Sept. 6, 2022

Hearings by a Committee or Public organisation

🌐suivre Marie-Anne Frison-Roche sur LinkedIn

🌐s'abonner à la Newsletter MAFR Regulation, Compliance, Law

____

► Référence complète : M.-A. Frison-Roche, Audition par le Comité de Liaison des Institutions ordinales (CLIO) sur "Europe, Compliance et Professions", 6 septembre 2022.

____

Cette présentation d'une quinzaine de minutes a ensuite donné lieu à un échange avec les membres du Bureau du CLIO.

____

► Résumé de la présentation : La perspective ici proposée est de partir non pas du schéma du marché concurrentiel, repris par le Droit de la concurrence, par rapport auxquels les professions et les ordres ont toujours dès le départ et définitivement statut d'exceptions, mais de partir - dans une vision paradoxalement moins juridique et plus concrète - de l'Europe telle qu'elle s'était construite à la fin de la Seconde Guerre mondiale et qu'elle se construit de nouveau.

I. LE PROJET POLITIQUE DE L'EUROPE : À COTE DE L'EUROPE DE LA CONCURRENCE, L'EUROPE DE LA RÉGULATION

La Régulation n'est en rien l'exception (qui serait en outre logée au niveau des Etats-membre) du Droit de la concurrence (qui serait en outre logée au niveau du Droit de l'Union), la concurrence écrasant doublement la Régulation, en ce qu'elle serait le seul principe (le principe prévalant sur l'exception) et qu'elle serait au-dessus dans la hiérarchie des normes.

Cela n'est pas vrai.

Il faut donc partir de l'Europe.

L’Europe est une idée politique, construite avec des moyens juridiques. C'est ainsi que Monnet l'avait conçu et c'est de nouveau que la Commission européenne la conçoit (voir par exemple ce qu'en dit Thierry Breton).

Au sortir d'une catastrophe, il s'est agi de construire l'Europe, conçue comme une communauté d’êtres humains (valeurs communes, groupe social fluide).

Pour cela, il fallait trouver les bons instruments juridiques, pour (re)créer ces valeurs communes : faire que les échanges se réalisent avec des règles juridiques "positives" (CECA, collaborations pour faire des rails) et des règles juridiques « négatif » (abattre les frontières ; prohibition des comportements anticoncurrentiels et prohibition des aides d’Etat, prohibition qui n’existe nulle pas ailleurs).

Puis en premier lier la Commission européenne, la Cour de justice, voire les Etats-membres ont « oublié » la construction positive et on n’a gardé que la construction négative : le vide concurrentiel (qui a des mérites, notamment en ce qu'il exprime la liberté), dont tout devait sortir ; en second lieu, on a pris l’instrument pour le but.

C'est ainsi que le Droit de la concurrence, en tant qu'il est une branche du Droit économique, est entièrement guidé par sa finalité, mais il a pour objet la concurrence : la téléologie a pour objet une fin qui ne lui est pas extérieure, c’est une « tautologie ».

L’Europe a changé, par le choc des crises successives depuis 2008, avec la crise financière et bancaire ; depuis 2020 avec la crise sanitaire ; depuis 2022 avec la crise climatique qui s’annonce.

C'est une opportunité (la crise est aussi une opportunité, parce qu'elle prise les idées de départ, fait de la place pour d'autres).

La téléologie européenne n’est plus tautologie ; la concurrence y retrouve sa place. Le système demeure celui d'une économie libérale mais la DG Concurrence ne résume plus la Commission européenne : l’Europe – y compris la Commission européenne – n’a plus pour seule fin la concurrence. La crise étant un souci majeur, car l'Europe a compris qu'elle était mortelle, le Droit a pour finalité de permettre à l'Europe de survivre (notamment face à la Chine : elle a pour fin d’être « durable » : de ne pas disparaître.

Cela a pris notamment forme dans l'Union bancaire, qui a pour but simple d'exclure la disparition de l'Europe.

Mais cela vaut aussi pour l'Europe de la communication des personnes et des biens. Voir par exemple la proposition le 7 juillet 2022 d’aides d’Etat sur les transports pour faire une Europe des transports avec des infrastructures publiques.

Voir aussi la naissance de la « gouvernance-énergie », signant la fin de la suprématie l’esprit de la directive de 2016 sur « l’ouverture à la concurrence » comme seul principe, nouant l'énergie et l'environnement, prolongeant la Régulation par la Supervision, c'est-à-dire avant tout l'Industrie. Or, dans une perspective à ce point concrète, là où il y a de l'industrie il y a des personnes ayant des savoirs-faire : des professionnels.

La crise de 2020 accélère la naissance de l’Europe de la Santé ; à partir du vaccin.

La DG Connect exprime volonté de construire un écosystème numérique européen : Europe des données, à la fois marchand, industriel et protecteur des personnes (Digital Markets Act ; Digital Services Act ; Governance Data Act ; Chip Act), initialement construit par le Juge européen (jugement de la CJUE Google Spain 2014).

Dans chaque perspective, il y a la fixation par les Autorités politiques européenne d'un « but monumental », à la fois propre à un secteur mais aussi commun à tous, et tous se regroupent autour d’une volonté proprement européenne : la protection des êtres humains.

L'Avenir de l'Europe est ainsi dans l'émergence de l'Europe de la Régulation.

La question qui se pose alors est : comment atteindre ces Buts ainsi politiquement posés ?

Car la distance est grande entre la volonté exprimée et la concrétisation de ces buts (affaire de "plan" et de "transition").

II. POUR CONSTRUIRE L'EUROPE SOUVERAINE : l'ACTION DES PROFESSIONS, ENTITÉS EN POSITION D'ATTEINDRE LES BUTS MONUMENTAUX

L’Europe de la Régulation, ainsi constituée, est, surtout avec l'enjeu des données (économie de l'information, industrie des données, souveraineté européenne), entre les mains des entreprises et de l'industrie, laquelle ne se pense pas en-dehors des professionnels.

La CJUE appuie le mouvement.

Mais comment la mettre en œuvre :

Le politique (la Commission européenne, les gouvernements nationaux, etc.) va rechercher des alliances, le Droit de la Compliance prolongeant le Droit de la Régulation et mettant en alliance les Autorités publiques (dont l'État n'est qu'un exemple) et les "entités en position de le faire".

Pour les institutions européennes, ces "entités en position d'agir" sont :

- :

- Les Etats membres

- Les entreprises cruciales, les entreprises publiques,

- Les ordres correspondent à cette définition

L'Europe se construit ainsi actuellement et à l’avenir sur deux piliers : Concurrence d’une part et Régulation et Compliance d’autre part.

- Ne pas se penser comme une exception (même légitime) au principe de concurrence

- Se penser comme un opérateur crucial contribuant à l'expression du second pilier de la construction européenne

- Donner à voir sa contribution structurelle à la construction de l’Europe, telle qu’elle se dessine

- Proposer son aide dans ce sens

______

► pour aller plus loin ⤵️

- M.-A. Frison-Roche, 🎤 Régulation et Compliance, expression des missions d'un Ordre, 2022

- M.-A. Frison-Roche, 📕Les buts monumentaux de la Compliance,2022

- M.-A. Frison-Roche, 📕Les outils de la Compliance, 2021

- M.-A. Frison-Roche, 💻Appliquer la notion de "Raison d'être" à la profession du Notariat, 2021

- M.-A. Frison-Roche, 📕Avocats et Ordres au 21ième siècle, 2017

- M.-A. Frison-Roche, 📝Déontologie et discipline des professions libérales, 1998

July 17, 2022

Compliance: at the moment

June 28, 2022

Compliance: at the moment

Référence complète : Frison-Roche, M.-A., S'associer structurellement pour atteindre un But Monumentale. Equilibre entre Concurrence et Compliance : l'entente bienvenue entre deux opérateurs dominants pour réduire l'émission des gaz à effet de serre, 28 juin 2022.

