June 12, 2024

Thesaurus : Doctrine

► Full Reference: J.-B. Racine, "L’arbitre, juge, superviseur, accompagnateur ?" (The arbitrator, judge, supervisor, coach?), in M.-A. Frison-Roche (dir.), L'Obligation de Compliance, Journal of Regulation & Compliance (JoRC) and Dalloz, coll. "Régulations & Compliance", 2024, forthcoming.

____

📕read the general presentation of the book, L'Obligation de Compliance, in which this article is published

____

► English Summary of this article (done by the Journal of Regulation & Compliance - JoRC) : From the outset, the author sets out what is at stake in these terms: "Quel rôle peut ou pourrait jouer l’arbitre dans les dispositifs de compliance ? Selon le rôle qu’il est amené à jouer, il peut ou pourrait venir en renfort de l’obligation de compliance. Poser cette question, c’est poser la question des pouvoirs de l’arbitre et de son office. C’est aussi, d’une certaine manière, renvoyer à la notion même d’arbitrage." (What role can or could the arbitrator play in compliance systems? Depending on the role he/she is called upon to play, he/she can or could reinforce the compliance obligation. Asking this question raises the question of the powers of the arbitrator and his/her office. In a way, it also goes back to the very notion of arbitration).

In practice, arbitrators deal with compliance issues in their office as judges. This is illustrated by disputes involving allegations of corruption, where the arbitrators' ruling obviously cannot give effect to a corrupt practice unless they violate themselves international public order. But in this, the arbitrator is only applying a legal standard, the main issue being then the question of evidence, with compliance tools often serving as indicators of the corruption itself. Leaving behind the strict legal source and coming to the standards issued by the ICC about the fight against corruption, we really enter into the "compliance obligation", in the strict sense, when a contract appears.

International business practices standards are emerging, not only in the area of probity but also in the protection of human rights, for which arbitrators can now act as guarantors. Arbitrators can do this, in particular, through the emerging litigation relating to vigilance obligation, either directly when vigilance plans are at issue,, even if a legal rule gives a specific competence to a State court (as the French 2017 law does) or if we imagine that a plan itself includes a system for recourse to arbitration, which would imply a change in culture, or if we consider that soft law is in the process of emerging from the practices of international trade laying down a duty of vigilance that arbitrators could take up.

In the second part of his contribution, the author takes a second, bolder approach, namely that of an arbitrator who understands Compliance Law in that he/she would be more than a Judge, i.e. he/she would do more than settle a dispute by applying the law.

This would be conceivable given the tendency to consider that the arbitrator could modify contracts and if example is taken from the technique of arbitration practised for concentration disputes in merger law. To give arbitration the required regulatory dimension, this third party would have to be able to exercise a supervisory function, which the notion of "dispute" hardly lends itself to, especially as an arbitrator is only set up to be a judge, and if he/she ceases to be one it is difficult for him/her to remain an arbitrator.... However, it is conceivable that in Ex Post the arbitrator could perform the monitoring function often required in Compliance Law. The technique of disputes boards is inspiring in this respect. The two fields, Arbitration and Compliance, are thus destined to move closer together, as the two traditional limits, arbitrability and litigation, are in the process of evolving so that they no longer stand in the way of such rapprochements.

The author can therefore conclude: "C’est aux différents acteurs de la compliance de penser à l’arbitrage, et à la souplesse, la plasticité et la liberté qu’il offre, pour éventuellement le configurer spécialement au service des buts de la compliance." (It is up to the various players in Compliance to think about Arbitration, and the flexibility, plasticity and freedom it offers, in order to configure it specifically to serve the goals of Compliance Law).

________

May 27, 2024

Organization of scientific events

► Référence complète : Les techniques de supervision des contenus numériques disponibles sur les plateformes, in cycle de conférences-débats "Contentieux Systémique Émergent", organisé à l'initiative de la Cour d'appel de Paris, avec la Cour de cassation, la Cour d'appel de Versailles, l'École nationale de la magistrature (ENM) et l'École de formation des barreaux du ressort de la Cour d'appel de Paris (EFB), sous la responsabilité scientifique de Marie-Anne Frison-Roche, 27 mai 2024, 11h-12h30, Cour d'appel de Paris, salle Cassin

____

► Présentation de la conférence :

____

🧮Programme de cette manifestation :

