprimer, d'alléguer des prétentions et de formuler des demandes contre un adversaire, ou comme une "partie à l'instance", catégorie beaucoup plus vaste, qui permettrait au juge d'entendre les intérêts des systèmes impliqués sans que des personnes ne puissent pour autant au nom d'un système formuler des prétentions à l'encontre ou au bénéfice d'une partie au litige.

____

🔓lire le document de travail ci-dessous⤵️

Jan. 12, 2024

Thesaurus : Doctrine

► Référence complète : M. Mekki, "Pour une compliance notariale", JCP N, n° 01-02, 12 janvier 2024, étude n° 1000, pp. 31-34

____

► Résumé de l'article (fait par l'auteur) : "Le droit est souvent appréhendé sous l'angle des risques qu'il crée ou qu'il canalise, cadre dans lequel la logique de compliance, outils de prévention et de gestion des risques systémiques, se déploie de manière exponentielle. Dans ce contexte, le notaire s'impose, en sa qualité d'officier public et ministériel, comme un acteur privilégié non seulement pour conseiller les entreprises qui s'engagent dans cette démarche proactive de compliance, mais également et surtout en sa qualité de gardien, Gatekeeper, enrichissant le service public de la sécurité juridique et numérique d'une nouvelle mission : contribuer à prévenir et à gérer les risques systémiques, dans une logique de régulation, principalement dans le domaine de la lutte contre la corruption, le blanchiment des capitaux et le financement des activités illicites, risques systémiques plus intenses en raison principalement de la dématérialisation des actifs (crypto-actifs) et de l'internationalisation des échanges."

____

🦉Cet article est accessible en texte intégral pour les personnes inscrites aux enseignements de la Professeure Marie-Anne Frison-Roche

________

Oct. 1, 2023

Thesaurus : Doctrine

► Référence complète : J.-C. Roda, "Les obligations environnementales et numériques pesant sur les entreprises : quelle gestion des risques concurrentiels ?", Revue Lamy de la concurrence, n°131, 1er octobre 2023, actualité 4501.

____

► Résumé de l'article (fait par l'auteur) : "Les entreprises cruciales sont aujourd'hui soumises à des obligations de plus en plus lourdes et qui concernent l'environnement et le numérique. Le franchissement de seuils de « taille » oblige désormais ces acteurs à se plier à la logique de la vigilance et de la compliance. De telles obligations ont un impact concurrentiel, surtout si l'on envisage les choses sous l'angle de la concurrence mondialisée. Comment, dès lors, les entreprises concernées peuvent-elles réagir, pour transformer la contrainte en un nouveau départ ? Celui-ci est-il envisageable ? Faut-il faire acte de résilience ou de résistance ?"

____

🦉Cet article est accessible en texte intégral pour les personnes inscrites aux enseignements de la Professeure Marie-Anne Frison-Roche

________

Sept. 7, 2023

Publications

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

____

► Full Reference: M.-A. Frison-Roche, "Droit de la compliance et climat. Pour prévenir le risque et construire l'équilibre climatiques" ("Compliance Law and climate. Prevent the climate risk and build the climate balance"), in M. Torre Schaub, A. Stevignon and B. Lormeteau (ed.), Les risques climatiques à l'épreuve du droit, Mare & Martin, coll. "Collection de l'Institut des sciences juridique et philosophique de la Sorbonne", 2023, pp.73-83

____

📝read the article (in French)

____

🚧read the bilingual Working Paper which is the basis of this article, with additional developments, technical references and hyperlinks

____

► Summary of the article: Compliance Law is beginning to emerge in climate topic, through the expression "Climate Compliance Law", but the climate issue itself is the most perfect example of why General Compliance Law is made for. It is indeed a new branch of Law, a global Law claiming to provide Ex Ante solutions here and now for global issues, so that in the future systemic catastrophies will not occur, will not happen: it is these "Monumental Goals" that give meaning, coherence, and simplicity to Compliance Law.

Compliance Law, linked to the Rule of Law principle, makes it possible to go beyond the choice often presented between the effectiveness of the protection of the planet and the renunciation of freedoms, in particular the freedom to do business and the freedom of individuals, especially the protection of their data.

Climate is thus exemplary of the object of Monumental Goals of Compliance Law (I). The systemic risk that it now constitutes is analogous to Banking or Digital Systemic Risks and therefore calls for the application of identical legal Compliance Tools, formerly put in place for Banking Regulatory and Compliance Law, recently invented for Digital. Compliance Law, extending Regulation Law, itself from the precondition of the Sector and the Territory, is therefore the branch which makes it possible to put in place new legal solutions, either by force (judicial agreements, compliance programs, etc.), or by will (commitments, global charters, etc.).

