Feb. 21, 2025

Conferences

🌐suivre Marie-Anne Frison-Roche sur LinkedIn

🌐s'abonner à la Newsletter MAFR Regulation, Compliance, Law

🌐s'abonner à la Newsletter en vidéo MAFR Surplomb

____

► Full Reference: M.-A. Frison-Roche, La qualification juridique du système de noms de domaine comme infrastructure et ses conséquences juridiques ("The legal status of the domain name system as an infrastructure and its legal consequence"), in M.-A. Frison-Roche et G. Loiseau (dir.), Durabilité de l'Internet : le rôle des opérateurs du système des noms de domaine (Sustainability of the Internet: the role of the operators of the domain name system. Compliance and regulation of the digital space). Compliance et régulation de l'espace numérique, 21 février 2025, organisé par le Journal of Regulation & Compliance et l'Institut de la Recherche en Droit de la Sorbonne (André Tunc - IRDJS), 12 place du Panthéon, Paris.

► Full Reference: M.-A. Frison-Roche, La qualification juridique du système de noms de domaine comme infrastructure et ses conséquences juridiques ("The legal status of the domain name system as an infrastructure and its legal consequence"), in M.-A. Frison-Roche et G. Loiseau (dir.), Durabilité de l'Internet : le rôle des opérateurs du système des noms de domaine (Sustainability of the Internet: the role of the operators of the domain name system. Compliance and regulation of the digital space). Compliance et régulation de l'espace numérique, 21 février 2025, organisé par le Journal of Regulation & Compliance et l'Institut de la Recherche en Droit de la Sorbonne (André Tunc - IRDJS), 12 place du Panthéon, Paris.

____

🧮see the full programme of this colloquium (in French)

____

► Summary of this conference: "Domain names" are a technical reality. This technical reality has come to the fore, seeming to have been both little "thought out" and little "conceived" in Law and, perhaps because it is little coveted, Competition Law, which neutralises the concreteness of things and services in order to focus on exchange, hardly qualifies them. It is rather from the 'Competition Policy' perspective that 'domain names' are apprehended. However, Competition Policy expresses wishes and perspectives, while Competition aw must make way for the perspective of Regulatory Law inside the liberal economic system.

Looking at the technicalities of the domain name system, we can proceed in 3 stages.

Firstly, if a domain name is taken in isolation, it may appear as property and/or a projection of a person, and has rightly been described as such by the courts. But domain names only exist in relation to each other, the addressing system on which the Internet itself and the digital space that enables everyone to spread, reach and be reached were built. In this way, they constitute an Infrastructure in their plurality, in a uniqueness (I). The legal system must take account of this technological reality through the concept of Essential Infrastructure, which is well known in Regulatory legal perspective(I).

Secondly, the legal consequences of this legal qualification of Infrastructure must be detailed (II). Regulatory Law does not necessarily imply institutions, a regulatory authority being an indication rather than a criterion. Rather, it requires specific charges, powers and controls to ensure that the Infrastructure is established and operates to fulfill, now and in the future, the function that is crucially expected of it. Because the digital space was born of the Internet, an a-sectional and a-territorial space, Compliance Law, which is an extension of Regulatory Law, outside the sectors and internalised in the crucial operators, is essential as it is appropriate without diminishing the public dimension of the organisation.

Thirdly, the evidential dimension should be emphasised (III). Indeed, because we need to ensure that the Domain Names Infrastructure is always solid and reliable, so as not to risk a systemic failure of the Internet, and therefore of the digital space, we must not remain with the traditional system of burden of proof that rests on the person making the complaint. Because there is a Compliance Obligation, it is up to the crucial operators to credibly show their ability to ensure the technical sustainability of this infrastructure on which the digital space in which we live is based.

It shall be different if the issue is one of non-technical Sustainability, for example that which is linked to a particular societal project, in which the operators of the domain name system are not at the origin and are required on an ad hoc basis because they are in a good position to help the Authorities or because they wish to do so.