Troisième conférence-débat

LES TECHNIQUES DE SUPERVISION DES CONTENUS NUMÉRIQUES DISPONIBLES SUR LES PLATEFORMES

Cour d’appel de Paris, salle Cassin

Présentation et modération par 🕴️Marie-Anne Frison-Roche, Professeure de Droit de la Régulation et de la Compliance, Directrice du Journal of Regulation & Compliance (JoRC)

🕰️11h-11h20. 🎤Les techniques de supervision utilisées par les plateformes, intervenant à venir

🕰️11h20-11h40. 🎤Les techniques de supervision par l’autorité administrative indépendante, par 🕴️Roch-Olivier Maistre, Président de l’Autorité de régulation de la communication audiovisuelle et numérique (Arcom)

🕰️11h40-12h30. Débat

____

🔴Les inscriptions et renseignements se font à l’adresse : inscriptionscse@gmail.com

🔴Pour les avocats, les inscriptions se font à l’adresse suivante : https://evenium.events/cycle-de-conferences-contentieux-systemique-emergent/

⚠️Les conférences-débat se tiennent en présentiel à la Cour d’appel de Paris.

________

April 4, 2024

Publications

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

____

► Full Reference: M.-A. Frison-Roche, "Le rôle du juge dans le déploiement du droit de la régulation par le droit de la compliance" ("Synthesis: The role of the Judge in the deployment of Regulatory Law through Compliance Law"), Synthesis in Conseil d'État (French Council of State) and Cour de cassation (French Court of cassation), De la régulation à la compliance : quel rôle pour le juge ? Regards croisés du Conseil d'Etat et de la Cour de cassation - Colloque du 2 juin 2023, La Documentation française, "Droits et Débats" Serie, 2024, pp.

____

____

🚧read the bilingual Working Paper which is the basis of this article, with additional developments, technical references and hyperlinks

____

► Presentation of this concluding article: It is remarkable to note the unity of conception and practice between professionals who tend to work in administrative jurisdictions and professionals who tend to work in judicial jurisdictions: they all note, in similar terms, an essential movement: what Regulatory Law is, how it has been transformed into Compliance Law, and how in one and even more so in the other the Judge is at the centre of it.

Judges, as well as Regulators and European officials, explain this and use different examples to illustrate the far-reaching changes it brings to the Law and to the companies responsible for increasing the systemic effectiveness of the rules through the practice and dissemination of a Culture of Compliance.

The role of the judge participating in this Ex Ante transformation is renewed, whether he/she is a judge of Public Law or a judge of Private Law, in a greater unity of the legal system.

____

► English Summary of this article: The tug-of-war between 'Compliance' and 'conformity', which is exhausting us, obscures what is essential, i.e. the great novelty of a branch of law that assumes a humanist vision expressing the ambition to shape the future so that it is not catastrophic (preventing systems from collapsing), or even better (protecting human beings in these systems).

The article begins by describing the emergence of Compliance Law, as an extension of Regulatory Law and going beyond it. This new branch of law takes account of our new world, brings its benefits and seeks to counter these systemic dangers so that human beings could be their beneficiaries and are not crushed by them. This branch of Ex Ante Law is therefore political, often supported by public Authorities, such as Regulatory Authorities, but today it goes beyond sectors, as shown by its cutting edge, the Obligation of Vigilance.

The "Monumental Goals" in which Compliance Law is normatively anchored imply a teleological interpretation, leading to an "empowerment" of the crucial operators, not only States but also companies, responsible for the effectiveness of the many new Compliance Tools.

The article goes on to show that Judges are increasingly central to Compliance Law. Lawsuits are designed to make companies more accountable. In this transformation, the role of the judge is also to remain the guardian of the Rule of Law, both in the protection of the rights of the defence and in the protection of secrets. Efficiency is not what defines Compliance, which should not be reduced to a pure and simple method of efficiency, which would lead to being an instrument of dictatorship. This is why the principle of Proportionality is essential in the judge's review of the requirements arising from this so powerful branch of Law.

The courts are thus faced with a new type of dispute, of a systemic nature, in their own area, which must not be distorted: the Area of Justice.