Therefore, an alliance can exist between political and public authorities, and crucial economic operators (II), that the rise in power of the "raison d'être" is the sight and whose technical challenge is the collection of information that must be put in correlation. Scientists pooling Information, this public good, provided by public and private entities. The courts are at the center of this articulation between Compliance Law and Climate, which object is the Future.

________

June 15, 2023

Thesaurus : Doctrine

► Référence complète : A. Beckers & G. Teubner, Three Liability Regimes for Artificial Intelligence: Algorithmic Actants, Hybrids, Crowds, Pedone, 2018.

____

► Présentation de l'ouvrage (par les auteurs) : This book proposes three liability regimes to combat the wide responsibility gaps caused by AI systems – vicarious liability for autonomous software agents (actants); enterprise liability for inseparable human-AI interactions (hybrids); and collective fund liability for interconnected AI systems (crowds). Based on information technology studies, the book first develops a threefold typology that distinguishes individual, hybrid and collective machine behaviour. A subsequent social science analysis specifies the socio-digital institutions related to this threefold typology. Then it determines the social risks that emerge when algorithms operate within these institutions. Actants raise the risk of digital autonomy, hybrids the risk of double contingency in human-algorithm encounters, crowds the risk of opaque interconnections. The book demonstrates that the law needs to respond to these specific risks, by recognising personified algorithms as vicarious agents, human-machine associations as collective enterprises, and interconnected systems as risk pools – and by developing corresponding liability rules. The book relies on a unique combination of information technology studies, sociological institution and risk analysis, and comparative law. This approach uncovers recursive relations between types of machine behaviour, emergent socio-digital institutions, their concomitant risks, legal conditions of liability rules, and ascription of legal status to the algorithms involved.

April 17, 2023

Newsletter MAFR - Law, Compliance, Regulation

♾️ follow Marie-Anne Frison-Roche on LinkedIn

♾️ subscribe to the Newsletter MAFR Regulation, Compliance, Law

____

► Full Reference: M.-A. Frison-Roche, "Dans les causes systémiques : "délibérer" plutôt que "se disputer"" ("In systemic causes: 'deliberate' rather than 'argue'"), Newsletter MAFR - Law, Compliance, Regulation, 17 April 2023.

____

📧Read by freely subscribing other news of the Newsletter MAFR - Law, Compliance, Regulation

____

🔴To deal with "systemic causes", including systemic cases of compliance, move from "argument" to "deliberation" from the start

Compliance Law involves systems, for example banking, financial, digital, health, etc. When a dispute is brought before a judge, this dimension remains, whether before a judge of the Law or a judge of the merits, whether before a civil, criminal, commercial, administrative or European judge, etc. The judge's office must be adapted accordingly. And this is in the process of being done.

____

📧read the article ⤵️

Feb. 1, 2023

Thesaurus : Doctrine

► Référence complète : G. Loiseau, "Le Digital Services Act", Communication - Commerce électronique, n°2, février 2023, étude 3

____

Résumé de l'article (fait par l'auteur) : "Le règlement (UE) 2022/2065 du 19 octobre 2022, qui entrera en application dans les États membres début 2024, s'attaque aux effets toxiques de l’activité des plateformes, qu'il s'agisse de la diffusion de contenus illicites ou de certaines pratiques, comme la publicité ciblée ou les interfaces trompeuses. Sans rien changer au régime de semi-responsabilité des hébergeurs voulu par la directive du 8 juin 2000, il table, pour lutter contre les contenus illicites, sur la pratique de modération qu’il rend obligatoire sur l’intervention d’un tiers, comptant aussi sur les initiatives des opérateurs techniques qui ont eux-mêmes intérêt à traiter les éléments les plus nocifs. Prescriptif, il fait porter l'effort de réglementation sur les sanctions que les plateformes peuvent décider, sur la motivation de leurs décisions ainsi que sur le traitement interne des réclamations. En complément de l’action ex-post ciblant les contenus illicites, le règlement appréhende certains risques, liés à des pratiques potentiellement nuisibles ou présentant un caractère systémique, dont il dicte la gestion ex-ante par les plateformes.".

____

🦉Cet article est accessible en texte intégral pour les personnes inscrites aux enseignements de la Professeure Marie-Anne Frison-Roche

________

Jan. 15, 2023

Compliance: at the moment

♾️ suivre Marie-Anne Frison-Roche sur LinkedIn

♾️ s'abonner à la Newsletter MAFR Regulation, Compliance, Law

____

► Référence complète : M.-A. Frison-Roche, "Si l'algorithme engendre un risque systémique de fraude, l'entreprise doit trouver le moyen de prévenir et détecter celle-ci : cas d'école", Newsletter MAFR Law, Compliance, Regulation, 15 janvier 2023.

