The recent news

Dec. 2, 2025

Law by Illustrations

🌐Follow Marie-Anne Frison-Roche on LinkedIn

🌐Subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐Subscribe to the video newsletter MAFR Overhang

🌐Subscribe to the Newsletter MaFR Law & Art

____

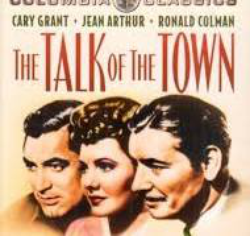

► Full reference : M.-A. Frison-Roche, "Fiction🎬The talks in the Town : what can a law professor do about it?", article from the Newsletter Law & Art, December 2025.

____

____

► Summary of this article : This 1942 film seems to have left little trace. However, the main character, an innocent man whom the villain manipulates into being designated as the culprit by the small town's population, leading him to behave like a guilty person, is played by Cary Grant.

This film inspired lawyers even more.

And even more so law professors, because it was a law professor, the dean of Harvard Law School, who saved the innocent man who had been caught in the trap.

And even more so today, since it was by playing on rumours, by creating them from the outset, in what we would call disinformation, that the powerful villain intended to win and, in the process, become mayor of the town, after escaping bankruptcy by setting fire to his own factory, a crime he blames on the innocent man thrown to the wolves of public opinion as citizens gather in the square. It's almost as if we were there...

____

🔓read the article below⤵️

Nov. 27, 2025

Interviews

🌐Follow Marie-Anne Frison-Roche on LinkedIn

🌐Subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐Subscribe to the video newsletter MAFR Overhang

🌐Subscribe to the Newsletter MaFR Law & Art

____

► Full reference : M.-A. Frison-Roche, ""Géomètres-experts : une profession qui assume concrètement sa responsabilité territoriale Géomètres-experts : une profession qui assume concrètement sa responsabilité territoriale (Chartered Surveyors: a Profession that takes its territorial responsibility seriously)", interview for JurisHebdo, 27 November 2025

___

► Read the interview (in French) in which the questions (translated below in English) were answered⤵

____

Q.You helped define the raison d'être of the profession of chartered surveyors and its Professional Order. In your opinion, what is its true consequences?

Q. Can the raison d'être become a tool for Compliance or Governance?

Q. What conflicts arise around the source of compliance norms and their implementation?

Q. Is this initiative part of a broader move towards social responsibility?

Q. How can the raison d'être influence the mission of the chartered surveyor, particularly in relation to land and environmental matters?

_________

⛏️Further reading on the subject:

🕴🏻M.-A. Frison-Roche, 🎤Designing a raison d'être and explaining it, 2025

🕴🏻M.-A. Frison-Roche, 📝The Monumental Goals of Compliance, the beating heart of Compliance Law, 2023

________

Nov. 19, 2025

Publications

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐subscribe to the Video Newsletter MAFR Surplomb

🌐subscribe to theNewsletter MaFR Droit & Art

____

► Full Reference: M.-A. Frison-Roche, « L'invention du "droit à l'enfant". Les conséquences de la pratique contractuelle comme source d'engendrement de l'enfant (The invention of the "right to a child". The consequences of the contractual practice as a source of childbearing)", in Special Issue Nouvelles filiations (New Filiations), AJ Famille, Lefebvre Dalloz, Nov. 2025, pp.568-571.

____

📗read the table of content of the special issue in which this article is published (in French)

____

📝read this article (in French)

____

____

► English summary of this article: Every legal system is built on concepts that form its pillars. Filiation is one such concept. A cas-law solution, presented as pragmatic and casuistic, can overturn this concept. Whether one agrees with it or not, it must first be acknowledged and assessed.

Through a series of rulings on surrogacy, notably a ruling by its First Civil Chamber granting exequatur to a judgment recognising the filiation established by surrogacy between a child and persons with no biological link to the child and without recourse to adoption, the French Cour de Cassation has introduced the possibility of creating parentage by contract. This not only changes the concept of filiation but also changes the very structure of the French legal system, which is based on the distinction between persons and things. One may agree or disagree with this, but it must be said.

Since the judge gives force to such a contract establishing filiation, with the foreign judge simply recognising it and the French judge ensuring only that the contract is balanced, the prospect opens up of a society in which individuals will be able to contractually create institutions at their disposal, within the private normative space of the contract, with the State's only function being to give effect to their right to legal recognition of their unique "project". Parentage is only a first example.

Thus constructed on what was "inconceivable", i.e. a "right to a child", thanks to the contractual power to which the State should lend its force a posteriori, the judge makes parentage resulting .the judge technically declares a parentage arising from a contract to be "admissible". Is opening a society in institutions were contractually governed.

