April 9, 2025

Thesaurus : Soft Law

► Référence complète : Perspectives de l'OCDE sur la politique de la réglementation 2025, Editions OCDE.

____

_____

____

►Présentation par l'OCDE de son rapport : Le rapport met en exergue que 82% des pays de l’OCDE imposent une participation systématique des parties prenantes pour élaborer les réglementations, que 41% doivent envisager des modes de conception agiles et flexibles pour formuler les réglementations, que 30% doivent tenir systématiquement compte de l’effet de leurs réglementations sur d’autres pays.

(commentaire : ce qui est présenté comme des "chiffres-clés" souligne ce qui est important pour l'OCDE, la façon dont les questions et les réponses ont été formulées par les pays).

Le dialogue pourrait être plus inclusif et les retours d’informations restent difficiles

L’obligation de mener des consultations sur les projets de réglementations est courante dans la zone OCDE. Quand un problème survient, les pays sont plus susceptibles de procéder à des consultations sélectives que de lancer un vaste dialogue. Les citoyens veulent aussi savoir en quoi ils ont aidé à une meilleure élaboration des normes, même si seul un tiers des Membres de l’OCDE leur procure un retour d’informations post-consultation, sachant que cette pratique n’a guère changé au cours des dix dernières années.

Intégrer des approches fondées sur les risques aux politiques de la réglementation peut améliorer les résultats

Les pouvoirs publics sont chargés de mettre en œuvre les réglementations en exerçant des fonctions d’orientation, de suivi, de conformité et de mise en œuvre des textes. Pour déployer ces efforts en fonction des risques éventuels, de leur probabilité et de leur impact, il convient d’accorder une plus grande priorité aux activités à haut risque qu’à celles qui le sont moins, ce qui fait gagner du temps et des ressources aux entreprises et aux pouvoirs publics tout en améliorant les résultats. Les approches fondées sur les risques peuvent fortement favoriser les transitions écologique et numérique.

Les pouvoirs publics peuvent renforcer leur politique de la réglementation afin de soutenir l’innovation au sein de la société

L’ampleur et le rythme de l’innovation sont en train de bouleverser le fonctionnement des sociétés et des économies, mais le processus d’élaboration des règles n’a pas toujours suivi. Si les pouvoirs publics évaluent de plus en plus les effets de l’innovation, il faut que beaucoup aillent encore plus loin pour gagner en flexibilité par l’expérimentation, par l’utilisation de bacs à sable réglementaires et par l’adoption d’autres approches non réglementaires. De même, il est possible d’améliorer la coordination entre les administrations – y compris entre leurs différents niveaux – pour partager informations et compétences sur les défis de l’innovation.

________

March 29, 2024

Conferences

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

____

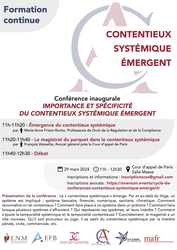

► Full Reference: M.-A. Frison-Roche, "L’émergence du Contentieux Systémique" ("Emergence of the Systemic Litigation"), in Importance et spécificité du Contentieux Systémique Émergent (Importance and specificity of the Emerging Systemic Litigation), in cycle of conferences-debates "Contentieux Systémique Émergent" ("Emerging Systemic Litigation"), organised on the initiative of the Cour d'appel de Paris (Paris Cour of Appeal), with the Cour de cassation (French Court of cassation), the Cour d'appel de Versailles (Versailles Court of Appeal), the École nationale de la magistrature - ENM (French National School for the Judiciary) and the École de formation des barreaux du ressort de la Cour d'appel de Paris - EFB (Paris Bar School), under the scientific direction of Marie-Anne Frison-Roche, March 29, 2024, 11h-12h30, Cour d'appel de Paris, salle Masse

____

🧮see the full programme of this event

____

🧮see the programme of the entire cycle Contentieux Systémique Émergent

____

🌐consult on LinkedIn the report of this speech (in French)

____

🌐consult on LinkedIn a general présentation of this event, which links to a presentation and a report of each speech (in French)

____

____

🔲see the slides used to support this intervention (in French)

____

🚧read the bilingual Working Paper which is the basis of this speech

____

► English Summary of the conference: We are seeing the emergence of what should be referred to as a category of its own: the "Systemic Litigation". This concept, proposed in 2021📎

These systems may be of different kinds: banking, financial, transport, health, energy, digital, algorithmic or climatic. Their presence in cases brought to the attention of judges, the variety and difficulties of which will be seen in later contributions, leads to basic questions relating to the emergence of Systemic Litigation: firstly, how can Systemic Litigation be defined? Secondly, what makes this category of litigation emerge? The answers to these two questions have essential practical consequences.