____

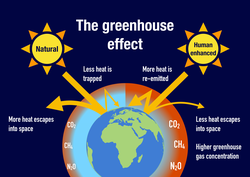

L'Autorité néerlandaise de la concurrence, l' Authority for Consumers and Markets, a exprimé le 27 juin 2022 une "opinion" concernant deux opérateurs énergétiques très puissants, Shell et TotalEnergie, décidés à collaborer pour réduire la pollution, parce que les effets négatifs de cette restriction de concurrence engendrée par cette entente sont moindres que les effets positifs de réduction d'émission de gaz à effet de serre, leur contribution à la lutte contre le déséquilibre climatique justifiant ainsi cette collaboration.

Au-delà de l'analyse précise de la situation, l'Autorité présente ainsi sa décision : "Following an assessment of their plans, the Netherlands Authority for Consumers and Markets (ACM) has decided to allow competitors Shell and TotalEnergies to collaborate in the storage of CO2 in empty natural-gas fields in the North Sea. By transporting CO2 through pipes and storing it in old gas fields, this greenhouse gas will not be released into the atmosphere. This initiative thus helps realize the climate objectives. As cooperation is necessary for getting this initiative off the ground and for realizing the climate benefits, the slight restriction of competition between Shell and TotalEnergies is not that harmful. The benefits for customers of both companies and for society as a whole exceed the negative effects of that restriction.".

L'Autorité n'hésite donc pas à affirmer que les entreprises peuvent s'entendre structurellement car cela est bénéfique pour les deux entreprises, bénéfiquespour les consommateurs et bénéfique pour le groupe social.

C'est surtout le dernier point qui est important.

Cette décision illustre l'évolution du rapport entre le Droit de la Concurrence et le Droit de la Compliance. Nous sommes bien loin de la façon dont on présente encore souvent ces deux branches du Droit, notamment dans ce que serait la Compliance pour le Droit de la Concurrence, à savoir un moyen d'accroître l'effectivité le Droit de la Concurrence (I). L'évolution de plus en plus forte donne aux entreprises le pouvoir, parce qu'elles en ont l'obligation d'atteindre le "but monumental" de faire quelque chose en matière climatique, par exemple d'inventer ensemble des structures bénéfiques à l'équilibre climatique : ce qui relève alors du Droit de la Compliance, lequel n'accroît pas le Droit de la Concurrence (puisque la Compliance légitime les ententes) mais vient se mettre en équilibre face au Droit de la Concurrence (II). En cela, le Droit de la Compliance est le prolongement du Droit de la Régulation, comme lui Ex Ante (les entreprises demandent en Ex Ante la validation de leur structure collaborative, et cela en dehors de tout secteur (III). L'avenir est donc au Droit de la Compliance, pilier de ces nouveaux équilibres.

I. LE RAPPORT TRADITIONNELLEMENT PRESENTÉ ENTRE DROIT DE LA CONCURRENCE ET DROIT DE LA COMPLIANCE

Lorsqu'on consulte le droit souple disponible, notamment celui émis par les Autorités de concurrence, par exemple le nouveau "document-cadre" publié par l'Autorité de la concurrence une première fois le 11 octobre 2021 puis une seconde fois, sous une forme définitive, le 24 mai 2022 : Document-cadre du 24 mai 2022 sur les programmes de conformité aux règles de concurrence.

Ce document débute ainsi : "La conformité, terme désormais bien ancré dans la pratique (également sous son nom anglais de « compliance ») désigne à la fois un processus et un objectif. L’objectif de la conformité consiste, pour une entreprise, à défendre des valeurs et encourager des comportements vertueux pour pleinement respecter les règles, notamment de concurrence. C’est une démarche éthique qui favorise un fonctionnement concurrentiel libre et non faussé de l’économie et permet pour les entreprises une gestion optimisée des risques, qu’ils soient financiers ou réputationnels. Le terme conformité renvoie, également, à un processus interne mis en place de façon permanente au sein même des entreprises, qui s’appuie notamment sur les « programmes de conformité ». La conformité désigne, à cet égard, les actions internes mises en place qui visent à diffuser la culture de concurrence, à assurer le respect des règles et la responsabilisation des acteurs économiques en faveur d’une concurrence basée sur les mérites. Les programmes de conformité s’appliquent aussi bien à prévenir les risques d’infraction aux règles de concurrence qu’à détecter les infractions éventuelles et à y remédier. Ils sont, en outre, amenés à évoluer au gré des besoins et des changements intervenus. La conformité combine, ainsi, trois composantes : préventive, curative et évolutive. ".

Pour l'Autorité de la concurrence, la "conformité" ou "compliance" (les deux termes étant pour elles synonyme, juste une question de traduction) est donc une sorte de voie d'exécution en Ex Ante : un moyen d'effectivité des règles de concurrence qui, plutôt que de prendre la forme de sanction Ex Post des violations commises par les entreprises, prend la forme Ex Ante d'une culture de concurrence développée par les entreprises elles-mêmes qui évitent, par divers moyens et pour diverses raisons, de commettre les manquements.

Dès lors, la Compliance fait totalement corps avec le Droit de la Concurrence ; c'est une sorte d'appendice, et rien de plus. Un peu comme l'on voyait il y a longtemps la procédure, "servante" des branches de Droit "substantielles" (c'est-à-dire nobles), comme le Droit public, le Droit des obligations, etc., chacune se reflétant dans son outil d'effectivité : le Droit public dans le Contentieux administratif, le Droit civil dans la Procédure civile, etc. Depuis quelques décennies, l'on ne pense plus ainsi.

En dehors même du fait que les branches du Droit qui donne aux règles leur effectivité, c'est-à-dire les procédures, sont depuis longtemps devenues autonomes, ont même été regroupées dans le "Droit processuel", le Droit de la Compliance est lui-même une branche du Droit qui n'est pas un ensemble de procédures d'effectivité : il est une branche du Droit substantiel.

Et il poursuit des buts qui lui sont propres.

C'est pourquoi il peut ne pas poursuivre les mêmes buts que le Droit de la Concurrence. Il vient alors non pas accroître par sa puissance la branche du Droit à laquelle il s'articule (ici les principes du Droit de la concurrence), mais au contraire équilibrer ces principes en confiant aux entreprises d'autres buts à atteindre.

🔴M.A. Frison-Roche, Droit de la concurrence et Droit de la compliance, 2018.

Les buts du Droit de la Compliance ne sont pas les mêmes que les buts du Droit de la Concurrence. Ils sont beaucoup plus ambitieux. Il y a notamment le climat. Si une Autorité de concurrence admet de prendre en considération la lutte effective contre la perspective de crise climatique catastrophique, alors elle intègre la logique du Droit de la Compliance, et notamment son premier principe qui est l'inverse du principe du Droit de la concurrence : l'impératif de s'allier avec d'autres dans la durée pour atteindre ce but.

La décision de l'Autorité de concurrence est exemplaire de cela. Elle valide par avance une infrastructure.

II. L'ENTENTE ENTRE DES ENTREPRISES POUR ATTEINDRE LE BUT MONUMENTAL DE L'ACTION CLIMATIQUE, VALIDÉE EX ANTE, EN ÉQUILIBRE DES PRINCIPES DU DROIT DE LA CONCURRENCE

Les 2 entreprises créent ensemble une activité qui est décrite et appréciée par l'Autorité en ces termes : "Shell and TotalEnergies wish to store CO2 in empty North Sea gas fields on a large scale. This is part of the Aramis project, in which the government, Gasunie and Energie Beheer Nederland work together with Shell and TotalEnergies in order to build a high-capacity trunkline that connects to empty gas fields, among other activities. Carbon capture and storage helps reduce CO2 emissions of businesses located in the Netherlands that, at the moment, still have few alternatives. Major investments are needed since it concerns a high-capacity trunkline and a new, innovative method. In order to get the project off the ground, Shell and TotalEnergies need to offer the CO2 storage together, and therefore jointly set the price with an eye to putting the first ±20% of the trunkline’s capacity into operation. For the remaining 80%, no collective agreements will be made. Shell and TotalEnergies compete with one another. Collaborations between two competitors may negatively affect price, quality, and innovation, but that effect can be offset by certain benefits that a collaboration has for the customers of those businesses and for society as a whole. That is why the parties have asked ACM for informal guidance about whether their collaboration is compatible with the competition rules that offer an exemption to the prohibition to restrict competition if, in short, the benefits outweigh the costs.".