_____

Feb. 18, 2025

Publications

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐subscribe to the Vide Newsletter MAFR Hangover

____

► Full Reference: M.-A. Frison-Roche, The legal status of the domain name system as an infrastructure and its legal consequences, Working paper, February 2025

► Full Reference: M.-A. Frison-Roche, The legal status of the domain name system as an infrastructure and its legal consequences, Working paper, February 2025

____

🎥 This working paper is the basis of the contribution to the symposium co-organised by the Journal of Regulation & Compliance (JoRC) and the Institut de Recherche Juridique de la Sorbonne (André Tunc - IRJS), Durabilité de l'Internet : le rôle des opérateurs du système des noms de domaine. Compliance et régulation de l'espace numérique (Sustainability of the Internet: the role of domain name system operators. Compliance and Regulatory Law in the Digital Space).

____

📝 It will also form the basis of the forthcoming📕.

____

► Summary of this Working Paper: Les "noms de domaine" sont une réalité technique. Cette réalité technique s'est imposée, semblant avoir été à la fois peu "pensée" et peu "conçue" en Droit et, peut-être parce qu'elle fait peu l'objet de convoitise, le Droit de la concurrence qui neutralise la concrétude des choses et prestations pour se concentrer sur l'échange, ne les qualifie guère. C'est plutôt dans une perspective de "politique de concurrence" que les noms de domaine" sont appréhendés. Or, la politique de la concurrence exprime des souhaits et des perspectives, tandis que le Droit de la concurrence doit faire place au sein du système économique libéral à la perspective de Régulation.

► Summary of this Working Paper: "Domain names" are a technical reality. This technical reality has come to the fore, seeming to have been both little "thought out" and little "conceived" in Law and, perhaps because it is little coveted, Competition Law, which neutralises the concreteness of things and services in order to focus on exchange, hardly qualifies them. It is rather from the 'Competition Policy' perspective that 'domain names' are apprehended. However, Competition Policy expresses wishes and perspectives, while Competition aw must make way for the perspective of Regulatory Law inside the liberal economic system.

Looking at the technicalities of the domain name system, we can proceed in 3 stages.

Firstly, if a domain name is taken in isolation, it may appear as property and/or a projection of a person, and has rightly been described as such by the courts. But domain names only exist in relation to each other, the addressing system on which the Internet itself and the digital space that enables everyone to spread, reach and be reached were built. In this way, they constitute an Infrastructure in their plurality, in a uniqueness (I). The legal system must take account of this technological reality through the concept of Essential Infrastructure, which is well known in Regulatory legal perspective(I).

Secondly, the legal consequences of this legal qualification of Infrastructure must be detailed (II). Regulatory Law does not necessarily imply institutions, a regulatory authority being an indication rather than a criterion. Rather, it requires specific charges, powers and controls to ensure that the Infrastructure is established and operates to fulfill, now and in the future, the function that is crucially expected of it. Because the digital space was born of the Internet, an a-sectional and a-territorial space, Compliance Law, which is an extension of Regulatory Law, outside the sectors and internalised in the crucial operators, is essential as it is appropriate without diminishing the public dimension of the organisation.

Thirdly, the evidential dimension should be emphasised (III). Indeed, because we need to ensure that the Domain Names Infrastructure is always solid and reliable, so as not to risk a systemic failure of the Internet, and therefore of the digital space, we must not remain with the traditional system of burden of proof that rests on the person making the complaint. Because there is a Compliance Obligation, it is up to the crucial operators to credibly show their ability to ensure the technical sustainability of this infrastructure on which the digital space in which we live is based.

It shall be different if the issue is one of non-technical Sustainability, for example that which is linked to a particular societal project, in which the operators of the domain name system are not at the origin and are required on an ad hoc basis because they are in a good position to help the Authorities or because they wish to do so.

_____

🔓read the developments below⤵️

June 28, 2022

Compliance: at the moment

Référence complète : Frison-Roche, M.-A., S'associer structurellement pour atteindre un But Monumentale. Equilibre entre Concurrence et Compliance : l'entente bienvenue entre deux opérateurs dominants pour réduire l'émission des gaz à effet de serre, 28 juin 2022.

____

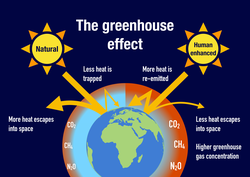

L'Autorité néerlandaise de la concurrence, l' Authority for Consumers and Markets, a exprimé le 27 juin 2022 une "opinion" concernant deux opérateurs énergétiques très puissants, Shell et TotalEnergie, décidés à collaborer pour réduire la pollution, parce que les effets négatifs de cette restriction de concurrence engendrée par cette entente sont moindres que les effets positifs de réduction d'émission de gaz à effet de serre, leur contribution à la lutte contre le déséquilibre climatique justifiant ainsi cette collaboration.