____

📝read article (in French)

________

March 16, 2024

Interviews

► Référence complète : R.-O. Maistre, "La place du Droit de la compliance dans la régulation de l’espace numérique", entretien mené par M.-A. Frison-Roche à l'occasion d'une série d'entretiens sur le Droit de la Compliance, in Fenêtres ouvertes sur la gestion, émission de J.-Ph. Denis, Xerfi Canal, enregistré le 12 décembre 2023, diffusé le 16 mars 2024

____

🌐consulter sur LinkedIn la présentation en décembre 2023 de l'entretien avec Roch-Olivier Maistre

____

____

🎥visionner l'interview complète sur Xerfi Canal

____

► Point de départ : En 2022, Roch-Olivier Maistre écrit une contribution sur 📝Quels buts fondamentaux pour le régulateur dans un paysage audiovisuel et numérique en pleine mutation ?, dans 📕Les Buts Monumentaux de la Compliance.

🧱lire la présentation de cette contribution ➡️cliquerICI

____

► Résumé de l'entretien :

Marie-Anne Frison-Roche : Question : L’Arcom a un rôle central en matière de Compliance. Pourriez-vous nous présenter cette Autorité de régulation qu’est l’Arcom ?

Roch-Olivier Maistre : Réponse : le Président Roch-Olivier Maistre décrit le rôle de l'Arcom, autorité qui résulte du CSA et de l'Hadopi, le législateur décidant de créer un nouveau grand Régulateur en charge à la fois de l'audiovisuel et du numérique. Cette Autorité collégiale s'assure du bon fonctionnement de ce secteur et est engagée dans la régulation des nouveaux acteurs du numérique.

____

MaFR : Q. : Comment Régulation et Compliance s’articulent-elles dans la mise en œuvre des missions de l’Arcom ?

R.O.M. : R. : Il répond qu'il s'agit d'une approche complémentaire. Coercition, sanctions s'y articulent. Il s'agit de préserver la liberté d'expression et de communication. Pour cela, objectifs de valeur constitutionnelle, les opérateurs doivent agir pour que ces objectifs soient atteints. Pour cela, ils sont supervisés par l'Autorité qu'est l'Arcom, qui intervient qu'ils ne se conforment à ces obligations de compliance. Lorsqu'il ne s'agit pas de l'audiovisuel, où le contenu est encore possible car il s'agit d'un "monde fini", mais qu'il s'agit du monde numérique, où les contenus se répandent d'une façon virale, c'est aux opérateurs d'agir : la Régulation et la Compliance agissent donc d'une façon complémentaire.

________

Dec. 5, 2023

Organization of scientific events

► Référence complète : M.-A. Frison-Roche, M. Mekki et J.-Ch. Roda (dir.), La Vigilance, pointe avancée de l'Obligation de Compliance, Journal of Regulation & Compliance (JoRC), Institut de Recherche Juridique de la Sorbonne (André Tunc - IRJS), Université Paris 1 Panthéon-Sorbonne, 5 décembre 2023.

____

🏗️Ce colloque s'inscrit dans le cycle de colloques organisé par le Journal of Regulation & Compliance (JoRC) et ses Universités partenaires, portant en 2023 sur le thème général de L'Obligation de Compliance.

____

📚Les travaux s'inséreront ensuite dans les ouvrages :

📕L'obligation de Compliance, à paraître dans la collection 📚Régulations & Compliance, coéditée par le Journal of Regulation & Compliance (JoRC) et Dalloz, publié en langue française.

📘Compliance Obligation, à paraître dans la collection 📚Compliance & Regulation, coéditée par le Journal of Regulation & Compliance (JoRC) et Bruylant, publié en langue anglaise.

____

► Présentation générale du colloque : L'Obligation de Vigilance est difficile à cerner à travers la multiplicité des textes et les cas dans lesquels on peut l'appréhender. Cela est particulièrement perceptible à travers le mécanisme de Vigilance qui tout à la fois illustre, voire force le trait, de l'Obligation de Vigilance. A travers les textes internationaux, la loi française et les textes européens adoptés ou en gestation, les contraintes de vigilance, mais aussi les structures et actions mises en place que les entreprises ont organisé ainsi que les actions que les parties prenantes ont engagé, la Vigilance a mis en lumière des aspects de l'Obligation de Compliance, voire a modifié celle-ci.