Ainsi, plutôt que faire les investissements conjoints en infrastructures, de faire fonctionner celles-ci et d'attendre une poursuite devant l'Autorité de concurrence pour entente en plaidant pour éviter la sanction le bénéfice social produit par cette collaboration dans cette infrastructure commune à travers la technique probatoire dite du "bilan", charge probatoire dont on connait la lourdeur et l'aléa, les autorités de concurrence prenant peu en considération ce bilan, souvent jugée trop politique et trop peu étayée économiquement (sur le droit positif, v. M.-A. Frison-Roche et J.-C. Roda, Précis Dalloz, Droit de la concurrence, 2022, n°452 et s.), les entreprises ont entrepris une démarche en Ex Ante.

Mais surtout les exemptions individuelles délivrées formellement au nom du Droit de la concurrence, telles que la Commission européenne le conçoit dans ses lignes directrices du 27 avril 2004 excluent de la mise en balance des considérations non-économiques et l'absence de prise en considération du souci climatique a été particulièrement critiquée.

L'on a pu ainsi anticiper la présente décision de l'Autorité néerlandaise de concurrence (M.-A. Frison-Roche et J.-C. Roda, Précis Dalloz, Droit de la concurrence, préc., n°454), du fait de la décision dite Shell rendue le 26 mai 2021 sur le terrain de la responsabilité civile par le Tribunal de La Haye.

III. LE DROIT DE LA COMPLIANCE, UN DROIT DE LA REGULATION A-SECTORIEL NE REQUERANT QU'UNE SUPERVISION

En effet et précisément, dans cet arrêt du 26 mai 2021, le Tribunal de La Haye a refusé de considérer que constituait une concurrence déloyale le fait d'imposer à Shell une obligation de réduire des émissions de CO2, même si cela freine sa croissance et que ses compétiteurs sur le marché du pétrole et du gaz n'y sont pas soumis car "l'intérêt servi par l'obligation de réduction l'emporte sur les intérêts commerciaux du groupe Shell...".

Le groupe Shell a donc une obligation d'action pour atteindre un intérêt qui le dépasse : un but monumental climatique, qui engendre à sa charge une Responsabilité Ex Ante.

🔴M.A. Frison-Roche, La Responsabilité Ex Ante, pilier du Droit de la Compliance, 2022.

Puisque le Droit de la Compliance impose aux entreprises de telles responsabilités, exige d'elles qu'elles prennent en charge de telles ambitions, détectent et préviennent de telles catastrophiques, alors implicitement, il leur confère les pouvoirs nécessaires pour le faire.

Cela serait inconcevable que les entreprises, obligées d'agir pour le climat, n'ont seulement n'aient pas le pouvoir de le faire, mais encore se voient interdire de le faire, par exemple par le Droit de la Concurrence. Cela est une conséquence directe du Principe de Proportionnalité, qui est au cœur du Droit de la compliance : l'entreprise ne doit certes pas avoir plus de pouvoir qu'il n'est nécessaire pour qu'elle atteigne le but qui lui est assigné, mais elle doit avoir tous les pouvoirs qui lui sont nécessaires pour cela.

🔴M.-A. Frison-Roche, Définition du Principe de proportionnalité et définition du Droit de la Compliance, in Les buts monumentaux de la Compliance, 2022

🔴M.-A. Frison-Roche, Concevoir le Pouvoir, 2021

Le Droit de la Compliance apparaît ici nettement puisqu'indépendamment des lignes directrices de 2004 de la Commission européenne qui n'admettent qu'un bilan concurrentiel, l'Autorité de concurrence prend ici directement appui sur l'initiative des entreprises qui s'associent structurellement pour atteindre un but climatique d'intérêt général.

En cela, et en Ex Ante, les entreprises mettent au point une infrastructure qui dans la durée va certes aller contre les principes de concurrence mais va tendre vers le But Monumental dont elles sont chargées, et pour Shell cette charge repose expressément sur elle puisque par ailleurs une juridiction le lui a expressément rappelé en refusant justement de faire jouer à son bénéfice la protection du Droit de la concurrence déloyale !

Ainsi, le Droit de la Compliance est ici illustré en ce qu'il est le prolongement du Droit de la Régulation.

🔴M.A. Frison-Roche, Du Droit de la Régulation au Droit de la Compliance, in Régulation, Supervision, Compliance, 2017

Ce mouvement va se renforcer, le Droit de la Compliance se plaçant au centre du Droit économique, laissant aux entreprises le soin, l'obligation, le pouvoir, de prendre des initiatives à long terme pour viser des buts d'intérêt général global, sous la supervision Ex Ante puis en continu des Autorités publiques.

________

June 23, 2022

Compliance: at the moment

Dans une émission de France Culture du 23 juin 2022, Philippe Sansonetti, titulaire de la chaire "Microbiologie et maladies infectieuses", professeur au Collège de France, expose, à propos de la "nième vague" du Covid, comment on est entré dans la période endémique : des vagues se succèdent, qui petit à petit sont, variant après variant, maîtrisées. Il expose qu'il faut apprendre à vivre avec et qu'il faut continuer les mesures adéquates pour diminuer la circulation du virus, ne pas envisager l'abandon trop radical du port du masque, exploiter les connaissances que l'on a du virus, continuer la pédagogie, ainsi que la vaccination.

Cela n'est pas fini et cela ne finira pas.

Il considère que l'on doit désormais parler de "calendrier vaccinal", c'est-à-dire non seulement parler d'une vaccination initiale mais encore de mise à jour régulière. De la même façon le port du masque doit faire l'objet d'une "intelligence collective" pour qu'il s'opère selon les circonstances.

Durant toute l'émission, il insiste sur la complexité de la situation, sur la difficulté à anticiper, sur le fait que l'on connait très mal les mécanismes de transmissibilité du virus, notamment lorsqu'il y a mutations, qu'on ne sait pas, à force de muter, il ne s'agit pas de nouveaux virus, même si d'une façon générale l'on a beaucoup progressé dans la connaissance du virus et de l'épidémie, de la même façon que la connaissance de la population a elle-même considérablement progressé.

Si l'on écoute avec une perspective juridique cette émission, qui a pour titre Envisager la fin, d'où il ressort que ce qui a été qualifié par les médecins et par les juristes de "crise" et traité comme telle, ne finira pas, cela amène une question en Droit de la régulation et de la Compliance : comment concevoir un Droit spécifique à la "crise sanitaire", qui suppose que le dispositif s'arrête, lorsqu'il apparaît que le virus continue de circuler ?

En effet, le rapport entre le Droit et les crises est difficile. Il suppose "par nature" que l'on change les règles ordinaires - ce que le Droit considère comme anormal mais exceptionnellement justifié par la crise - quand la crise débute mais ce qui doit s'arrêter lorsque la crise s'achève : il faut alors "revenir à la normale".

La notion de "crise sanitaire" est d'ailleurs une notion juridique puisque c'est sur cette situation expressément visée que le Législateur, et avant lui le ministre de la Santé par un simple décret, a justifié des mesures exceptionnelles, d'ailleurs qualifiées comme des "outils", comme le port obligatoire du masque, ce qui était contraire à la liberté, le confinement était une des mesures juridiques les plus violentes au regard des libertés.

Sans aborder la question de la légitimité même de ces mesures au regard des libertés, sur laquelle a statué le Conseil constitutionnel, la question ici est plutôt de se demander quand la crise sanitaire finit, puisqu'il apparaît que jamais le virus ne cessera de circuler, tandis qu'il n'est pas acquis que, de mutation en mutation, il s'agisse encore à la fin du même virus, ce qui peut faire douter, en Droit de la Régulation qu'une mesure adoptée pour le virus A soit encore applicable lorsque la situation dans un temps ultérieure concerne le virus A+++++++.