The new solutions must be based on a classic distinction, used in particular in criminal and administrative proceedings, which are more objective, but also in civil proceedings, notably by Hébraud, namely the distinction between the "party to the dispute/litigation" and the "party to the proceedings". Depending on whether it is accepted that the system should be considered as a "party to the litigation", which would allow it, through an entity that is legitimate in expressing it, to allege claims and formulate demands against an adversary, or as a "party to the proceedings", a much broader category, which would allow the judge to hear the interests of the systems involved without individuals being able, on behalf of a system, to formulate claims against or for the benefit of a party to the litigation.

This makes it possible to innovate while preserving the measure of which the judge is the guardian.

________

Dec. 14, 2021

Thesaurus : Doctrine

► Référence complète : Labbée, Th, N., Le droit face aux technologies disruptives : : le cas de la blockchain, Thèse Strasbourg, 2021.

____

_________

July 22, 2019

Publications

This working document serves as a basis for a contribution to the Grands Arrêts de la Propriété intellectuelle (major cases in Intellectual Property), published under the direction of Michel Vivant, in the new section devoted to Regulatory perspective.

Conceived as a "regulatory tool", intellectual property is then used by the State as an "incentive for innovation". Public authorities adopt solutions that stem from sectoral concerns that permeate intellectual property. Because the economic sectors become prime, the systemic perspective then prevails in the solutions retained in the judgments passed by the courts.

One can see it through three French court decisions:

► Civ., 1ière, 28 février 2006, named Mulholland Drive ;

► Paris, 11 décembre 2012, Sanofi-Aventis ;

► Civ., 1ière, 6 juillet 2017, SFR, Orange, Free, Bouygues télécom et autres.

Summary:

Intellectual property, derived from the State and inserted in a public policy, can be conceived, not to reward a posteriori the creator but to incite others to innovate. It is then an Ex Ante tool of Regulation, alternative to subsidies. If private copying is an exception, it is not in relation to the principle of competition but in an insertion in a system of incentives, starting from the costs borne by the author of the first innovation: the owner of the rights is then protected , not only according to a balance of interests, but in order not to discourage innovative potentials and the sector itself. (1st decision).

The sectoral policy then pervades the intellectual property used to regulate a sector, for example that of the drug. While it is true that a laboratory wishing to market a generic medicine did not wait for the patent expiry of the original medicine to do so, it is not relevant to sanction this anticipation of a few days because investments made by the holder of the intellectual property right have been made profitable by it and because the public authorities favor generics for the sake of public health (2nd decision).

The systemic interest provides and that is why Internet service providers have to bear the costs of access blocking while they are irresponsible because of the texts. This obligation to pay is internalized by Compliance because they are in the digital system best able to put an end to the violation of intellectual property rights that the ecosystem requires to be effective. (3rd decision).

It is necessary to underline the paradox represented by the infatuation of the theoreticians of Regulation with intellectual property, whose legal nature it transforms by an exogenous reasoning(I). Influenced, the case law uses reasoning based on incentives, investments, returns and costs, so that the State obtains the operators expected behaviors (II). As a natural result, there is a sectoral segmentation, for example in telecommunications or pharmacy, which ends up calling into question the uniqueness of intellectual property, according to the technologies and public policies that affect them (III). There are still imputations of new obligations on operators just because they are in the technical position of implementing intellectual property rights: the transition from Regulation to Compliance is thus taking place (IV).

Sept. 5, 2018

Thesaurus : Doctrine

Référence complète : Petit, N., Innovation competition and merger policy: New? Not sure. Robust? Not quite!, Revue Concurrences, n°2-2018, pp. 1-4.

Les étudiants Sciences-Po peuvent consulter l'article via le drive, dossier "MAFR-Regulation & Compliance".

Updated: April 4, 2018 (Initial publication: Nov. 12, 2017)

Publications

Pour lire l'article en français, cliquer sur le drapeau français.

This working paper serves as a support for an article published in French in the Recueil Dalloz.

In Lisbon, in the Web Summit of November 2017, a machine covered with a skin-like material and a sound-producing device gave a speech in public at this conference on digital. For example, a French article tells the event by this title : Le premier robot citoyen donne sa propre conférence au web summit (The first citizen robot gives his own conference to the web summit).

Some time later, reports show the same robot walking and taking more than 60 facial expressions, the text laudatif that accompanies the images designating the automaton by the article: she.

The machine, which falls legally within the category of "things", is thus presented as a person.

Let's look elsewhere.

Women, who are human beings, sign contracts by which they agree to give birth to children, with whom they claim they have no connection, that they are not mothers, that they will hand them over immediately at the exit of their belly to those who desired their coming, this desire for parenthood creating by hitself the true and only link between the child and his "parents of intent". The mother-carrier is often openly referred to as "oven".

The woman, who falls legally within the category of the "person", is thus presented as a thing.

The two sensational phenomena are of the same nature.