L'effet de révélation ainsi produit et le mouvement ainsi déclenché, dont les racines sont profondes et les effets systémiques très importants, justifient que l'on cerne davantage des mécanismes qui sont articulés entre eux alors qu'ils sont parfois perçus en silo, ce qui rend difficile la compréhension d'ensemble. De la même façon, parce que la Vigilance est la pointe avancée de l'Obligation de Compliance, l'on peut ainsi mieux distinguer et articuler ce qui relève des spécificités sectorielles, notamment en matière bancaire et financière ou bien en matière numérique, et les articuler avec ce que la Vigilance a, comme la Compliance, de plus général. Plus encore, l'intensité de la Vigilance varie selon les ambitions quelle porte et selon la position de l'entreprise assujettie, ce que traduisent les variations de qualification juridique qui vont du devoir à l'obligation pénalement sanctionnée.

Les différents systèmes juridiques traduisent ces évolutions dans leur loi, leur jurisprudence et la pratique des entreprises et des parties prenantes de façon spécifique car ces différents techniques expriment des normes de comportement et de reddition de comptes dont les exigences probatoires, les conceptions de la responsabilité et les traductions institutionnelles à travers de possibles organes de régulation sont la traduction directe.

En conséquence, le colloque est construit en trois temps. Après une Introduction générale sur les rapports systémiques entre la Vigilance et la Compliance, une première partie porte sur la variation des Intensités de la Vigilance, pointe avancée de la Compliance, une deuxième partie porte sur les Tensions que la Vigilance engendre ou exacerbe, une troisième partie porte sur les Modalités que la Vigilance emprunte dans les systèmes de Compliance.

____

____

► Interviennent :

🎤Laurence Dubin, Professeure à l'Université Paris 1 Panthéon-Sorbonne

🎤Marie-Anne Frison-Roche, Professeure de Droit de la Régulation et de la Compliance, directrice du Journal of Regulation & Compliance (JoRC)

🎤Bernard Haftel, Professeur à l'Université Paris-Nord

🎤Marie Lamoureux, Professeure à Aix-Marseille Université

🎤Grégoire Loiseau, Professeur à l'Université Paris 1 Panthéon-Sorbonne

🎤Véronique Magnier, Professeure à l'Université Paris-Saclay

🎤Gilles J. Martin, Professeur émérite à l'Université Côte d'Azur, membre du Groupe de Recherche en Droit, Économie, Gestion (GREDEG) du CNRS

🎤Mustapha Mekki, Professeur à l'Université Paris 1 Panthéon-Sorbonne

🎤Jean-Christophe Roda, Professeur à l'Université Jean Moulin Lyon 3

🎤Anne-Claire Rouaud, Professeure à l'Université Paris 1 Panthéon-Sorbonne

____

Lire une présentation détaillée de la manifestation ci-dessous⤵️

Aug. 31, 2023

Conferences

♾️suivre Marie-Anne Frison-Roche sur LinkedIn

♾️s'abonner à la Newsletter MAFR Regulation, Compliance, Law

____

► Référence complète : M.-A. Frison-Roche, "Le prolongement du Droit de la Régulation par le Droit de la Compliance : fixer les buts et superviser les moyens", in XXIV Jornadas Internacionales de Derecho Administrativo (XXIVièmes Journées internationales de Droit administratif), Université Externado de Colombie, Bogota, 31 août 2023.

____

🧮consulter le programme complet cette manifestation

Présentation de la conférence : Dans le temps imparti, il n'est pas discuté de la façon dont les États se transforment pour devenir des "États Régulateurs" : cela est exposé dans d'autres contributions. Il est donc ici pris pour acquis que les Etats sont "Régulateurs" à la fois dans leur conception même (c'est-à-dire qu'ils accompagnent l'économie de marché pour l'infléchir en s'appuyant sur elle) et dans des techniques nouvelles, notamment la mise en place des Autorités de Régulation. C'est ainsi que naît une branche spéciale du Droit : le Droit de la Régulation. Celui-ci demeure encore ancré dans le Droit administratif à beaucoup d'égard (cela non plus n'est pas discuté ici).

En quelque sorte, la présente contribution porte sur l'étape suivante, qui consiste au développement de cette sorte d'étape qu'est l'Etat Régulateur, qu'exprime le Droit de la Régulation, dans le Droit de la Compliance. Il convient de conserver ce terme américain de "compliance", malgré toutes ses ambiguïtés, parce que l'instant on n'en a pas trouvé d'autres ...

La conférence est bâtie en dix points, succinctement développés dans le document de travail sous-jacent.

