The recent news

Organization of scientific events

► Full reference : M.-A. Frison-Roche, Scientific coprdination and co-hosting of the colloquia series Compliance and Contract, organised on the initiative of the Journal of Regulation & Compliance (JoRC) and its academic partners

____

____

► The Symposium Series in a nutshell : As a direct continuation of the previous symposium series co-organised by the Journal of Regulation & Compliance and its partner universities on "Compliance Obligation", which served as the basis for the publication of the book 📘Compliance Obligation, The series, some elements of which began in 2024 and others are already present in this book, explored in depth the specific theme of the links between compliance law and contracts. Indeed, compliance law is often analysed as the construction of laws and regulations to achieve "📘 Monumental Goals " of a political nature desired by States and public authorities, to the achievement of which systemic economic operations contribute through 📘Compliance Tools that are now well documented. Contracts are still relatively little studied, or even developed, in compliance systems that are often perceived through the orders issued, the technologies put in place and the 📘sanctions to be avoided or endured. On the contrary, the future of compliance law, particularly in its European conception, which places human beings at the centre of concerns for the sustainability of systems and the use of contracts, is the new conception that we must adopt. Contracts then appear to be both the means by which the subject company fulfils its legal obligations, forges relationships with other actors and deploys the necessary innovations. Contract law is both used and renewed as a result. The series of symposiums will examine various aspects of this general issue. It will result in the publication of a 📘book Compliance and Contrat.

____

► Presentation of symposiums in development :

- March 2026: COMPLIANCE AND SOCIAL CONTRACT: read the presentation

- 24 April 2026🧮COMPLIANCE: CLAUSE BY CLAUSE: read the presentation

- 29 May 2026🧮THE JUDGE CONFRONTED WITH CONTRACTS OF COMPLIANCE AND COMPLIANCE CLAUSES: read the presentation

- June 2026🧮COMPLIANCE AND COMMON CONTRACT LAW : read the presentation

- 12 June 2026🧮THE "CONTRACT OF COMPLIANCE" : read the presentation

- September 2026🧮COMPLIANCE, VALUE CHAINS AND CONTRACT: read the presentation

________

Feb. 23, 2026

Conferences

🌐suivre Marie-Anne Frison-Roche sur LinkedIn

🌐s'abonner à la Newsletter MAFR Regulation, Compliance, Law

🌐s'abonner à la Newsletter en vidéo MAFR Surplomb

🌐s'abonner à la Newsletter MaFR Droit & Art

____

► Référence complète : M.-A. Frison-Roche, "L'avenir de la compliance", cycle La compliance, Centre Perelman, Bruxelles, 23 février 2026.

____

🧮consulter le programme complet du cycle La compliance

____

📶consulter les slides

____

► Présentation de cette conférence : L'avenir de la Compliance, bien malin qui le connaît. Celui qui pratique et étudie les textes, les contentieux, les structures et les comportements devra bien reconnaître qu'on ne sait pas ce que va devenir ce qui pourtant a émergé comme une nouvelle branche du Droit, ce qui est un phénomène peu courant, dont les ondes perturbantes et régénérantes se font sentir et dans toutes les branches du Droit et dans les autres systèmes normatifs, accompagnant et traduisant le nouveau monde dans lequel nous sommes déjà entrés, que l'on en soit content ou non.

D'une part, parce qu'on ne connaît pas l'avenir (ce qui pose un problème lorsqu'au nom de la Compliance, on veut rendre responsable les entreprises pour l'avenir, confondant responsability et liabiility, ce que récusa en 2024 la Cour d'appel de La Haye dans l'affaire Shell) Pour deux raisons. D'une part, parce que la Compliance est un phénomène naissant, plus encore si on mesure qu'il s'agit d'une branche du Droit.