Au-delà de l'analyse précise de la situation, l'Autorité présente ainsi sa décision : "Following an assessment of their plans, the Netherlands Authority for Consumers and Markets (ACM) has decided to allow competitors Shell and TotalEnergies to collaborate in the storage of CO2 in empty natural-gas fields in the North Sea. By transporting CO2 through pipes and storing it in old gas fields, this greenhouse gas will not be released into the atmosphere. This initiative thus helps realize the climate objectives. As cooperation is necessary for getting this initiative off the ground and for realizing the climate benefits, the slight restriction of competition between Shell and TotalEnergies is not that harmful. The benefits for customers of both companies and for society as a whole exceed the negative effects of that restriction.".

L'Autorité n'hésite donc pas à affirmer que les entreprises peuvent s'entendre structurellement car cela est bénéfique pour les deux entreprises, bénéfiquespour les consommateurs et bénéfique pour le groupe social.

C'est surtout le dernier point qui est important.

Cette décision illustre l'évolution du rapport entre le Droit de la Concurrence et le Droit de la Compliance. Nous sommes bien loin de la façon dont on présente encore souvent ces deux branches du Droit, notamment dans ce que serait la Compliance pour le Droit de la Concurrence, à savoir un moyen d'accroître l'effectivité le Droit de la Concurrence (I). L'évolution de plus en plus forte donne aux entreprises le pouvoir, parce qu'elles en ont l'obligation d'atteindre le "but monumental" de faire quelque chose en matière climatique, par exemple d'inventer ensemble des structures bénéfiques à l'équilibre climatique : ce qui relève alors du Droit de la Compliance, lequel n'accroît pas le Droit de la Concurrence (puisque la Compliance légitime les ententes) mais vient se mettre en équilibre face au Droit de la Concurrence (II). En cela, le Droit de la Compliance est le prolongement du Droit de la Régulation, comme lui Ex Ante (les entreprises demandent en Ex Ante la validation de leur structure collaborative, et cela en dehors de tout secteur (III). L'avenir est donc au Droit de la Compliance, pilier de ces nouveaux équilibres.

I. LE RAPPORT TRADITIONNELLEMENT PRESENTÉ ENTRE DROIT DE LA CONCURRENCE ET DROIT DE LA COMPLIANCE

Lorsqu'on consulte le droit souple disponible, notamment celui émis par les Autorités de concurrence, par exemple le nouveau "document-cadre" publié par l'Autorité de la concurrence une première fois le 11 octobre 2021 puis une seconde fois, sous une forme définitive, le 24 mai 2022 : Document-cadre du 24 mai 2022 sur les programmes de conformité aux règles de concurrence.

Ce document débute ainsi : "La conformité, terme désormais bien ancré dans la pratique (également sous son nom anglais de « compliance ») désigne à la fois un processus et un objectif. L’objectif de la conformité consiste, pour une entreprise, à défendre des valeurs et encourager des comportements vertueux pour pleinement respecter les règles, notamment de concurrence. C’est une démarche éthique qui favorise un fonctionnement concurrentiel libre et non faussé de l’économie et permet pour les entreprises une gestion optimisée des risques, qu’ils soient financiers ou réputationnels. Le terme conformité renvoie, également, à un processus interne mis en place de façon permanente au sein même des entreprises, qui s’appuie notamment sur les « programmes de conformité ». La conformité désigne, à cet égard, les actions internes mises en place qui visent à diffuser la culture de concurrence, à assurer le respect des règles et la responsabilisation des acteurs économiques en faveur d’une concurrence basée sur les mérites. Les programmes de conformité s’appliquent aussi bien à prévenir les risques d’infraction aux règles de concurrence qu’à détecter les infractions éventuelles et à y remédier. Ils sont, en outre, amenés à évoluer au gré des besoins et des changements intervenus. La conformité combine, ainsi, trois composantes : préventive, curative et évolutive. ".