____

🚧Lire le document de travail sous-jacent à la conférence.

________

Feb. 23, 2022

Thesaurus : Doctrine

Référence complète : Briatta, G., Concrete steps towards progress in the Banking Union, The European Finance Magazine, fév. 2022, p.116-.

____

Feb. 2, 2022

Teachings : Droit de la régulation bancaire et financière - semestre 2022

► Référence complète : Frison-Roche, M.-A., Le Droit européen de régulation et de supervision bancaire et financière, in Leçons de Droit de la Régulation bancaire et financière, Sciences po (Paris), 2 février 2022.

► Référence complète : Frison-Roche, M.-A., Le Droit européen de régulation et de supervision bancaire et financière, in Leçons de Droit de la Régulation bancaire et financière, Sciences po (Paris), 2 février 2022.

____

► Résumé de la leçon sur le Droit européen de Régulation et de Supervision bancaire et financière : L'Europe est avant tout et pour l'instant encore une construction juridique. Elle fut pendant longtemps avant tout la construction d'un marché, conçu politiquement comme un espace de libre circulation (des personnes, des marchandises, des capitaux). C'est pourquoi le Droit de la Concurrence est son ADN et demeure le cœur de la jurisprudence de la Cour de justice de l'Union européenne, qui tient désormais l'équilibre entre les diverses institutions, par exemple la Banque Centrale Européenne, dont les décisions peuvent être attaquées devant elle. Mais aujourd'hui le Droit de l'Union européenne se tourne vers d'autres buts que la "liberté", laquelle s'exprime dans l'immédiat, notamment la "stabilité", laquelle se développe dans le temps. C'est pourquoi la Banque y prend un si grande importance.

En outre, face aux "libertés" les "droits" montent en puissance : c'est par les institutions juridiques que l'Europe trouve de plus en plus son unité, l'Europe économique et financière (l'Union européenne) et l'Europe des droits humains (le Conseil de l'Europe au sein duquel s'est déployée la Cour européenne des droits de l'Homme) exprimant les mêmes principes. C'est bien à travers une décision prenant appui sur le Droit de la concurrence que la Commission européenne le 18 juillet 2018 a obligé Google à concrétiser le "droit d'accès" à des entreprises innovantes, apte à faire vivre l'écosystème numérique, tandis que le Régulateur financier doit respecter les "droits de la défense" des personnes qu'il sanctionne.

Aujourd'hui à côté de l'Europe économique se développe en même temps par des textes une Europe bancaire et financière (on ne sait pas si par le Droit - par exemple le droit de la propriété intellectuelle - existera une Europe industrielle).La crise a fait naître l'Europe bancaire et financière. L'Union bancaire est issue de Règlements communautaires du 23 novembre 2010 établissant des sortes de "régulateurs européens" (ESMA, EBA, EIOPA) qui donnent une certaine unité aux marchés financiers qui demeurent nationaux, tandis que les entreprises de marché, entreprises privées en charge d'une mission de régulation, continuent leur déploiement selon des techniques de droit privé. L'Union bancaire est née d'une façon plus institutionnelle encore, par trois piliers qui assurent un continuum européen entre la prévention des crises, la résolution des crises et la garantie des dépôts. En cela, l'Europe bancaire est devenue fédérale.

Sur les marchés de capitaux, des instruments financiers et des titres, l'Union européenne a utilisé le pouvoir que lui confère depuis la jurisprudence Costa et grâce au processus Lamfallussy d'une sorte de "création continuée" pour injecter en permanence de nouvelles règles perfectionnant et unifiant les marchés nationaux. C'est désormais au niveau européen qu'est conçu la répression des abus de marché mais aussi l'information des investisseurs, comme le montre la réforme en cours dite "Prospectus 3". A l'initiative de la Commission Européenne, les textes sont produits en "paquet" car ils correspondent à des "plan d'action " . Cette façon de légiférer est désormais emprunté en droit français, par exemple par la loi dite PACTE du 29 avril 2019. Cette loi vise - en se contredisant parfois - à produire plus de concurrence, d'innovation, à attirer l'argent sur des marchés dont l'objectif est aussi la sécurité, notion d'égale importance que la liberté, jadis seul pilier du Droit économique. Conçue par les but, La loi est définitivement un "instrument", et un instrument parmi d'autres, la Cour de Justice tenant l'équilibre entre les buts, les instruments et les institutions.