____

⛏️Aller plus loin :

🕴🏻M.-A. Frison-Roche, 📝Le Droit de la compliance, 2016

🕴🏻M.-A. Frison-Roche, 📝Naissances d'une branche du droit : le Droit de la Compliance, 2024

🕴🏻M.-A. Frison-Roche, 📝L'aventure de la compliance, 2020

🕴🏻M.-A. Frison-Roche, 📕Les Buts Monumentaux de la Compliance, 2022

🕴🏻M.-A. Frison-Roche, 📕L'obligation de compliance, 2025

🕴🏻M.-A. Frison-Roche, 📝Droit de la compliance et contentieux systémique, 2025

________

Jan. 29, 2026

Conferences

🌐Follow Marie-Anne Frison-Roche on LinkedIn

🌐Subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐Subscribe to the video newsletter MAFR Overhang

🌐Subscribe to the Newsletter MaFR Law & Art

____

► Full reference : M.-A. Frison-Roche, "Le Droit de la Compliance, voie de la transition vers une égalité effective, efficace et efficiente entre les êtres humains (Compliance Law, for the transition towards the effectiveness, efficacy and efficiency of the equality between human beings)", in Chair "Mutualist and cooperative banking at the service of the economy", ESCP, Les banques coopératives et les transitions (Cooperative Banks and Transitions), 29 January 2026.

____

🧮view the general programme for the conference Cooperative banks and transitions (in French)

____

📶see the slides (in French)

____

► Presentation of this conference: The conference is not specifically aimed at lawyers, and even less so at specialists in Compliance Law. That is why it is divided into three parts, in order to show how Compliance Law is relevant in practice for creating effective, efficace and efficient equality between human beings.

The first part of the lecture sets out the ambition of equality between human beings. As this is a political principle and not a natural one. As it is an ambition, it justifies being placed first and after that this ambition must be concretised, in a sort of second place. This second place is built bay a tro : that of effectiveness (real application of the norm), efficacy (that the goal for which the norm was established is achieved) and efficiency (that the system is transformed so that, having become robust, it endures through sustainabily).

The second part of the conference will present the new branch of law known as Compliance Law. This should be distinguished from simple conformity, which consists of mechanically obeying a body of regulations that are constantly growing and becoming more complex. Compliance Law's Goal is to protect systems from risks that could cause them to disappear (all systems). "Sustainability" is the key principle, which is not limited to the climatic system (also digital system, banking system, and so on) and imposes the future as its object and the long term as its relevant time frame (unlike the market and Competition Law). "Transition" is also a key concept, as it involves moving from one state to another, from an expressed ambition to its realisation, through collaboration with others. These Goals are "Monumental" and are the normative legal basis of Compliance Law. In Europe, the Compliance Monumental Goal is to preserve systems for that the human beings who are involved in them, willingly or unwillingly, are not crushed by them, but rather benefit from them (for instance in banking sector). This is a "Monumental Negative Goal", to which is added a "Monumental Positive Goal", which a new conception of the "Ex Ante Responsability" (not liabily).

Dialectically, the third part of the conference explains how Compliance Law internalises the political ambition of equality between human beings, which develops in the three concentric circles of effectiveness, efficacy and efficiency, among the operators best placed to contribute to it.

Mutual banks belong to these circles more than the others. Firstly, because they are structured around the principle of taking human beings into consideration. Secondly, because they are rooted in their local areas. Thirdly, because they are driven by the long term, duration and sustainable. The transition est easer. The dificulty is the necessity to proof the effective and efficient will to do this transition.