Cette seconde question relève de la compétence scientifique et non pas de la compétence juridique. Dans l'émission radiophonique, Philippe Sansonetti décrit par exemple les différents animaux impliqués, les transmissions, les mutations, etc. Si un tel cas était soumis à un juge, sans doute une expertise serait requise. C'est donc une question de méthode et de procédure, renvoyant aux rapports entre le Droit et la Science, ici plus spécifiquement entre le Droit et la Biologie.

La première question sur la "fin de la crise" et donc de la fin du "droit de crise" peut être affrontée par le Droit lui-même : comment le système juridique peut-il faire s'il s'avère que les situations de crises ne se terminent jamais ?

En effet, ce qui est exposé à propos du virus du Covid-19 peut être soutenu en dehors des situations de pandémies. Ainsi en matière financière, il est soutenu que l'on passe de crise en crise, qu'en matière climatique nous pourrions être dans une sorte de "crise permanente" avec laquelle il faudrait "vivre avec".

S'il en était ainsi, quelles conséquences juridiques faut-il en tirer ?

1. La crise est la situation ordinaire et non pas la crise extraordinaire : il faut donc préparer la crise suivante, ne serait-ce que pour prévenir celle-ci ;

2. La détection et la prévention des crises qui viennent doit être au cœur du Droit ;

3. Le Droit ne doit pas être comme "surpris" par une crise, puisque celle-ci n'est pas "anormale" et ne va pas passer, elle changerait juste de forme : parce que la crise serait ce qui est notre ordinaire et qu'elle ne finit pas, que la précédente a engendré la présente qui engendrera la suivante, le Droit doit d'une façon ordinaire se constituer en Ex Ante pour détecter, prévenir et gérer les crises.

4. La branche du Droit qui a pour fonction de prévenir, détecter et gérer les crises est le Droit de la Régulation et de la Compliance.

🔴 Sur l'analyse entre les situations de crises et le Droit de la régulation et de la compliance, v. le chapitre consacré à ce thème dans l'ouvrage : M.-A. Frison-Roche (dir.), 📕Les buts monumentaux de la compliance, collection📚 Régulations & Compliance, Journal of Regulation & Compliance et Dalloz, à paraître.

May 9, 2022

Publications

► Référence complète : Frison-Roche, M.-A., Notes prises pour la synthèse sur le vif de la conférence L'office du juge et les causes systémiques, in Cycle de conférences, Penser l'office du juge, Grand Chambre de la Cour de cassation, 9 mai 2022, 17h-19h.

____

► Résumé des notes prises au fur et à mesure de la conférence : les trois juges, Christophe Soulard, Président de la Chambre criminelle de la Cour de cassation, Fabien Raynaud, Conseiller d'Etat, et François Ancel, Président de la Chambre internationale de la Cour d'appel de Paris, invités à réfléchir et réagir à une hypothèse, à savoir l'existence parmi les cas qui leur sont apportés par les parties, sont intervenus à la fois d'une façon très diverse, très originale et exprimant pourtant l'unicité de l'art de juger.

Les notes prises ci-dessous montrent que les juges ont conscience que les temps ont changé et que, de plus en plus, les "systèmes" sont présents dans les causes qui, construites par les parties, leur sont présentées (1). Leurs analyses, réactions et propositions ont montré à ceux qui les écoutaient que pour appréhender des causes systémiques, les juges doivent être expérimentés (2). Ils ont eu souci de fixer des critères pour identifier la nature systémique des causes parmi la multitude de celles qu'ils traitent, justifiant alors un traitement procédural et décisionnaire particulier (3). L'auditoire a ainsi pu mesurer la part qui revient aux parties (4), puisque le système est dans la construction des faits de la cause et la part qui revient à l'office du juge (5).

Il apparaît alors que par un effet de miroir, l'office du juge se déplace de l'Ex Post vers l'Ex Ante (6), les trois juges décrivant et proposant des mécanismes concrets pour appréhender en Ex Ante cette dimension systémique et y répondre (7). Ils soulignent que cela s'opère en collaboration avec les avocats, dans une instruction élargie et le débat contradictoire (8), dans une collaboration qui s'opère en amont (9). Les trois magistrats ont recherché les techniques procédurales pour accroître la plus grande considération des systèmes (10) et les nouvelles organisations à mettre en place pour répondre à cette dimension systémique de certaines causes (11). Pour ce faire, une dialectique est à opérer vers, à la fois, de l'informel mais aussi plus de formel (12), l'ensemble produisant une meilleure réception méthodologique des systèmes par les juges (13) par une plus grande compréhension entre les juges, quel que soit leur niveau et les droits substantiels en cause, les autorités et les parties systémiques (14).

____

🎥Voir la vidéo de l'ensemble de la conférence

🎥 Voir la vidéo de la synthèse réalisée sur le vif par Marie-Anne Frison-Roche au terme de la conférence

____

📝Lire l'article de Marie-Anne Frison-Roche rendant compte au Dalloz de la conférence.

____

🚧 lire le document de travail L'hypothèse de la "cause systémique, réalisé préalablement à la conférence, pour préparer celle-ci.

_____

✏️ lire les notes exhaustives prises pendant la conférence⤵️

March 23, 2022

Publications

► Full Reference: M.-A. Frison-Roche & J.-Ch. Roda, Droit de la concurrence (Competition Law), 2nd ed., Paris, Dalloz, "Précis" Serie, 2022, 842 p.

____

► This second edition follows on from the first, written with Marie-Stéphane Payet.

📝read the foreword written in dedication to Marie-Stéphane (in French)

____

📕read the 4th cover of the book (in French)

____

► English Summary of the book: Even if reforms follow one another and upheavals are incessant, whether de facto (digital) or political (apprehension of foreign investment, controversies over objectives), the framework of Competition Law is stable, with French Law and European Law in harmony. Competition Law combines both the Law of competitive markets and the Law of relations between economic players. Its age and homogeneity increase its capacity to find solutions. This book restores the coherence and strength of Competition Law, which, once clarified, is easier to master and anticipate.

The first part therefore sets out the blocks of rules that "protect competitive markets", through mechanisms that are increasingly ex ante, not only merger control but also the control of buyer power, leading to the governance of markets by authorities working together, while sanctions for anti-competitive behaviour restore markets that have been damaged by abuse.

The second part sets out the blocks of rules that "rebalance economic relations". The tools used are often older, but their handling is no less innovative.

____

📕read the table of contents of the book (in French)

____

📝read the review of the book made by the Professor Walid Chaiehloudj in the Concurrences review

________

March 8, 2022

Hearings by a Committee or Public organisation

🌐suivre Marie-Anne Frison-Roche sur LinkedIn

🌐s'abonner à la Newsletter MAFR Regulation, Compliance, Law

____

► Référence complète : M.-A. Frison-Roche, audition par la Commission des Lois du Sénat sur la Proposition de Loi constitutionnelle relative à l'interruption volontaire de grossesse et à la contraception, 27 septembre 2022.

►Référence complète : M.-A. Frison-Roche, Audition par la Section du Rapport et des Etudes du Conseil d'Etat pour la préparation du Rapport annuel sur Les réseaux sociaux, Conseil d'Etat, 8 mars 2022.

____

►Résumé de la présentation faite avant la discussion : Pour la partie reproductible de cette audition, consistant dans la présentation qui a pu être faite de la relation entre le Droit de la Compliance et le phénomène des réseaux sociaux, il a été repris l'idée générale d'un impératif de "réguler un espace sans ancrage" et l'apport que représente pour cela le Droit de la Compliance, dès l'instant qu'il n'est pas défini comme le fait de "se conformer" à l'ensemble de la réglementation applicable à l'agent mais comme la charge d'atteindre des "Buts Monumentaux", négatifs ou/et positifs, l'opérateurs ainsi chargé de cette obligation de moyens parce qu'il est en position de le faire, devant avoir la puissance pour y parvenir.