_________

Nov. 13, 2025

Interviews

🌐Follow Marie-Anne Frison-Roche on LinkedIn

🌐Subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐Subscribe to the video newsletter MAFR Overhang

🌐Subscribe to the Newsletter MaFR Law & Art

____

► Full reference : M.-A. Frison-Roche, ""Ordonner la Compliance : pourquoi le faire et comment le faire ? (Organising Compliance: why do it and how to do it?)", interview Focus on... conducted for Dalloz Actu Étudiants, 13 November 2025

___

► read the interview : 💬 Read the interview (in French)

____

🌐read the interview presentation on LinkedIn (in French)

🌐read the interview presentation through the MAFR Newsletter Law, Compliance, Regulation, (in English)

____

► presentation of the interview by Dalloz Actu-Étudiants : Compliance can be defined as a new branch of law that mobilises major economic players and their stakeholders to ensure that the large systems in which we live do not collapse, but remain solid and sustainable. Sanctions, contracts, ethical principles, court decisions and corporate cultures all converge to achieve this. The ambition is great, some contest it, many want to escape it. It is still difficult to define compliance, which seems to be going in all directions. Who? What? Why? How?

These are all questions addressed by Marie-Anne Frison-Roche, professor of law and editor-in-chief of the Journal of Regulation & Compliance (JoRC), together with the contributors to the collective works in the Régulations & Compliance series under her scientific direction. Compliance (JoRC), together with the contributors to the collective works in the "Regulations & Compliance" collection under her scientific direction, sheds light on with her imaginative power combined with her legal precision.

____

Q.Why do the fundamental objectives of compliance unify all legal compliance techniques?

Summary of MAFR's response: because all these regulatory frameworks, which large companies are required to enforce effectively and which appear disparate, creating as many specific requirements as there are regulatory compliance blocks, find their unity when we consider the following reality: whatever the body of regulations in question (Sapin 2, Vigilance, Nis2, Dora, IAA, etc.), the aim is always to identify and prevent systemic risks so that these systems do not collapse.

Q. How can we define the obligation of compliance?

Summary of MAFR response: the company concerned is therefore obliged to put in place "compliance structures", such as mapping, plans, alert structures and programmes (obligation of result), but of course, and this is the key point, to achieve this goal, namely to ensure that the system in question (banking, financial, climate, digital, algorithmic, etc.) does not collapse. This is an obligation of means. This is the exact, simple definition that unifies all the regulations of the Compliance Obligation for which subject companies are responsible.

Q. What conflicts arise around the source of compliance standards and their implementation?

Summary of MAFR's response: It must remain a matter of law. However, many argue that because it is only a matter of "compliance" and "ticking all the boxes", algorithms (which do not think or know anything) will do this, eliminating the need for lawyers and the law. This must be avoided. Furthermore, given the immense ambition of safeguarding systems, political and public authorities, businesses and stakeholders must join forces. They must not fight to bring each other down.

Q. What are the complexities of compliance law?

Summary of MAFR's response: I would not say "complexity", because although the regulations are complicated, compliance law is fairly simple and unified around its monumental goals of safeguarding systems, ensuring their future sustainability and protecting the people involved in them. However, it is a new branch of law that is still poorly understood and therefore sometimes poorly mastered. It therefore needs to be organised.

Q. What is your proposal for ordering it?

Summary of MAFR's response: Teaching more about compliance law will facilitate its organisation. The courts, to which all regulations converge through litigation, will participate in this organisation, which is necessary to ensure that regulations do not remain in silos and do not contradict each other when they have the same purpose, which constitutes their legal normativity. This new branch of law must also be articulated with all other branches of law. This is notably what the recently published book, L'obligation de compliance (The Obligation of Compliance), does.

_________

Nov. 6, 2025

Conferences

🌐Subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐Subscribe to the video newsletter MAFR Overhang

🌐Subscribe to the Newsletter MaFR Law & Art

____

► Full reference : M.-A. Frison-Roche, "Concevoir une Raison d'être et l'explicitre (Conceiving a Raison d'être and explaining it)", speech at the round table discussion "Dire sa Raison d'être (Expressing your Raison d'être)", National Conference of the Géomètres Expert (French Chartered Surveyors), 6 November 2025, Paris.

____

► Presentation of the Round Table : This round table opens two days of work bringing together all the leaders, members of the Council of the Order of Chartered Surveyors and Regional Councils of Chartered Surveyors, in the presence of the relevant Ministry, in specific sessions during which the two Raison d'être that have been developed over several years of work and adopted, the Raison d'être of the profession and the Raison d'être of the Order, are presented.