____

⛏️Go further :

🕴🏻M.-A. Frison-Roche, 📝Drawing the circles of Compliance Law, 2017

🕴🏻M.-A. Frison-Roche, 📝Monumental goals, the beating heart of compliance law, 2021

🕴🏻C. Peicuti and 🕴🏻J. Beyssade, 📝The feminisation of management positions in companies as a compliance objective. The example of the banking sector, in 🕴🏻M. -A. Frison-Roche, 📘The Monumental Goals of Compliance, 2022

🕴🏻M.-A. Frison-Roche, 📝Births of a New Branch of Law: Compliance Law, 2024

________

Jan. 25, 2026

Newsletter MAFR - Law, Compliance, Regulation

🌐suivre Marie-Anne Frison-Roche sur LinkedIn

🌐s'abonner à la Newsletter MAFR Regulation, Compliance, Law

🌐s'abonner à la Newsletter en vidéo MAFR Surplomb

🌐s'abonner à la Newsletter MaFR Droit & Art

____

► Référence complète : M.-A. Frison-Roche, "La difficulté de réguler, faute de données disponibles nombreuses et fiables : illustrations", Newsletter MAFR Law, Compliance, Regulation, 25 janvier 2026

____

🌐lire l'article paru sur LinkedIn

____

📧Lire par abonnement gratuit d'autres news de la Newsletter MAFR - Law, Compliance, Regulation

____

► Résumé de l'article : On

.

____

📝⤵lire l'article ci-dessous⤵

Jan. 22, 2026

Newsletter MAFR - Law, Compliance, Regulation

🌐Follow Marie-Anne Frison-Roche on LinkedIn

🌐Subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐Subscribe to the video newsletter MAFR Overhang

🌐Subscribe to the Newsletter MaFR Law & Art

____

► Full reference: M.-A. Frison-Roche, "Asset freezing in the legal saga between American power and Venezuelan wealth", MAFR Law, Compliance, Regulation Newsletter, 23 January 2026

____

🌐read this article published on LinkedIn the 23 January 2026

____

📧Read other articles from the MAFR Newsletter - Law, Compliance, Regulation for free with a subscription.

____

► Summary of this article : It is often emphasised that the law is merely a masquerade in the series of events we are witnessing.

This is not entirely true.

For three reasons.

1. Much will depend on the judge who will rule on the Madura couple's case. The energy sector has always similarly mixed regulation, public policies of states and businesses, both articulated by States and companies, both articulated by international contracts, always organising international arbitration

3. If ExxonMobil now refuses to make the investments desired by Trump, it is also because this enterprise remembers that many years ago the freeze of assets granted by the arbitrators was not very successful, and now the company manager believes that investment in Venezuala's infrastructure is therefore "impossible".

And given the current state of the law in the US, there is little Trump can do about it..

____

📝⤵Read the complete article below⤵

Jan. 8, 2026

Interviews

🌐suivre Marie-Anne Frison-Roche sur LinkedIn

🌐s'abonner à la Newsletter MAFR Regulation, Compliance, Law

🌐s'abonner à la Newsletter en vidéo MAFR Surplomb

🌐s'abonner à la Newsletter MaFR Droit & Art

____

► Référence complète : M.-A. Frison-Roche, «"Géomètres-experts : une profession qui s’engage dans la compliance"», interview pour Solution Notaire Hebdo, Lefebvre Dalloz, 8 janvier 2026

Interrogée par Juliette Courquin, journaliste à Solution Notaire Hebdo

___

► lire l'entretien : 💬 Lire l'interview au cours duquel les réponses ont été apportées aux questions reproduites ci-dessous⤵

____

Q. Pourriez-vous définir le droit de la compliance ?

Q. La compliance se prête-t-il à l'Ordre des géomètres-experts et à la profession elle-même ?

Q. L'OGE et la profession se sont engagés dans la compliance en définissant leur raison d'être, quelles en sont les conséquences juridiques ?

Q. Un dernier mot sur l'Ordre des géomètres-experts et la profession avec qui vous avez travaillé sur la compliance ?

_________

⛏️Aller plus loin sur la question :

🕴🏻M.-A. Frison-Roche, 🎤Concevoir une raison d'être et l'expliciter, 2025

🕴🏻M.-A. Frison-Roche, 📝Les buts monumentaux de la compliance, coeur battant du droit de la compliance, 2023

________

Dec. 10, 2025

Conferences

🌐Follow Marie-Anne Frison-Roche on LinkedIn

🌐Subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐Subscribe to the video newsletter MAFR Overhang

🌐Subscribe to the Newsletter MaFR Law & Art

____

► Full reference : M.-A. Frison-Roche, Saisir les principes du Droit de la Compliance à travers l'actualité (Understanding the principles of compliance law through current current legal cases and events), Jean Moulin - Lyon 3 University Law Faculty, 10 December 2025.