Se dégagent alors des notions nouvelles, comme la "Responsabilité Ex Ante" ou une notion de "Pouvoir" qui est commune aux opérateurs de droit privé et de droit public, leur nationalité venant également en second plan, le Droit de la Compliance étant naturellement a-territorial.

Cette définition substantielle du Droit de la Compliance qui met en première ligne les opérateurs requiert que ceux-ci soient supervisé (dans un continuum entre Régulation, Supervision, Compliance,) le Droit de la Compliance opérant un continuum du Droit de la Régulation en n'étant plus lié avec l'impératif d'un secteur. Les opérateurs cruciaux numériques sont ainsi "responsabilisés", grâce à une "responsabilité Ex Ante", et s'ils sont supervisés par des Autorités de supervision (dont le modèle historique est le superviseur bancaire, ici l'Arcom), c'est le juge qui a fait naitre cette nouvelle notion de "responsabilité Ex Ante, pilier du Droit de la Compliance, aujourd'hui délivré du territoire dans une jurisprudence à propos du Climat qu'il convient de concevoir plus largement.

Ainsi délivré du secteur et du territoire, le Droit de la Compliance peut affronter le mal des réseaux sociaux que sont la désinformation et l'atteinte des enfants, maux systémiques où peut se perdre la Démocratie, perspective face à laquelle l'Ex Post est inapproprié.

Le Droit de la Compliance est donc pleinement adéquat.

Il convient que le Juge continue sa mue en concevant lui-même non pas seulement dans un Ex Post plus rapide, mais dans un office Ex Ante, contrôlant des entreprises qui, elles-mêmes doivent avoir des fonctions des offices de gardiens (ici gardiens des limites concernant les contenus).

______

Voir ⤵️ la structure plus formelle de l'intervention, qui fut ensuite discutée

Feb. 16, 2022

Teachings : Droit de la régulation bancaire et financière - semestre 2022

► Référence complète : Frison-Roche, M.-A., Les principes et la place de la répression dans le Droit de la Régulation et de la Supervision bancaire et financière, in Leçons de Droit de la Régulation bancaire et financière, Sciences po (Paris), 16 février 2022.

► Référence complète : Frison-Roche, M.-A., Les principes et la place de la répression dans le Droit de la Régulation et de la Supervision bancaire et financière, in Leçons de Droit de la Régulation bancaire et financière, Sciences po (Paris), 16 février 2022.

____

► Résumé de la leçon sur les principes et la place de la répression dans le Droit de la Régulation et de la Supervision bancaire et financière : Après avoir vu précédemment les règles techniques qui gouvernent la sanction et la prévention des Abus de marché, il convient pour mieux comprendre les décisions et les conflits de revenir sur la tension permanente et peut-être définitive qui marque les principes et la place de la répression dans le Droit de la régulation bancaire et financière : dans le même temps qu'elle est un outil presque ordinaire de la Régulation, puisque la répression des abus de marché assure l'intégrité et le fonctionnement des marchés financiers, la répression ne peut et ne doit se soustraire à ce avec quoi elle entretient un lien de filiation : le Droit pénal. Dès lors et par exemple, alors qu'au premier titre, l'efficacité est son premier souci, au second titre, les droits de la défense et le souci des secrets demeurent, tandis que la nature régalienne du Droit pénal trace un cercle par nature national alors que la Régulation financière est au mieux mondiale, au moins européenne.

Il convient de reprendre cette question à travers une perspective plus générale, notamment à travers le Droit pénal et le droit européen.

En effet, dans le même temps et parce qu'il s'agit de mécanismes qui ne peuvent pas faire sécession avec le système juridique, sa structure et ses fondements, l'on pourrait penser que la répression en matière bancaire et financière est une déclinaison du droit pénal général, qu'elle en emprunte et en respecte les principes généraux, concevant des infractions spéciales pour les besoins qui lui sont propres. Ainsi, tout ce qui caractérise le Droit pénal , l'élément intentionnel de l'infraction, le caractère restrictif de l'interprétation des textes, le principe de la personnalité des délits et des peines, le système procédural indissociable des règles substantielles (comme les charges de preuve ou le principe non bis in idem) devrait s'appliquer dans des infractions générales qui concernent le secteur , comme l'escroquerie ou l'abus de confiance comme dans les infractions plus particulières, comme l'abus de biens sociaux, voire des infractions spécifique comme le blanchiment d'argent.

Mais et tout d'abord, par souci d'efficacité , le droit a tout d'abord développé un système de répression qui a emprunté d'autres méthodes, imprégnées avant tout du souci d' efficacité . En outre, le droit a organisé une sorte de double jeu répressif, par un droit administratif répressif à la disposition des régulateurs, qui prend assez souvent distance par rapport au droit pénal classique, lequel continue pourtant de s'exercer.

Les tensions ne peuvent qu'apparaître. A l'intérieur du droit pénal , dont les principes sont assouplis alors que la rigidité du droit pénal est dans sa nature même, dans l'articulation du droit pénal avec le droit administratif répressif , guidé par le service efficace de l'ordre public de marché, les Cours constitutionnelles tentant de garder un équilibre à l'ensemble.

Il faut sans doute prendre acte que contrairement aux principes classiques, le droit pénal financier n'est plus autonome du reste de la régulation , la répression devient objective, l' efficacité est son critère et ses objectifs sont systémiques. La loi dite "Sapin 2" le manifeste en internalisant tout le dispositif répressif dans les opérateurs eux-mêmes, devenant à la fois les assujettis et les agents d'effectivité de la Régulation .

____

🔎 Revenir aux bases avec le Dictionnaire bilingue du Droit de la Régulation et de la Compliance

🔎 Approfondir par la Bibliographie générale de Droit de la Régulation bancaire et financière

🔎 Revenir à la présentation générale du cours

🔎 Se reporter au plan général du cours

____

Voir ci-dessous le reste des supports utiles au suivi profitable de la leçon

Feb. 9, 2022

Teachings : Droit de la régulation bancaire et financière - semestre 2022

► Référence complète : Frison-Roche, M.-A., Prévention et sanction des Abus de Marchés, in Leçons de Droit de la Régulation bancaire et financière, Sciences po (Paris), 9 février 2022.

► Référence complète : Frison-Roche, M.-A., Prévention et sanction des Abus de Marchés, in Leçons de Droit de la Régulation bancaire et financière, Sciences po (Paris), 9 février 2022.

____

► Résumé de la leçon sur les Abus de marché : Dans une conception classique et du Droit et du "libre marché", le principe est la liberté d'action de la personne. Même si l'exercice de cette liberté, voire d'un droit subjectif peut causer un dommage, par exemple un dommage concurrentiel, c'est en quelque sorte le prix légitime d'une société libre et concurrentielle. Ainsi dans une conception libérale, seul l'abus est sanctionné, c'est-à-dire l'exercice fautif que l'on fait de sa liberté ou de son droit, allant parfois jusqu'à l'exigence d'une faute qualifiée.

Mais les secteurs bancaires et financiers ne sont pas gouvernés par le principe de libre concurrence. Ils sont gouvernés par le principe de régulation, le principe de concurrence n'y a qu'un rôle adjacent. Cela ne pourra qu'engendrer de graves difficultés lorsque le Droit de la concurrence et le Droit bancaire et financier font s'appliquer d'une façon cumulée ou confrontée sur une même situation.

Les marchés financiers sont construits sur le principe de régulation qui pose le principe de transparence et de partage d'une information exacte : c'est ainsi que l'intégrité des marchés financiers est assurée, l'Autorité des Marchés financiers en étant le gardien.

La prévention et la sanction des "abus" de marché est donc non pas une part résiduelle du Droit financier, mais un pilier de celui-ci, contrairement au Droit des marchés ordinaires concurrentiels, sur lesquels l'opacité et le non-partage des informations est la règle.

Cela explique l'état du droit des "abus de marché", dont l'effectivité de la prohibition est essentielle pour le bon fonctionnement ordinaire des marchés financiers. Leur prohibition nationale a été harmonisée par le Droit de l'Union européenne, à travers des textes dont les signes reprennent l'appellation anglaise : Market abuses (ainsi le nouveau Règlement communautaire sur les abus de marché est dit Règlement MAR (Market Abuses Regulation) et la directive qui l'accompagne MAD (Market Abuses Directive).