Pour l'Autorité de la concurrence, la "conformité" ou "compliance" (les deux termes étant pour elles synonyme, juste une question de traduction) est donc une sorte de voie d'exécution en Ex Ante : un moyen d'effectivité des règles de concurrence qui, plutôt que de prendre la forme de sanction Ex Post des violations commises par les entreprises, prend la forme Ex Ante d'une culture de concurrence développée par les entreprises elles-mêmes qui évitent, par divers moyens et pour diverses raisons, de commettre les manquements.

Dès lors, la Compliance fait totalement corps avec le Droit de la Concurrence ; c'est une sorte d'appendice, et rien de plus. Un peu comme l'on voyait il y a longtemps la procédure, "servante" des branches de Droit "substantielles" (c'est-à-dire nobles), comme le Droit public, le Droit des obligations, etc., chacune se reflétant dans son outil d'effectivité : le Droit public dans le Contentieux administratif, le Droit civil dans la Procédure civile, etc. Depuis quelques décennies, l'on ne pense plus ainsi.

En dehors même du fait que les branches du Droit qui donne aux règles leur effectivité, c'est-à-dire les procédures, sont depuis longtemps devenues autonomes, ont même été regroupées dans le "Droit processuel", le Droit de la Compliance est lui-même une branche du Droit qui n'est pas un ensemble de procédures d'effectivité : il est une branche du Droit substantiel.

Et il poursuit des buts qui lui sont propres.

C'est pourquoi il peut ne pas poursuivre les mêmes buts que le Droit de la Concurrence. Il vient alors non pas accroître par sa puissance la branche du Droit à laquelle il s'articule (ici les principes du Droit de la concurrence), mais au contraire équilibrer ces principes en confiant aux entreprises d'autres buts à atteindre.

🔴M.A. Frison-Roche, Droit de la concurrence et Droit de la compliance, 2018.

Les buts du Droit de la Compliance ne sont pas les mêmes que les buts du Droit de la Concurrence. Ils sont beaucoup plus ambitieux. Il y a notamment le climat. Si une Autorité de concurrence admet de prendre en considération la lutte effective contre la perspective de crise climatique catastrophique, alors elle intègre la logique du Droit de la Compliance, et notamment son premier principe qui est l'inverse du principe du Droit de la concurrence : l'impératif de s'allier avec d'autres dans la durée pour atteindre ce but.

La décision de l'Autorité de concurrence est exemplaire de cela. Elle valide par avance une infrastructure.

II. L'ENTENTE ENTRE DES ENTREPRISES POUR ATTEINDRE LE BUT MONUMENTAL DE L'ACTION CLIMATIQUE, VALIDÉE EX ANTE, EN ÉQUILIBRE DES PRINCIPES DU DROIT DE LA CONCURRENCE

Les 2 entreprises créent ensemble une activité qui est décrite et appréciée par l'Autorité en ces termes : "Shell and TotalEnergies wish to store CO2 in empty North Sea gas fields on a large scale. This is part of the Aramis project, in which the government, Gasunie and Energie Beheer Nederland work together with Shell and TotalEnergies in order to build a high-capacity trunkline that connects to empty gas fields, among other activities. Carbon capture and storage helps reduce CO2 emissions of businesses located in the Netherlands that, at the moment, still have few alternatives. Major investments are needed since it concerns a high-capacity trunkline and a new, innovative method. In order to get the project off the ground, Shell and TotalEnergies need to offer the CO2 storage together, and therefore jointly set the price with an eye to putting the first ±20% of the trunkline’s capacity into operation. For the remaining 80%, no collective agreements will be made. Shell and TotalEnergies compete with one another. Collaborations between two competitors may negatively affect price, quality, and innovation, but that effect can be offset by certain benefits that a collaboration has for the customers of those businesses and for society as a whole. That is why the parties have asked ACM for informal guidance about whether their collaboration is compatible with the competition rules that offer an exemption to the prohibition to restrict competition if, in short, the benefits outweigh the costs.".

Ainsi, plutôt que faire les investissements conjoints en infrastructures, de faire fonctionner celles-ci et d'attendre une poursuite devant l'Autorité de concurrence pour entente en plaidant pour éviter la sanction le bénéfice social produit par cette collaboration dans cette infrastructure commune à travers la technique probatoire dite du "bilan", charge probatoire dont on connait la lourdeur et l'aléa, les autorités de concurrence prenant peu en considération ce bilan, souvent jugée trop politique et trop peu étayée économiquement (sur le droit positif, v. M.-A. Frison-Roche et J.-C. Roda, Précis Dalloz, Droit de la concurrence, 2022, n°452 et s.), les entreprises ont entrepris une démarche en Ex Ante.