____

► Methodological presentation of this 4-hour MasterClass : It is difficult to teach a branch of law that is still being developed, to find a way to open its doors, because if by explaining its principles ex abrupto, the risk exists of remaining at the door, even though the aim is to open it. This door is all the more blocked by the accumulation of multiple regulatory corpus, which are now perceived as being linked to Compliance Law: GDPR, Sapin 2, Vigilance, Nis2, Dora, FCPA, etc.; These are highly technical and complicated, and tend to be studied in silos, with little connection between them and little articulation with the traditional branches of Law. Therefore, the principles that form the backbone of Compliance Law as an autonomous branch of Law are all the less apparent, even though they would make these "compliance blocks" more intelligible and manageable. However, setting out these principles, which shed light not only on the current positive law but also on how it will evolve, seems "theoretical".

In order to open the door to this new branch of Law, which already occupies a significant place in practice and is set to expand, so that it can be handled by lawyers who understand its spirit and is not entirely dominated by those from other disciplines who will master its tools (risk mapping, assessment, internal investigation, etc.), most often through algorithms and platforms (compliance by design), it is relevant to start with a few cases, a few decisions, a few texts, and a few comments, to gauge what they reveal.

Because the principles are already there. They are gradually emerging. The challenge is that they often emerge quickly, in a manner that is sufficiently consistent with other branches of Law, and that the legal aspect takes precedence. That is what is at stake today.

Each hour is devoted to a different case, based on a document of a different legal genre.

____

🌐read a post on LinkedIn (in French)

____

____

⛏️Find out more :

🕴🏻M.-A. Frison-Roche, 📝Compliance Law, 2016

🕴🏻M.-A. Frison-Roche, 📝Monumental Goals, the beating heart of Compliance Law, 2023

🕴🏻M.-A. Frison-Roche, 📝In Compliance Law, the legal consequences for Entreprises of their commitments and undertakings, 2025

🕴🏻M.-A. Frison-Roche, 📝Compliance Law and Systemic Litigation, 2025

________

Dec. 2, 2025

Law by Illustrations

🌐Follow Marie-Anne Frison-Roche on LinkedIn

🌐Subscribe to the Newsletter MAFR Regulation, Compliance, Law

🌐Subscribe to the video newsletter MAFR Overhang

🌐Subscribe to the Newsletter MaFR Law & Art

____

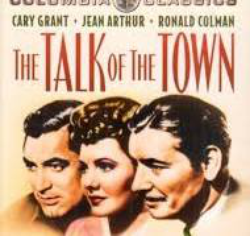

► Full reference : M.-A. Frison-Roche, "Fiction🎬The talks in the Town : what can a law professor do about it?", article from the Newsletter Law & Art, December 2025.

____

____

► Summary of this article : This 1942 film seems to have left little trace. However, the main character, an innocent man whom the villain manipulates into being designated as the culprit by the small town's population, leading him to behave like a guilty person, is played by Cary Grant.

This film inspired lawyers even more.

And even more so law professors, because it was a law professor, the dean of Harvard Law School, who saved the innocent man who had been caught in the trap.

And even more so today, since it was by playing on rumours, by creating them from the outset, in what we would call disinformation, that the powerful villain intended to win and, in the process, become mayor of the town, after escaping bankruptcy by setting fire to his own factory, a crime he blames on the innocent man thrown to the wolves of public opinion as citizens gather in the square. It's almost as if we were there...

____

🔓read the article below⤵️