Il sanctionne un certain nombre de comportements, qui portent atteinte à l'intégrité des marchés,

Mais il n'exprime plus des exceptions par rapport à un principe : des fautes par rapport à des libertés ou à des droits. Il exprime des moyens par rapport à des principes dont la sanction des abus ne constitue que la concrétisation de principes dont ils sont la continuité même : l'efficacité du marché, son intégrité, sa transparence, l'information de l'investisseur.

C'est pourquoi la sanction des abus de marché ne sont pas du tout un phénomène périphérique par rapport à la Régulation des marchés financiers et à l'activité et au fonctionnement des bancaires, comme l'est le Droit pénal : elle est au contraire à la fois ordinaire et centrale. Cette différence des deux ordres publics va se retrouver dans la question lancinante de la sanction pénale et de la sanction administrative des mêmes abus de marché (par exemple "manquement d'initié" et "délit d'initié", qui ont tendance à se cumuler dans des techniques de répression qui seront l'objet de la prochaine leçon.

_____

🔎 Accéder aux slides servant de support à la leçon sur les abus de marché

🔎 Revenir aux bases avec le Dictionnaire bilingue du Droit de la Régulation et de la Compliance

🔎 Approfondir par la Bibliographie générale de Droit de la Régulation bancaire et financière

🔎 Revenir à la présentation générale du cours

🔎 Se reporter au plan général du cours

____

Utiliser les matériaux ci-dessous pour aller plus loin et pour préparer votre conférence de méthode ⤵️

Jan. 19, 2022

Organization of scientific events

► Full Reference: Frison-Roche, M.-A., coordination and moderation of the conference L'office du juge et les causes systémiques (""The Office of the Judge and systemic causes"), in Cycle of Conferences, Penser l'office du juge ("Thinking the Office of the Judge"), Grand Chamber of the Cour de cassation, Paris, May 9, 2021, 17h-19h.

The conference is held in French.

____

► General presentation of the conference: the conference is based on the intervention of three judges, Christophe Soulard, Fabien Raynaud, and François Ancel, who think and debate among themselves on a hypothesis: the existence of "systemic causes". The hypothesis is that beyond and through the diversity of disputes and cases that are submitted to the most diverse judges, there is a category of cases that are systemic, which means containing in what is submitted to the judge for resolution a system. If such a category exists, which also raises the question of the diversity of systems and the difficulty arising from their submission to rules that are not legal (for example economic, biological, financial "laws", etc.) , then the judge should take this into account, both in the procedure and in the judgment they make on the case and in the way they formulate et restitute this judgment.

____

📝read the presentation of this conference by the Cour de cassation (in French)

📝read the program of the cycle of conferences 2022 (in French)

____

🎥see the conference video (in French)

🎥 see the synthesis video of the conference, made in situ by Marie-Anne Frison-Roche (in French)

____

✏️read the notes taken during the conference to make the synthesis (in French)

📝read the article of Marie-Anne Frison-Roche restituting this conference, published in the Recueil Dalloz (in French)

____

►read the works, basis of the two interventions of Marie-Anne Frison-Roche

🚧 L'hypothèse de la "cause systémique (made before the conference to prepare it), available en English

📝Synthese of the conference (made during the conference)

________

Aug. 16, 2021

Publications

► Full Reference: Frison-Roche, M.-A, Reinforce the judge and the lawyer to impose Compliance Law as a characteristic of the Rule of Law, Working Paper, August 2021.

► Full Reference: Frison-Roche, M.-A, Reinforce the judge and the lawyer to impose Compliance Law as a characteristic of the Rule of Law, Working Paper, August 2021.

____

🎤 this working document has been made to prepare some elements of the opening intervention in the symposium Quels juges pour la Compliance) ? (Which judges for Compliance?), co-organized by the Journal of Regulation & Compliance and the Institut Droit Dauphine, held at the Paris Dauphine University on September 23, 2021, constituting the first part of the intervention.

____

📝it has been also the basis for an article:

📕 published in its French version in the book La juridictionnalisation de la Compliance, in the collection📚Régulations & Compliance

📘published in its English version in the book Compliance Jurisdictionalisation, in the collection 📚Compliance & Regulation

____

► Summary of the Working Paper: One can understand that the compliance mechanisms are presented with hostility because they seem designed to keep the judge away, whereas there is no Rule of Law without a judge. Solid arguments present compliance techniques as converging towards the uselessness of the judge (I). Certainly, we come across magistrates, and of all kinds, and powerful ones, but that would be a sign of imperfection: its ex-ante logic has been deployed in all its effectiveness, the judge would no longer be required... And the lawyer would disappear so with him...

This perspective of a world without a judge, without a lawyer and ultimately without Law, where algorithms could organize through multiple processes in Ex Ante the obedience of everyone, the "conformity" of all our behaviors with all the regulatory mass that is applicable to us, supposes that this new branch of Law would be defined as the concentration of processes which gives full effectiveness to all the rules, regardless of their content. But supposing that this engineer's dream is even achievable, it is not possible in a democratic and free world to do without judges and lawyers.

Therefore, it is imperative to recognize their contributions to Compliance Law, related and invaluable contributions (II).

First of all, because a pure Ex Ante never existed and even in the time of the Chinese legists📎

Even more so, Compliance Law only takes its sense from its Monumental Goals📎

____

🔓read the Working Paper developments below⤵️

L’empire chinois n’a semble-t-il jamais apprécié les juges, ne leur faisant place que sous la forme de serviteurs purs de l’Etat, qu’ils soient des enquêteurs, des punisseurs et de gardiens de l’ordre public. Sur cet aspect du Droit chinois, v. … ; sur cette période particulièrement sanglante des légistes, où le principe de « certitude » de la législation a été portée à ses nues, v. …

🕴️Frison-Roche, M.-A. (ed.), 📘Compliance Monumental Goals, 2022.

The topic of this study is general. For a more analytical perspective, s.. 🕴️Frison-Roche, M.-A., « The function of the Judge in Compliance Law », in 🕴️Frison-Roche, M.A. (ed.), 📘Compliance Jurisdictionalisation, 2023.

🕴️Frison-Roche, M.-A. (ed.), 📘Compliance Tools, 2021.

June 23, 2021

Publications : Doctrine

► Référence complète : Douville, T., Quel droit pour les plateformes ?, in Delpech, X. (dir.), L'émergence d'un droit des plateformes, coll. « Thèmes et commentaires », Dalloz, 2021, pp.217-239.

_____

► Lire la présentation générale de l'ouvrage dans lequel est publié cet article.

June 17, 2021

Compliance: at the moment

► Compliance Law and Competition: for building, is it necessary to legislate ? Example of quasi-public interest judicial agreement: the French Competition Authority's Statement of June 3, 2021 on Facebook

The French law so-called "Sapin 2" of 2016, organized the "convention judiciaire d’intérêt public - CJIP" (Public Interest Judicial Agreement) which allows the prosecutor to undertake not to prosecute a company in returns for this company's commitments for the future. Is this mechanism reserved for this law, which only concerns corruption and bribery? The answer is often positive.

Is it so obvious?

Since the entity having the power to prosecute therefore always has the power not to prosecute. As the company always has the freedom to make commitments for the future. And everything stops.

News in Competition Law illustrate this. On June 9, 2021, as part of a transaction, the Autorité de la concurrence (French Competition Authority) sanctions Google (➡️📝 Communiqué of the Autorité de la Concurrence , translated in English by the French Competition Authority) , which has not contested the facts, for abuse of dominant position for having privileged its services in the online advertising services. Similar facts were alleged against Facebook. But on June 3, 2021, the Autorité de la concurrence (French Competition Authority) published a "communiqué de presse" (➡️📝statement translated in English by the French Competition Authority) saying that Facebook has, during the investigation, proposed commitments regarding its future behavior. It is remarkable that this statement on Facebook is published as an “acte de régulation” (regulatory act).