Mais surtout les exemptions individuelles délivrées formellement au nom du Droit de la concurrence, telles que la Commission européenne le conçoit dans ses lignes directrices du 27 avril 2004 excluent de la mise en balance des considérations non-économiques et l'absence de prise en considération du souci climatique a été particulièrement critiquée.

L'on a pu ainsi anticiper la présente décision de l'Autorité néerlandaise de concurrence (M.-A. Frison-Roche et J.-C. Roda, Précis Dalloz, Droit de la concurrence, préc., n°454), du fait de la décision dite Shell rendue le 26 mai 2021 sur le terrain de la responsabilité civile par le Tribunal de La Haye.

III. LE DROIT DE LA COMPLIANCE, UN DROIT DE LA REGULATION A-SECTORIEL NE REQUERANT QU'UNE SUPERVISION

En effet et précisément, dans cet arrêt du 26 mai 2021, le Tribunal de La Haye a refusé de considérer que constituait une concurrence déloyale le fait d'imposer à Shell une obligation de réduire des émissions de CO2, même si cela freine sa croissance et que ses compétiteurs sur le marché du pétrole et du gaz n'y sont pas soumis car "l'intérêt servi par l'obligation de réduction l'emporte sur les intérêts commerciaux du groupe Shell...".

Le groupe Shell a donc une obligation d'action pour atteindre un intérêt qui le dépasse : un but monumental climatique, qui engendre à sa charge une Responsabilité Ex Ante.

🔴M.A. Frison-Roche, La Responsabilité Ex Ante, pilier du Droit de la Compliance, 2022.

Puisque le Droit de la Compliance impose aux entreprises de telles responsabilités, exige d'elles qu'elles prennent en charge de telles ambitions, détectent et préviennent de telles catastrophiques, alors implicitement, il leur confère les pouvoirs nécessaires pour le faire.

Cela serait inconcevable que les entreprises, obligées d'agir pour le climat, n'ont seulement n'aient pas le pouvoir de le faire, mais encore se voient interdire de le faire, par exemple par le Droit de la Concurrence. Cela est une conséquence directe du Principe de Proportionnalité, qui est au cœur du Droit de la compliance : l'entreprise ne doit certes pas avoir plus de pouvoir qu'il n'est nécessaire pour qu'elle atteigne le but qui lui est assigné, mais elle doit avoir tous les pouvoirs qui lui sont nécessaires pour cela.

🔴M.-A. Frison-Roche, Définition du Principe de proportionnalité et définition du Droit de la Compliance, in Les buts monumentaux de la Compliance, 2022

🔴M.-A. Frison-Roche, Concevoir le Pouvoir, 2021

Le Droit de la Compliance apparaît ici nettement puisqu'indépendamment des lignes directrices de 2004 de la Commission européenne qui n'admettent qu'un bilan concurrentiel, l'Autorité de concurrence prend ici directement appui sur l'initiative des entreprises qui s'associent structurellement pour atteindre un but climatique d'intérêt général.

En cela, et en Ex Ante, les entreprises mettent au point une infrastructure qui dans la durée va certes aller contre les principes de concurrence mais va tendre vers le But Monumental dont elles sont chargées, et pour Shell cette charge repose expressément sur elle puisque par ailleurs une juridiction le lui a expressément rappelé en refusant justement de faire jouer à son bénéfice la protection du Droit de la concurrence déloyale !

Ainsi, le Droit de la Compliance est ici illustré en ce qu'il est le prolongement du Droit de la Régulation.

🔴M.A. Frison-Roche, Du Droit de la Régulation au Droit de la Compliance, in Régulation, Supervision, Compliance, 2017

Ce mouvement va se renforcer, le Droit de la Compliance se plaçant au centre du Droit économique, laissant aux entreprises le soin, l'obligation, le pouvoir, de prendre des initiatives à long terme pour viser des buts d'intérêt général global, sous la supervision Ex Ante puis en continu des Autorités publiques.