____

Le cas agite et inquiète à juste titre. Il est notamment relayé dans Le Parisien et dans Libération.

Il apparait qu'un professeur de master découvre que la moitié de la promotion de ses étudiants avait fait écrire sa copie par un algorithme (ChatGPT), dont on dit que les productions mécaniques se rapprochent, à s'y méprendre, du "langage naturel", c'est-à-dire manié par les êtres humains. Il en a résulté des copies correctes, mais si identiques que l'usage de l'outil par les étudiants avait été ainsi détecté.

La dimension systémique du phénomène mérite qu'on y réfléchisse car il s'agit non seulement de détecter mais encore de prévenir le recours à cet outil, si l'on veut que les travaux rendus par les étudiants permettent d'évaluer leurs niveaux.

L'on peut certes rechercher des solutions très radicales, comme obliger les étudiants à écrire à la main dans des contrôles faits sur table et surveillés..., ou interdire le recours aux algorithmes, interdiction dont l'effectivité va être difficile ; ou rêver d'une Université où l'on leur donnerait des sujets de réflexion à traiter chacun d'une façon originale, ce qui suppose sans doute un nombre d'étudiants moins élevés (d'ailleurs, les lycées et collègues sont aussi concernés).

Mais si l'on regarde le "but" : il s'agit bien de prévenir et détecter un comportement systémiquement dommageable, pour l'Université et pour les étudiants eux-mêmes (qui n'auront rien appris ; ce sont les premières victimes).

Or, la prévention et détection des comportements systémiquement dommageables non pas tant pour les sanctionner mais pour qu'ils ne prospèrent pas à l'avenir, ici garder les avantages des algorithmes comme outils et prévenir leur usage dolosif, c'est la définition du Droit de la Compliance comme mode de prévention et de détection des maux systémique. Cela constitue un "but monumental".

🔴 M.-A. Frison-Roche, 📕Les buts monumentaux de la Compliance, 2022

Pour concrétiser une telle ambition, notamment face à la puissance de ces outils neutres que sont les algorithmes, qui permettent d'ailleurs à des professeurs de rédiger sans difficulté des cours sur l'originalité desquels on ne leur demande pas de compte, le Droit de la Compliance présente un atout majeur : il repose sur les entreprises elles-mêmes, notamment celles par lesquelles le risque est né.

Historiquement, le Droit de la Compliance est né aux Etats-Unis, en imposant aux entreprises ayant contribué par leur comportement interne à la crise de 1929 une série d'obligations de prudence, de gestion des conflits d'intérêts, d'information et de soumission à un superviseur.

🔴 M.-A. Frison-Roche, 📝Compliance : avant, maintenant, après, 2018

C'est en effet aux entreprises de trouver les solutions pour détecter et prévenir les comportements systémiques dommageables.

L'article publié dans Libération fait état des travaux menés par les entreprises fabriquant les algorithmes pour que soient insérés dans les textes des signaux, indétectables par l'usager (par exemple l'algorithme achevant une phrase sur dix par un mot finissant par la même lettre, ou une phrase sur vingt par un mot commençant par la même lettre), mais qu'un autre algorithme pourrait "détecter" pour que le travail produit soit analysé par le professeur (comme on le fait déjà en matière de plagiat).

Il s'agit ici d'une "compliance consentie, choisie par l'entreprise elle-même ; cela pourrait être leur être également imposé.

🔴 L. Benzoni et B. Deffains, 📝Approche économique des outils de la Compliance: finalité, effectivité et mesure de la Compliance subie et choisie, in M.-A. Frison-Roche (dir.), 📕Les outils de la Compliance, 2021

Apparaît ainsi le juste et efficace rapport entre le Droit de la Compliance et ce que l'on appelle "l'intelligence artificielle", dès l'instant que l'on n'a précisément pas une vision mécanique du Droit de la Compliance, ce qui permet de laisser les algorithmes à leur place : des "outils".

🔴 M.-A. Frison-Roche, 🎥Compliance, Intelligence artificielle et gestion des entreprises : la juste mesure, 2022

________

Sept. 1, 2022

Thesaurus : Doctrine

► Full Reference: R.-O. Maistre, "Quels buts fondamentaux pour le régulateur dans un paysage audiovisuel et numérique en pleine mutation ?" ("What Monumental Goals for the regulator in a rapidly changing audiovisual and digital landscape?"), in M.-A. Frison-Roche (ed.), Les Buts Monumentaux de la Compliance, coll. "Régulations & Compliance", Journal of Regulation & Compliance (JoRC) and Dalloz, 2022, p. 47-54.