🪑🪑🪑Other participants in the round table discussion, moderated by Hervé Grélard, General Deputy of the French Order of Chartered Surveyors:

🕴🏻Thomas Bonnel, chartered surveyor

🕴🏻Luc Lanoy, chartered surveyor,

🕴🏻Séverine Vernet, Chairwoman of the French Order of Chartered Surveyors

____

► Summary of my presentation : Firstly, I spoke to remind everyone what a "raison d'être" is, in itself, and why it is particularly important when the entity that embodies it also constitutes a "profession", the raison d'être expressing this hybrid nature that is destined to endure in today's societies. It moves those who uphold the raison d'être – the professional, the profession, the umbrella organisation that is the Order – from the past to the future. To effectively carry this raison d'être, its bearer cannot remain isolated. Unlike the agent who operates in a market and whose strategy is solitary dynamism against others, the bearer of the raison d'être must find allies who share similar or compatible ideas and develop points of contact to carry out a collective project (the "Monumental Goals"). This is why it is just as important to communicate, explain and share the raison d'être with the outside world.

Secondly, as the discussion surrounding the statement of purpose of the French Order of Surveyors and the profession progressed, I was led to point out that the raison d'être is not, or not only, ethical in nature, but also legal in nature, constituting at the very least a legal fact that can become enforceable against those who recognise themselves in it and claim it. This kind of reward, which is the "ex ante responsibility" expressed by the raison d'être and relayed by Compliance Law, anchored in its monumental goals of sustainability and responsibility, justifies that the profession that embraces its raison d'être is not simply an efficient profession in a supply and demand market, but establishes the Order as a regulator. This places both in the long term.

________

⛏️Further reading on the subject: (with English Summaries)

🕴🏻M.-A. Frison-Roche, 💬"Géomètres-experts : une profession qui assume concrètement sa responsabilité territoriale", 2025

🕴🏻M.-A. Frison-Roche, 📝A quoi engagent les engagements, 2025

🕴🏻M.-A. Frison-Roche et 🕴🏻S. Vernet, 📝La profession investit le Droit de la compliance et détermine sa Raison d'être, 2023

🕴🏻M.-A. Frison-Roche, 📧Quels sont les points de contact entre la Raison d'être des entreprises et le Droit de la Compliance ?, 2022

________

Oct. 30, 2025

Publications

►Full Reference: M.A. Frison-Roche, "Droit de la compliance et Contentieux systémique" (Compliance Law and Systemic Litigation), in Chroniques Droit de la Compliance (Compliance Law Chronicles), Recueil Dalloz, 6 November 2025

____

____

►read the English presentation of the previous chronicles:

- "Compliance and conformity: Distinguish them in order to articulate them", 2024

- "Regulations, Compliance, Contracts, and Judges: places and alliances", 2023

- "Contract of compliance, stipulations fo compliance", 2022

- "The Adventure of the Compliance", 2020

- "Compliance and Legal Personality", 2019

- "TLegal Theory of Risk Mapping", 2019

►read the English presentation of the whole chroniques

____

►English summary of this article: Legal systems have changed, and Compliance Law, in its uniqueness, reflects this change and plays a powerful role in it. Through new sets of compliance rules, particularly at European level, in areas such as data protection (GDPR), anti-money laundering (AMLA), climate balance protection (CS3D) and banking and financial system sustainability (Banking Union), techniques (always the same) have been developed and imposed on large companies, which must implement them: alerts, mapping, assessment, sanctions, etc. These new regulatory frameworks only make sense in relation to their ‘Monumental Goals’: to detect systemic risks Ex Ante and prevent crises so that the systems in question do not collapse, but ‘sustain". All the legal instruments in the corpus are normatively rooted in these Monumental Goals, which are the core that unifies Compliance Law (I).

Judges are the guardians (II) of this new and highly ambiguous normative framework, which relies on the practical ability of companies to do just that. They ensure that the technical provisions are applied teleologically in each of these compliance blocks, and that the regulatory frameworks are mutually supportive, for it is always the same systemic goal that all compliance regulations serve: to ensure that systems (banking, financial, climate, digital, energy, etc.) do not collapse, that they are sustainable, and that present and future human beings are not crushed by them but, on the contrary, benefit from them. This unity is still little perceived, as regulations pulverize this profound unity of compliance law in the myriad of changing provisions. Entrusting the "regulatory mass" to algorithms increases this pulverization, making the whole increasingly incomprehensible and therefore impossible to handle. Acknowledging the judge's rightful place, i.e. at the heart of the matter, will enable us to master this new branch of law. But it's not the judge's job alone to restore clarity to a whole covered in the dust of his own technicality.