________

Nov. 28, 2021

Compliance: at the moment

Sept. 16, 2021

Thesaurus : Doctrine

► Full Reference: Vaquieri, J.-F., The "Monumental Goals" perceived by the company. The example of Enedis, in Frison-Roche, M.-A. (ed.),Compliance Monumental Goals, series "Compliance & Regulation", Journal of Regulation & Compliance (JoRC) and Bruylant, to be published.

___

► Article Summary: The article aims to show how a particular company in that it is charged by the State to effectively distribute electricity to everyone in France participates in the Monumental Goals, makes them concrete and integrates them into its functioning itself. The firm Enedis, a French monopolistic State company, operator of the distribution network participates directly in these Goals under the express application of the French Energy Code.

Under the control of the Regulator, the company is responsible for the continuity of the electricity supply and responds to the challenges of energy transition, Enedis ensuring equal treatment at national and local level, Compliance thus extending Regulatory system to which this firm responds and which it internalizes. The management of personal data, energy being at the heart of the digital revolution, implies a particularly strong internal framework of Compliance. This articulation between this new Compliance in terms of personal information and this classic Compliance as a continuation of the Regulation to serve the citizen, both converging for the benefit of people, explains that Enedis has put Compliance at the heart of its commitments, particularly expressed in its code of conduct, its industrial and human project (Projet industriel et humain - PIH) and its environmental actions.

The Compliance which is specific to Enedis is disseminated by it to various entities, in particular via concession contracts, giving these an original framework. This importance of Compliance for Enedis leads the company through the "Monumental Goals" which unite it to design and maintain balances between the diversity of these so that the values carried by the companies continue to decline, especially locally.

____

______

June 16, 2021

Compliance: at the moment

► Compliance Law is essential for the future of Africa: this is also a lesson from the Juin 2021 G7 Summit in its Infrastructure Plan.

It emerges from the G7 summit which ends on June 13, 2021 in Carbis Bay in the United Kingdom, a common desire to increase infrastructures in Africa, in itself and because otherwise China will do it, and will do it differently.

Compliance Law will be determinant in this common action for three reasons.

First and because the issue is about infrastructures, the construction and the management of infrastructures falling more under Regulatory Law than Competition Law (📕Chevalier, J.-M., Frison-Roche, M.-A, Keppler, J.EPPLER, J.H. et Noumba, P. (ed.), Économie et droit de la régulation des infrastructures. Perspectives des pays en voie de développement, 2009). However, Compliance Law is not a simple process for the effectiveness of rules which are external to it, it is the extension in companies of Regulatory Law. Where companies must implement regulatory goals within themselves, they develop Compliance rules (➡️📝see Frison-Roche, M.A., From Regulation Law to Compliance Law, 2017.

Secondly and because the issue is about Africa, the Rule of Law is sometimes not very solid there. By internalizing Regulatory Law in companies (or even by associating Arbitration with it), Compliance Law makes it possible to get out of this dead end (➡️📝Salah, MM, Conception and Application of Compliance in Africa, in 📕 Frison-Roche, M.-A. (ed.), Compliance Tools, 2021.

Thirdly and because the topic si about China, Compliance Law in its European conception has the Monumental Goal of defending individuals while in its Chinese conception it aims to obtain their obedience to the rules (➡️📝Frison-Roche, M.-A., In China, Compliance Law deploys without, and even against democracy, China seeing Compliance only as an "efficiency process"; in Europe, it deploys with and even for democracy, 2021). On construction sites and in the human management of infrastructures, this changes everything.

G7 members share the first conception.

They must now implement it by their companies and thanks to them, private sector being in alliance with the political authorities which just expressed. Because Compliance Law is an alliance between political authorities and crucial economic operators.

Nov. 18, 2020

Conferences

🎥Compliance Law, an adequate legal framework for GAIA-X, in 🧮GaiaX Summit2020, The World with GAIA-X

► Full Reference: M.-A. Frison-Roche, "Compliance Law, an adequate legal framework for GAIA-X", in Pan-European GAIA - X Summit, The World with GAIA-X, November18, 2020.

____

🧮See the general presentation of the Summit

____

📈See the slides, basis of this intervention.