They call two questions:

1. Why? The answer is: money. Because both are the result of the new construction of two fabulous markets by supply.

2. How? The answer is: by the destruction of the distinction between the person and things.

The distinction between person and things is not natural, it is legal. It is the base of the western legal systems, their summa divisio.

If this distinction disappears, and for money to flow, it must actually disappear, then the weak human being will become the thing of the strong one.

Read below the developments.

It is true that in 1966, the BBC already presented a sort of robot being the "ideal" servant and designating it by the article "she".

Feb. 26, 2018

Blog

Cryptocurrencies seem to be admitted, delivered from the State. And many rejoiced.

Let's take the question on the side of Law.

In France, we remember an article written in 1968 by the great lawyer Carbonnier : L'imagerie des monnaies (Imagery of Coins), seeing in Caesar's face engraved on the coin the image of the State itself, guarantor of the entire monetary and exchange system.

In Europe, we remember the discussions on the image of the euro, how each state in the zone could express its existence while the guarantee was common and concentrated in the same central bank, preferring a public building to a character.

Today the currencies to be virtual do not have less an "image".

One could even say that they have only that, since it is no longer the State which, by the face of Caesar is inserted there.

But other faces can be imbued. Could the law find fault with it, because some figures would be "reprochable" because only Caesar would be beyond reproach? Could the Law draw any consequences from it, because some figures would be "engaging", less than that of Caesar but still a little?

Certainly, not faces that the Criminal Law rejects, not that of Jack the Ripper, not that of Hitler. But other historical figures less clearly banned, in this period where it is easily argued that everything would be "questionable" and therefore admissible and that besides everything would be "to discuss", the currency thus expressing this flow of discussion , speech that goes from hand to hand, from post to post on virtual networks?

Still, figures are block around them. This is particularly true in communities that can thus elect them to trust each other: just like their "Caesar", and knowing each other well, lend themselves more easily with confidence, to pay each other, while they would not lend to others, they would not buy from others.

Why no. Since we accept the principle of this currency, based on the only technical security (double encryption) and trust between people (intersubjectivity of a circle that has been chosen), without mentioning the issue of the debtor as a last resort, in order to challenge Caesar and public finances.

But let us take the hypothesis that the figure embedded in the virtual currency is that of Jesus. And the hypothesis is not fancy.

Indeed, the "religious currencies" are multiplying.

And the platforms that offer them insist on the fact that these tokens that are exchanged between people who believe in Jesus place great trust in the "son of God" and are therefore particularly trusting each other, for example in their respective capacity to keep their commitment. Outside the Law. On their respective ability to help each other. Outside the Law.

Is it necessary to forget the affirmation that it was necessary "to render to Caesar what was Caesar's"?

Let's ask some questions in Law.

- Reflections on what could or should be the "regulation" of non-state currencies, whether we call them virtual or not (in what does this change the nature of the currency?), That we secure them by encryption technology and / or by the decentralization of information, should they also relate to images?

- Are non-state currencies so much that the religious image, as long as it is not contrary to public order, is permissible, notably in legal systems where the constitutional principle of secularism has as its object and effect not only to neutralize the religious significance of religious objects but also to protect religious freedom?

- Can "religious currencies" be protected and have specific economic and financial significance, as the United States Supreme Court admitted in the Hobby Lobby judgment of June 30, 2014? Europe is not the United States.

- If the image of Jesus is encrusted on the currency, can we consider that the corpus is also inserted so that the platform that attracts a particularly interesting clientele (solvent, "responsible", holding its commitments, etc.) ? This insertion of the religious corpus, as the state was through the face of Caesar would operate not de jure but de facto, so that the company holding the platform should respond to third parties by the factual belief that this may have generated in third parties.

- Moreover, do not these "religious currencies" produce a specific systemic risk? Not that such and such a religion could collapse, or this or that religious effigy to undergo a haircut with a domino effect on all the saints, waves of doubt provoking a mistrust of all the faithful ones because the various religions are doing well, but precisely because the mark of these religious communities to which these platforms specifically appeal is to make "their own law" prevailing over the law of the Dtate, considered inferior since it comes only from men and not from God.

And now the churches are starting to coin money...

At the very least, it will be necessary in Ex Post that the faithful do not come to seek the state by guaranteeing if there is bankruptcy, because Caesar does not meddle in the affairs of Jesus. To each his currency and each to reread Carbonnier, one of the finest readers of the Bible

______

Jan. 10, 2018

Thesaurus : Doctrine

Référence complète : Parachkévova, I., et Teller, M., (dir.) Quelles régulations pour l'économie collaborative ? Un défi pour le droit économique, Dalloz, coll. "Thèmes et commentaires", 2018, 202 p.

May 17, 2017

Thesaurus : Doctrine

Référence complète : Beltran, A., Derdevet, M., Roques, F., Énergie. Pour des réseaux électriques solidaires, Descartes & Cie, 2017, 236 p.