Yes, it is indeed an regulatory act about the future and structuring the online advertising area, internalized in this company which engages itself in its future behavior. With its statement, the Competition Authority invites the “acteurs du secteur” (actors of this sector) to make observations, for the development of what will be a sort of compliance program.

In these negotiations which are akin to a game table, where everyone calculates without knowing if they enter into a negotiation or a confrontation, the first game assuming that one shows more cards than in the second, it is indeed towards a kind of Public Interest Judicial Agreement that they are going with a Competition Authority which is both Judge and Prosecutor, concludes the agreement and, through a later decision, gives it force. Under the various legal qualifications, it is indeed the same general mechanism of Compliance Law, well beyond the specific French law known as Sapin 2.

Managed in this way, Compliance Law being an Ex Ante corpus, transforms the Competition Authority, an Ex Post Authority, into an Ex Ante Authority, openly taking "acte de régulation" (Regulatory Act), and allows it to rely on the power of companies, thus “committed”, to structure markets, which are however not regulated. Like advertising or retailing areas (➡️📝see Frison-Roche, M.-A., From Competition Law to Compliance Law: Example of French Competition Authority's decision on central purchasing body in mass distribution, 2020).

Thus Compliance Law has achieved the autonomy of Regulatory Law with regards to the notion, which nevertheless seemed intimate to it, of "sector".

June 16, 2021

Compliance: at the moment

► Compliance Law is essential for the future of Africa: this is also a lesson from the Juin 2021 G7 Summit in its Infrastructure Plan.

It emerges from the G7 summit which ends on June 13, 2021 in Carbis Bay in the United Kingdom, a common desire to increase infrastructures in Africa, in itself and because otherwise China will do it, and will do it differently.

Compliance Law will be determinant in this common action for three reasons.

First and because the issue is about infrastructures, the construction and the management of infrastructures falling more under Regulatory Law than Competition Law (📕Chevalier, J.-M., Frison-Roche, M.-A, Keppler, J.EPPLER, J.H. et Noumba, P. (ed.), Économie et droit de la régulation des infrastructures. Perspectives des pays en voie de développement, 2009). However, Compliance Law is not a simple process for the effectiveness of rules which are external to it, it is the extension in companies of Regulatory Law. Where companies must implement regulatory goals within themselves, they develop Compliance rules (➡️📝see Frison-Roche, M.A., From Regulation Law to Compliance Law, 2017.

Secondly and because the issue is about Africa, the Rule of Law is sometimes not very solid there. By internalizing Regulatory Law in companies (or even by associating Arbitration with it), Compliance Law makes it possible to get out of this dead end (➡️📝Salah, MM, Conception and Application of Compliance in Africa, in 📕 Frison-Roche, M.-A. (ed.), Compliance Tools, 2021.

Thirdly and because the topic si about China, Compliance Law in its European conception has the Monumental Goal of defending individuals while in its Chinese conception it aims to obtain their obedience to the rules (➡️📝Frison-Roche, M.-A., In China, Compliance Law deploys without, and even against democracy, China seeing Compliance only as an "efficiency process"; in Europe, it deploys with and even for democracy, 2021). On construction sites and in the human management of infrastructures, this changes everything.

G7 members share the first conception.

They must now implement it by their companies and thanks to them, private sector being in alliance with the political authorities which just expressed. Because Compliance Law is an alliance between political authorities and crucial economic operators.

May 5, 2021

Thesaurus : Doctrine

Full Reference : Akman, P., A web of Paradox: Empirical Evidences on Online Platform Users and Implications for Competition and Regulation in Digital Markets, Paper, June 2021.

Abstract (done by the author) :This article presents and analyses the results of a large-scale empirical study in which over 11,000 consumers from ten countries in five continents were surveyed about their use, perceptions and understanding of online platform services. To the author’s knowledge, this is the first cross-continental empirical study on consumers of online platform services of its kind. Among others, the study probed platform users about their multi-homing and switching behaviour; engagement with defaults; perceptions of quality, choice, and well-being; attitudes towards targeted advertising; understanding of basic platform operations and business models; and, valuations of ‘free’ platform services. The empirical evidence from the consumer demand side of some of the most popular multi-sided platforms reveals a web of paradoxes that needs to be navigated by policymakers and legislatures to reach evidence-led solutions for better functioning and more competitive digital markets. This article contributes to literature and policy by, first, providing a multitude of novel empirical findings and, second, analyzing those findings and their policy implications, particularly regarding competition and regulation in digital markets. These contributions can inform policies, regulation, and enforcement choices in digital markets that involve services used daily by billions of consumers and are subjected to intense scrutiny, globally.

April 1, 2021

Publications : Doctrine

March 30, 2021

Thesaurus : Doctrine

Full reference: Luguri, J. and Strahilevitz, L. J., Shining a Light on Dark Patterns, Journal of Legal Analysis, Vol. 13, Issue 1, 2021, 67p.

Sciences Po's students can read this article via Sciences Po's Drive in the folder MAFR - Regulation & Compliance.

March 30, 2021

Newsletter MAFR - Law, Compliance, Regulation

Full reference: Frison-Roche, M.-A., Why do we regulate? If it is to prevent systemic risks, systemic "family offices" must be subject to it (Archegos case) (Pourquoi régule-t-on? Si c'est pour prévenir les risques systémiques, les "family offices" systémiques doivent y être soumis (cas Archegos)), Newsletter MAFR - Law, Compliance, Regulation, 30th of March 2021

Read by freely subscribing other news of the Newsletter MAFR - Law, Compliance, Regulation

Summary of the news:

Archegos was a wealth management company whose activity consisted mainly in managing funds that were not themselves from the financial markets (hence its title of "family office"). Obviously, Archegos was proving to be too fragile financially in view of the highly speculative commitments it made on the financial markets and systemic banks were particularly deeply affected by the liquidation of large amounts by Archegos to be able to respond to margin calls.

As the mandate of the financial regulatory authorities is aimed almost exclusively at the protection of public savings, Archegos completely escaped the regulation and supervision of the Securities and Exchange Commission (SEC). However, Regulation Law also aims to prevent and manage systemic risks, which are often multi-sectoral and even trans-sectoral, and this in a teleological way. In view of this and the increasingly important place taken by speculative behavior in the financial markets, the financial regulatory authorities must give up the condition of using public savings in their consideration of operators which should be regulated because even an operator not handling public savings can threaten the existence of financial markets. From this perspective, "family offices", not handling public savings but having a systemic dimension, must come under the regulation and supervision of financial regulatory authorities.

March 23, 2021

Thesaurus : Soft Law

Full reference: Bayrou, F., Electricité: le devoir de lucidité (Electricity: the duty of lucidity), note n°4 from the Haut-Commissariat au Plan (French government planification agency), 23rd of March 2021, 37 p.

Read the note (in French)

Read the summary of the note done by the Haut-Commissariat au Plan on is official website (in French)

March 10, 2021

Teachings : Banking and Financial Regulatory Law - Semester 2021

Résumé de la dernière leçon : La Compliance, ne serait-ce que par ce terme même, est un mécanisme nouveau dans les systèmes juridiques européens, venant notamment en convergence du Droit de la concurrence, du Droit financier et du Droit du commerce international. L'on considère généralement qu'il provient du Droit financier et du Droit américain, qui développe ainsi d'une façon extraterritoriale ses conceptions juridico-financières.

Est ainsi en train de naître un Droit de la Compliance.

Il pourrait être celui qui disciplinerait l'économie numérique, laquelle croise étroitement l'économie bancaire et financière, qu'elle renouvelle.

Pour en mesurer l'importance et le développement, qui ne font que commencer, le plus probant est de commencer par sa manifestation incontestable en Droit français, à savoir la loi du 9 décembre 2016 de la loi dite "Sapin 2", suivant de peu la loi du 21 juin 2016 sur les abus de marché et suivie de peu par la loi du 27 mars 2017 sur le devoir de vigilance des sociétés donneuses d'ordre.