____

► Summary of the intervention: Europe may offer an adequate legal framework for the GAIA-X project through Compliance Law. Compliance Law is a new form for Regulatory Law, driven by "Monumental Goals", negative Monumental Goals, for instance prevention of systemic failures, and positive Monumental Goals, for instance innovation or stability. This very new branch of Law works on these Monumental Goals, which must be explicit and internalized in Crucial Enterprises. These Crucial Enterprises concretize these Goals, supervised by public Authorities.

European Compliance Law already works, for instance about Personal Data protection (case law and GDPR) or prevention banking systemic failures (Banking Union), Compliance Tools being in balance with Competition principle. European Union Law is moving from the Ex-Post Competition Law to the Ex-Ante Compliance Law, internalizing Monumental Goals in Crucial Enterprises.

There is a perfect adequacy between European Compliance Law and GAIA-X. This project built by Crucial Enterprises must be supervised by public authority, maybe a specific or the European Commission. The governance of GAIA-X must be transparent and accountable. This private organization must use it powers in respect of the proportionality principle, controlled by the public supervisory body. The legal framework is required but it is sufficient.

___

📈see the slides, basis of this intervention.

____

🎥watch the video of this intervention.

________

Aug. 24, 2020

Newsletter MAFR - Law, Compliance, Regulation

Full reference: Frison-Roche, M.-A., The control by regulator of the essential infrastructure manager's investment plan: example of electric network and the notion of "doctrine", Newsletter MAFR - Law, Compliance, Regulation, 24th of August 2020

Read by freely subscribing other news of the Newsletter MAFR - Law, Compliance, Regulation

Summary of the news

On 31st of July 2020, the Commission de Régulation de l'Energie (CRE and French energy regulator) has examined the investment plan of the French electric network manager (RTE) as it does every year. This investment plan is an economic document but it also contains societal purposes, especially the adaptation of the electric network in order to integrate renewable energies.

The control by the CRE is not a financial control. The crucial operator (RTE) is free to decide the way it wants to manage its budget. The CRE just advices on the financial side by recommending for exemple to be more flexible in its financial strategies. The true CRE's control is about the investment plan's general orientations, the methodology of needs analysis and crucial operator's investment choices which must be aligned with those of the regulator.

Such a control leads to the emergence of an "investment doctrine" from the side of the crucial operator, mixing its own choices and the regulator's guidelines. Beyond this, the elaboration of the investment plan is the result of a true co-writing between the regulator and the firm which discuss together, exchanges points of view and methods. Such a method, expressing a kind of coregulation, could be used in other sectors.

June 23, 2019

JoRC

The European Banking Union is based on supervision as much as on regulation: it concerns the operators as much as the structures of the sector, because the operators "hold" the sector.

This is why the "regulator - supervisor" holds the operators by the supervision and is close to them.

He meets them officially and in "soft law" relations. This is all the more necessary since the distinction between the Ex Ante and the Ex Post must be nuanced, in that its application is too rigid, in that it involves a long time (first of all the rules, then to apply them, then to notice a gap between rules and behaviors, then to repair it) is not appropriate if the system aims at the prevention of systemic crises, whose source is inside the operators.

This is why the body in charge of solving the difficulties of the systemic banks for the salvation of the systeme meets the banking sector itself, to ensure that they are permanently "resolvable", so that the hypothesis of their resolution never arises. This is the challenge of this system: that it is always ready, for never be applying.

____

In the European Banking Union, the Single Resolution Board (SRB) is in charge of "resolve" the difficulties of European systemic banks in difficulty. It is the public body of the second pillar of the Banking Union. The first pillar is the prevention of these difficulties and the third is the guarantee of deposits. The resolution is therefore more like an Ex Post mechanism.

But in this continuum through these three pillars between the Ex Ante and the Ex Post, the SRB does not wait passively - as would a traditional judge do - that the file of the troubled bank reaches it. Like a supervisor - which brings it closer to the first public in the system (Single Supervisory Board -SSB), which supervises all the banks, it is in direct contact with all the banks, and it approaches the hypothesis of a bank in trouble by a systemic perspective: it is therefore to the entire banking system that the SRB addresses itself.

As such, it organizes meetings, where he is located: in Brussels.

To resolve in Ex Post the difficulties of a bank, it has to present a quality (a little known concept in Bankruptcy Law): "resolvability". How build it? Who build it ? In its very design and in its application, bank by bank.