____

📕read a general presentation of the book, Les Buts Monumentaux de la Compliance, in which this article is published

____

____

► Summary of the article (done by the Journal of Regulation & Compliance): In France, since the law of 1982 which put an end to the State monopoly on the audio-visual area, the landscape has profoundly evolved and diversified. In view of the multitude of players who are now established there, the Autorité de régulation de la communication audiovisuelle et numérique - Arcom (French Audiovisual and Digital Regulatory High Council) must ensure the economic balance of the sector and the respect for pluralism, in the interest of all audiences. The growing societal responsibilities of audiovisual media and new digital players have multiplied the "monumental goals" on which the Arcom) is watching.

Its competences have gradually been extended to the digital space and the successive laws concerning its missions aim at new objectives, in particular in terms of protection of minors, fight against online hate or against disinformation. The emergence of a new European model of Regulation makes it possible to give substance to these additional goals, the Regulator adopting a systemic perspective and calling on soft law tools to fulfill its new missions.

________

Sept. 1, 2022

Publications

♾️follow Marie-Anne Frison-Roche on LinkedIn

♾️subscribe to the Newsletter MAFR Regulation, Compliance, Law

____

► Full Reference: M.-A. Frison-Roche, "Les Buts Monumentaux, cœur battant du Droit de la Compliance" ("Monumental Goals, beating heart of Compliance Law"), in M.-A. Frison-Roche (ed.), Les Buts Monumentaux de la Compliance, coll. "Régulations & Compliance", Journal of Regulation & Compliance (JoRC) and Dalloz, 2022, p. 21-44.

____

📝read the article (in French)

____

🚧read the bilingual Working Paper which is the basis of this article, with additional developments, technical references and hyperlinks

____

📕read a general presentation of the book, Les Buts Monumentaux de la Compliance, in which this article is published

____

► Summary of the article: Compliance Law can be defined as the set of processes requiring companies to show that they comply with all the regulations that apply to them. It is also possible to define this branch of Law by a normative heart: the "Monumental Goals". These explain the technical new legal solutions, thus made them clearer, accessible and anticipable. This definition is also based on a bet, that of caring for others that human beings can have in common, a universality.

Through the Monumental Goals, appears a definition of Compliance Law that is new, original, and specific. This new term "Compliance", even in non-English vocabulary, in fact designates a new ambition: that a systemic catastrophe shall not be repeated in the future. This Monumental Goal was designed by History, which gives it a different dimension in the United States and in Europe. But the heart is common in the West, because it is always about detecting and preventing what could produce a future systemic catastrophe, which falls under "negative monumental goals", even to act so that the future is positively different ("positive monumental goals"), the whole being articulated in the notion of "concern for others", the Monumental Goals thus unifying Compliance Law.

In this, they reveal and reinforce the always systemic nature of Compliance Law, as management of systemic risks and extension of Regulation Law, outside of any sector, which makes solutions available for non-sector spaces, in particular digital space. Because wanting to prevent the future (preventing evil from happening; making good happen) is by nature political, Compliance Law by nature concretizes ambitions of a political nature, in particular in its positive monumental goals, notably effective equality between human beings, including geographically distant or future human beings.

The practical consequences of this definition of Compliance Law by Monumental Goals are immense. A contrario, this makes it possible to avoid the excesses of a "conformity law" aimed at the effectiveness of all applicable regulations, a very dangerous perspective. This makes it possible to select effective Compliance Tools with regard to these goals, to grasp the spirit of the material without being locked into its flow of letters. This leads to not dissociating the power required of companies and the permanent supervision that the public authorities must exercise over them.

We can therefore expect a lot from such a definition of Compliance Law by its Monumental Goals. It engenders an alliance between the Political Power, legitimate to enact the Monumental Goals, and the crucial operators, in a position to concretize them and appointed because they are able to do so. It makes it possible to find global legal solutions for global systemic difficulties that are a priori insurmountable, particularly in climate matters and for the effective protection of people in the now digital world in which we live. It expresses values that can unite human beings.

In this, Compliance Law built on Monumental Goals is also a bet. Even if the requirement of "conformity" is articulated with this present conception of what Compliance Law is, this conception based on Monumental Law is based on the human ability to be free, while conformity law supposes more the human ability to obey.

Therefore Compliance Law, defined by the Monumental Goals, is essential for our future, while conformity law is not.

________