Revenir aux bases avec le Dictionnaire bilingue du Droit de la Régulation et de la Compliance

Approfondir grâce à la Bibliographie générale du cours de Droit de la Régulation bancaire et financière

Revenir au plan général du cours de Droit de la Régulation bancaire et financière

Revenir à la présentation générale du cours de Droit de la Régulation bancaire et financière

Parcourir les billets quotidiens d'actualité sur la Compliance.

Utiliser les matériaux ci-dessous pour aller plus loin et préparer votre conférence de méthode:

Feb. 3, 2021

Teachings : Banking and Financial Regulatory Law - Semester 2021

Résumé de la leçon : L'Europe est avant tout et pour l'instant encore une construction juridique. Elle fut pendant longtemps avant tout la construction d'un marché, conçu politiquement comme un espace de libre circulation (des personnes, des marchandises, des capitaux). C'est pourquoi le Droit de la Concurrence est son ADN et demeure le coeur de la jurisprudence de la Cour de justice de l'Union européenne, qui tient désormais l'équilibre entre les diverses institutions, par exemple la Banque Centrale Européenne, dont les décisions peuvent être attaquées devant elle. Mais aujourd'hui le Droit de l'Union européenne se tourne vers d'autres buts que la "liberté", laquelle s'exprime dans l'immédiat, notamment la "stabilité", laquelle se développe dans le temps. C'est pourquoi la Banque y prend un si grande importance.

En outre, face aux "libertés" les "droits" montent en puissance : c'est par les institutions juridiques que l'Europe trouve de plus en plus son unité, l'Europe économique et financière (l'Union européenne) et l'Europe des droits humains (le Conseil de l'Europe au sein duquel s'est déployée la Cour européenne des droits de l'Homme) exprimant les mêmes principes. C'est bien à travers une décision prenant appui sur le Droit de la concurrence que la Commission européenne le 18 juillet 2018 a obligé Google à concrétiser le "droit d'accès" à des entreprises innovantes, apte à faire vivre l'écosystème numérique, tandis que le Régulateur financier doit respecter les "droits de la défense" des personnes qu'il sanctionne.

Aujourd'hui à côté de l'Europe économique se développe en même temps par des textes une Europe bancaire et financière (on ne sait pas si par le Droit - par exemple le droit de la propriété intellectuelle - existera une Europe industrielle).La crise a fait naître l'Europe bancaire et financière. L'Union bancaire est issue de Règlements communautaires du 23 novembre 2010 établissant des sortes de "régulateurs européens" (ESMA, EBA, EIOPA) qui donnent une certaine unité aux marchés financiers qui demeurent nationaux, tandis que les entreprises de marché, entreprises privées en charge d'une mission de régulation, continuent leur déploiement selon des techniques de droit privé. L'Union bancaire est née d'une façon plus institutionnelle encore, par trois piliers qui assurent un continuum européen entre la prévention des crises, la résolution des crises et la garantie des dépôts. En cela, l'Europe bancaire est devenue fédérale.

Sur les marchés de capitaux, des instruments financiers et des titres, l'Union européenne a utilisé le pouvoir que lui confère depuis la jurisprudence Costa et grâce au processus Lamfallussy d'une sorte de "création continuée" pour injecter en permanence de nouvelles règles perfectionnant et unifiant les marchés nationaux. C'est désormais au niveau européen qu'est conçu la répression des abus de marché mais aussi l'information des investisseurs, comme le montre la réforme en cours dite "Prospectus 3". A l'initiative de la Commission Européenne, les textes sont produits en "paquet" car ils correspondent à des "plan d'action " . Cette façon de légiférer est désormais emprunté en droit français, par exemple par la loi dite PACTE du 29 avril 2019. Cette loi vise - en se contredisant parfois - à produire plus de concurrence, d'innovation, à attirer l'argent sur des marchés dont l'objectif est aussi la sécurité, notion d'égale importance que la liberté, jadis seul pilier du Droit économique. Conçue par les but, La loi est définitivement un "instrument", et un instrument parmi d'autres, la Cour de Justice tenant l'équilibre entre les buts, les instruments et les institutions.

La question du "régulateur" devient plus incertaine : la BCE est plus un "superviseur" qu'un "régulateur" ; le plan d'action pour une Europe des marchés de capitaux ne prévoit pas de régulateur, visant un capitalisme traditionnelle pour les petites entreprises (sorte de small businesses Act européen)

Revenir à la présentation générale du cours

Se reporter au plan général du cours

Utiliser les matériaux ci-dessous pour aller plus loin et préparer votre conférence de méthode.

Dec. 31, 2020

Thesaurus : Doctrine

Full reference: Zittrain, J. L., "Gaining Power, Losing Control", Clare Hall Tanner Lecture 2020, 2020

Read the intervention's report

This intervention is divided in two parts:

- Between Abdication and Suffocation: Three Eras of Governing Digital Platforms

- With Great Power Comes Great Ignorance: What’s Wrong When Machine Learning Gets It Right

Dec. 1, 2020

Newsletter MAFR - Law, Compliance, Regulation

Full reference: Frison-Roche, M.-A., New SEC Report to Congress about Whistleblower Program: what is common between American and European conception, Newsletter MAFR - Law, Compliance, Regulation, 1st of December 2020

Read by freely subscribing other news of the Newsletter MAFR - Law, Compliance, Regulation

Summary of the news

Like every year since the adoption of the Dodd-Frank Act, the Securities and Exchanges Commission (SEC) and especially its Office of the Whistleblowers (OWB) handed to the Congress of the United-States a report about the success of its program concerning whistleblowers, especially estimated with the amount of financial rewards granted to them during the year. This report especially presents the amount granted to whistleblowers, the quality of the collected information and the efficacy of SEC's whistleblowers' protection process.

If Americans condition the effectiveness of whistleblowing to the remuneration of whistleblowers, Europeans oppose the "ethical whistleblower" who shares information for the love of Law to the "bounty hunter" uniquely motivated by financial reward and favor the former to the later, as it is proven in the French Law Sapin II of 2016 (which do not propose financial reward to whistleblowers) or the British Public Interest Disclosure of 1998 (which just propose a financial compensation of the whistleblower's losses linked to whistleblowing).

However, American and European conceptions are not so far from each other. As United-States, Europe has a real care for legal effectivity, even if, because of their different legal traditions, Americans favor effectivity of rights while European favor effectivity of Law. If it places effectivity at the center of its preoccupations, Europe should conceive with less aversion the possibility to financially incite whistleblowers. Moreover, United-States and Europe share the same common willingness to protect whistleblowers and if rewarding would enable a better protection, then Europe should not reject it, as shows the recent declarations of the French Defenders of Rights. It is not excluded that both systems converges in a close future.

Nov. 23, 2020

Interviews

Full reference: Frison-Roche, M.-A., Facebook: Quand le Droit de la Compliance démontre sa capacité à protéger les personnes (Facebook: When Compliance Law proves its ability to protect people), interview with Olivia Dufour, Actu-juridiques Lextenso, 23rd of November 2020

Read the interview (in French)

Read the news of the Newsletter MAFR - Law, Compliance, Regulation about this question

Nov. 18, 2020

Thesaurus : 05. CJCE - CJUE

Full reference: CJEU, 1st chamber, 18th of November 2020, decision C‑519/19, Ryanair DAC vs DelayFix

Summary of the decision

This decision of the CJEU of 18th of November 2020 is about the jurisdiction clause for any dispute in air transport contracts, here those of Ryanair. This decision is especially interesting about the question to know whether the professional assignee (collection company) of a debt whose holder was a consumer may or may not avail itself of the consumer protection provisions, canceling the scope of this type of clause.

The Court takes back the criteria and the solution already used in 2019 about a credit contract: the protection applies by the criterion of the parties to the contract and not of the parties to the disputes. Such a clause is effective only if the integrality of the contract is transferred to the professional, and not only some of the stipulations.

This Regulatory decision, through "private enforcement", incentivizes consumers to transfer their compensation claim (around 250 euros) to collection companies which, in turn, discipline airlines to stay on schedule.