For the resolution body vis-à-vis all players in the banking and financial sector, it's clear: "Working together" is crucial in building resolvability ".

In the projection that is made, it is affirmed that there can be a successful resolution only if the operator in difficulty is not deprived of access to what makes to stay it alive, that is to say the banking and financial system itself, and more specifically the "Financial Market Infrastructures", for example payment services.

Does the Single Resolution Board expect spontaneous commitments from the FMIs for such a "right of access"? In this case, as the Single Resolution Board says, this right of access corresponds to "critical functions" for a bank, the resolution situation can not justify the closure of the service.

By nature, these crucial operators are entities that report to regulators who oversee them. Who enforces - and immediately - this right of access? When one can think that it is everyone, it risks being nobody .... That is why the resolution body, relaying in this a concern of the Financial Stability Board, underlines that it is necessary to articulate the supervisors, regulators and "resolvers" between them.

_____

To read this program, since it is a proposed program of work for the banking sector, four observations can be made:

1. We are moving more and more towards a general "intermaillage" (which will perhaps replace the absence of a global State, but it is an similar nature because it is always to public authorities that it refers and not to self-regulation);

2. But as there is no political authority to keep these guardians, the entities that articulate all these various public structures, with different functions, located in different countries, acting according to different temporalities, these are the companies themselves that internalize the concern that animates those who built the system: here the prevention of systemic risk. This is the definition of Compliance, which brings back to companies, here more clearly those those which manage the Market Infrastructures, the obligations of Compliance (here the management of systemic risk through the obligation of giving access).

3. Even without a single systemic guard, there is always a recourse. That will be the judge. There are already many, there will probably be more in a system of this type, more and more complex, the articulation of disputes is sometimes called "dialogue". And it is undoubtedly "decisions of principle" that will set the principles common to all of these particular organisms.

4. We then see the emergence of Ex Ante mechanisms for the solidity of the systems, and the solidity of the players in the systems, and then the Ex Post resolution of the difficulties of the actors according to access to the solidity of the infrastructures of these systems, which ultimately depend on judges (throughout the West) facing areas where all of this depends much less on the judge: the rest of the world.

____

March 21, 2017

Thesaurus : 10. Autorité de la Concurrence

Full reference: Autorité de la concurrence (French Competition Authority), Decision relating to practices implemented in natural gas, electricity and energy services supply sector, Engie vs Direct Energie/UFC que choisir, 21st of March 2017, n°17-D-06

Read the press release of the decision of 9th of September 2014 on which this decision is based

Nov. 18, 2015

Thesaurus : Doctrine

Référence complète : Barban, P., Les entreprises de marché. Contribution à l'étude d'un modèle d'infrastructure de marché, préface de France Drummond, Avant-propos de Jean-Jacques Daigre, LGDJ, nov. 2015.

May 21, 2009

Publications

Référence complète : FRISON-ROCHE, Marie-Anne, Le droit est-il un outil ou un obstacle à la régulation des infrastructures essentielles ? in Economie et droit de la régulation des infrastructures. Perspectives des pays en voie de développement, Banque Mondiale / Chaire régulation, coll. Droit et Economie, LGDJ, Paris, 2008, p. 37-49.

La Banque mondiale a montré que le développement économique des pays est lié à son développement juridique. Cela est aussi vrai pour les réseaux d'infrastructures, qui ne dépendent pas seulement des politiques publiques, mais encore du droit car il s'agit de biens essentiels pour lesquels il faut avoir un droit d'accès. Mais les pays en voie de développement souffrent d'une immaturité juridictionnelle car ils ne disposent pas d'une organisation juridictionnelle fiable et impartiale, alors que le droit a besoin d'un juge. On peut songer à deux pistes de solution : soit un tribunal internalisé dans le régulateur, sur le modèle de l'OMC, soit des pouvoirs et des taches de régulation confiées aux gestionnaires de réseau en ce qu'ils sont des "opérateurs cruciaux".

Lire la présentation générale de l'ouvrage dans lequel l'article a été publié.

Lire le résumé de l'article ci-dessous.

April 12, 2001

Publications

Référence complète : FRISON-ROCHE, Marie-Anne, "Le droit de la régulation", D.2001, chron., pp.610-616.

____

Pour lire l'article, cliquez ici

June 8, 1995

Conferences