Lire la 4ième de couverture.

Lire la table des matières.

Lire la conclusion.

Nov. 2, 2016

Thesaurus : Doctrine

Référence complète : Koenig, G., Le marché des idées, Revue Concurrences, n°4-2016, pp.1-3.

Les étudiants Sciences Po peuvent consulter l'article via le drive, dossier "MAFR - Régulation & Compliance"

April 2, 2016

Blog

Droit et Technologie, c'est le nouveau couple à la mode, reléguant celui formé par "Droit et Science" ou "Droit et Science" au rang des ménages rangés.

Droit et Technologie est beaucoup plus fringuant : il est accompagné de mots étrangers et étranges : bitcoins, trusted machines, blockchains et repose lui-même sur le couple qui désormais fait rêver plus que tout autre : Confiance et Innovation !

Dec. 16, 2015

Thesaurus : Doctrine

Référence générale : Verdier, M., Innovation, concurrence et réglementation pour la fourniture de services bancaires en ligne, in Revue d’Économie Financière, Innovation, technologie et finance. Menaces et opportunités, n°120, déc. 2015, p. 67-89.

Les étudiants de Sciences po peuvent lire l'article via le drive dans le dossier "MAFR - Régulation".

Il est remarquable que dans cet article le droit de la concurrence soit perçu et analysé que comme une "réglementation".

Dans cette perspective, il est posé que cette "réglementation" doit s'adapter car pour le développement de l'activité bancaire dans l'espace numérique les acteurs doivent coopérer, ce qui est contraire à la base de la "réglementation concurrentielle".

Pour que les opérateurs innovent, il faut donc mettre le cursus entre la concurrence et la coopération, à la fois dans les relations verticales et entre opérateurs installés et nouveaux entrants.

Dec. 12, 2013

Thesaurus

Updated: July 31, 2013 (Initial publication: Sept. 6, 2011)

Teachings : Les Grandes Questions du Droit, semestre d'automne 2011

Jan. 28, 2013

Thesaurus : Doctrine

Référence complète : Serres, M., L'innovation et le numérique, conférence inaugurale du Programme Paris Nouveaux Mondes, Pôle de recherche et d'enseignement supérieur « hautes études, Sorbonne, arts et métiers », 28 janvier 2013.

Lire le résumé ci-dessous.

Aug. 31, 2011

Publications

Référence complète : FRISON-ROCHE, Marie-Anne, participation à la table ronde n°2 Régulation et innovation sont-elles compatibles ? in Croissance, innovation, régulation, Les rapports de l’ARCEP, juillet 2011, p.47-50, p.59-60.

Accéder à la première intervention de Marie-Anne Frison-Roche,

Accéder à la seconde intervention de Marie-Anne Frison-Roche,

Accéder à la rubrique "Ils ont dit" (Les cahier de l’ARCEP, n°6, juillet 2011).

Aug. 29, 2011

Publications

Référence complète : FRISON-ROCHE, Marie-Anne, participation à la table ronde n°2 Régulation et innovation sont-elles compatibles ? in Croissance, innovation, régulation, Les rapports de l'ARCEP, juillet 2011, p.47-50, p.59-60.

Accéder à la première intervention de Marie-Anne Frison-Roche.

Accéder à la seconde intervention de Marie-Anne Frison-Roche.

Accéder à la rubrique "Ils ont dit" (Les cahier de l'ARCEP, n°6, juillet 2011).

Sept. 16, 2010

Publications

Références complètes : FRISON-ROCHE, Marie-Anne, Politique publique de la maîtrise de santé, protection de la santé publique, droit général de la concurrence et régulation sectorielle, in FRISON-ROCHE, Marie-Anne (dir.), Concurrence, santé publique, innovation et médicament, coll. "Droit et Économie", LGDJ - Lextenso édition, Paris, 2010, p.1-14.

Sept. 15, 2010

Publications

Référence complète : FRISON-ROCHE, Marie-Anne, L'office du juge en matière de médicaments, in FRISON-ROCHE, Marie-Anne (Dir.), Concurrence, santé publique, innovation et médicament, coll. Droit et Economie, LGDJ, Paris, 2010, p.423-432.

Lire la présentation générale de l'ouvrage dans lequel l'article a été publié.

Sept. 25, 2009

Conferences

Ce colloque devait donner lieu à une publication.

Un article a été rédigé à cette fin, résumant les propos tenus et émanant quelques propositions sur le thème.

Finalement la publication n'a pas eu lieu.

June 18, 2007

Conferences

Oct. 31, 2003

Publications

Référence complète : FRISON-ROCHE, Marie-Anne,Vers une rente pour autrui, in Le droit favorise-t-il l’innovation ? , Revue Droit et Patrimoine, octobre 2003, pp.73-76.

March 31, 2000

Publications