The systemic object of Compliance Law is transferred to Litigation. Indeed, the Litigation that emerges from the new Compliance Law is also fundamentally new, by transitivity. Indeed, the aim of Compliance Law is to make systems sustainable (or sustainable, or resilient, the vocabulary varies). The result is litigation which is itself "systemic litigation" (III), most often initiated by an organization against a systemic operator. The place and role of each are transformed (IV).

________

Updated: Oct. 26, 2025 (Initial publication: Sept. 4, 2024)

Publications

🌐Follow Marie-Anne Frison-Roche on LinkedIn

🌐Subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐Subscribe to the video newsletter MAFR Overhang

🌐Subscribe to the Newsletter MaFR Law & Art

____

► Full reference : M.-A. Frison-Roche, The invention of the 'right to a child'. The consequences of contractual practice as a source of filiation, working document, Sept. 2024 - Oct. 2025.

► Full reference : M.-A. Frison-Roche, The invention of the 'right to a child'. The consequences of contractual practice as a source of filiation, working document, Sept. 2024 - Oct. 2025.

____

🎤This working document forms the basis of a presentation entitled, "Le "droit à l'enfant" est-il concevable, pourquoi et avec quelles conséquences" (Is the 'right to a child' conceivable, why and with what consequences", in Les nouvelles filiations. Diifférentes perspectives (New parentage. Different perspectives." held at the Paris Court of Appeal on 12 September 2024.

____

📝Revised, this working document forms the basis of the article published in the dossier "Les nouvelles filiations. Regards croisés" (New parentage. Different perspectives), Act. jur. Dalloz Droit de la famille (in French).

____

► Summary of this working document : Every legal system is built on concepts that form its pillars. Filiation is one such concept. A cas-law solution, presented as pragmatic and casuistic, can overturn this concept. Whether one agrees with it or not, it must first be acknowledged and assessed. Through a series of rulings on surrogacy, notably a ruling by its First Civil Chamber granting exequatur to a judgment recognising the filiation established by surrogacy between a child and persons with no biological link to the child and without recourse to adoption, the French Cour de Cassation has introduced the possibility of creating parentage by contract. This not only changes the concept of filiation but also changes the very structure of the French legal system, which is based on the distinction between persons and things. One may agree or disagree with this, but it must be said. Since the judge gives force to such a contract establishing filiation, with the foreign judge simply recognising it and the French judge ensuring only that the contract is balanced, the prospect opens up of a society in which individuals will be able to contractually create institutions at their disposal, within the private normative space of the contract, with the State's only function being to give effect to their right to legal recognition of their unique "project". Parentage is only a first example. Thus constructed on what was "inconceivable", i.e. a "right to a child", thanks to the contractual power to which the State should lend its force a posteriori, the judge makes parentage resulting from a contract technically "admissible" and opens up a contractually governed society.

_____

🔓read the working document below⤵️

Oct. 23, 2025

Publications

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐subscribe to the VideoNews MAFR Surplomb

🌐subscribe to the Newsletter MaFR Law & Art

____

► Full Reference: M.-A. Frison-Roche, "Trio", in Mélanges en l'honneur au Professeur Denis Mazeaud, LGDJ-Lextenso, 2025.

____

📝read the article (in French)

____

Since then, due to editorial deadlines, this text has been modified, since this article deals with the so specific French Concours d'Agrégation de Droit, and François Terré, who prepared me for it, joined Pierre Catala before the overall typescript became final.

At Pierre Catala's funeral, where Rémy recounted their last meeting, I was seated at the back next to Yves Lequette, and at François Terré's funeral I was again seated at the back next to Jacques-Henri Robert.

Yves Lequette and Jacques-Henri Robert, with whom I worked long and hard to prepare the Mélanges in honour of François Terré. Yes, it is indeed the Mélanges that, in a great chain, honour the masters. It doesn't matter that this is incomprehensible to those outside the Alma Mater.

When I read Denis's bibliography, which opens his Mélanges, I discover that Denis, who contributed to so many Mélanges, had his first contribution to this sort of books for the Mélanges conceived for François.

____

► English Summary of this contribution : The contribution pays tribute to Denis Mazeaud as a candidate in the Concours d'Agrégation des Facultés de Droit that we took together. As long as the University benefits from professors instituted in this way, i.e. in a non-competitive relationship with their peers and in a non-financially valued relationship with their knowledge and talent, Alma Mater will remain.

____

📗Read the general presentation of these Mélanges.

________