La question du "régulateur" devient plus incertaine : la BCE est plus un "superviseur" qu'un "régulateur" ; le plan d'action pour une Europe des marchés de capitaux ne prévoit pas de régulateur, visant un capitalisme traditionnelle pour les petites entreprises (sorte de small businesses Act européen).

____

____

Se reporter au Plan complet du cours.

____

Revenir aux bases avec le Dictionnaire bilingue du Droit de la Régulation et de la Compliance.

__________________________________________________________________________

Documentation spécifique à cette leçon sur

l'Europe du Droit de la Régulation bancaire et financière

Documentation sur les textes et les institutions :

- Présentation par la BCE du système unique de supervision (single supervisory mechanism) (en anglais), qui prend soin de rattacher la supervision à la fonction d'origine de la BCE.

- Présentation du Fond de Résolution unique par lui-même (en anglais)

- Présentation du nouveau Règlement dit Prospectus III par l'AMF (adopté en 2017, applicable en 2019

- La transformation du Droit français par l'adoption du Règlement dit Prospectus III

- Présentation du paquet MIR 2 par l'AMF

- The European RuleBook

- MoU entre l'ESMA et la Financial Conduct Authority, 1ier février 2018.

- Capital Markets Union Action Plan, 2019

- Présentation par l'AMF des Réglements de l'Union européenne "Prospectus 3" et leur transposition, 2019

Documentation sur la jurisprudence :

- ESMA, 11 juillet 2018, Danske Bank

- Article sur l'arrêt de la Cour suprême britannique du 4 juillet 2018, Goldman Sach v/Novo Banco

- CJCE, 15 juillet 1964, Costa

- CJCE, 16 juin 2015,

- Cons. cons., 6 février 2015, Société mutuelle de transports Assurance

- AMF, Comm. sanction, 24 janvier 2019, BRED

________

Sept. 30, 2021

Thesaurus : Soft Law

► Référence complète : Parlement européen, Preventing money laundering in the banking sector reinforcing the supervisory and regulatory framework, 30 septembre 2021.

___

________

Dec. 15, 2020

Thesaurus : Soft Law

Full reference: AMF / AFM, Position paper : Call for a European Regulation for the provision of ESG data, rating, and relate services, 15th of December 2020

In this document, AMF and AFM analyses the perspective to supervise ESG rating agencies and the perspective to make ESMA supervisor of these agencies.

Oct. 9, 2020

Thesaurus : Soft Law

Full reference: Financial Stability Board, The Use of Supervisory and Regulatory Technology by Authorities and Regulated Institutions. Market Developments and Stability Implications, Report of 9th of October 2020, 36 p.

Read the presentation of the report by the Financial Stability Board

To go further on the question of the use of new technologies in regulatory processes, read Marie-Anne Frison-Roche's working paper: Analysis of blockchains with regards with the uses they can fulfill and the functions that the ministerial officers must ensure

Sept. 2, 2020

Newsletter MAFR - Law, Compliance, Regulation

Full reference: Frison-Roche, M.-A., For regulating or supervising, technical competence is required: example of the French creation of the "Pôle d'expertise de la régulation numérique", Newsletter MAFR - Law, Regulation, Compliance, 2nd of September 2020

Lire par abonnement gratuit d'autres news de la Newsletter MAFR - Law, Regulation, Compliance

Summary of the news

Through a decree of 31st of August 2020, the government created a national service, the "Pôle d'expertise de la régulation numérique" (digital regulation expertise pole). It has to furnish to State services a technical expertise in computer science, data science and algorithm processes in order to assist them in their role of control, investigation and study. The aim is to favor information sharing between researchers and State services in charge of regulating digital space.

As its acronym indicates, this pole of expertise aims to represents constance in a changing world. Moreover, more than being a national service, this organism must adopt a transversal dimension, its creation decree being signed by the Prime Minister, Minister of Economy, Minister of Culture and Minister of Digital Transition. The creation of such a pole shows the awareness of the government of the importance of technical competency in the regulation of digital space and of the necessity to centralize these expertises in one organ.

However, as the decree indicates, this pole of expertise could be consulted only by "State services", that excludes regulators which are independent from the State and which could put the pole in conflict of interest, and courts even if they are supposed to play a central role in the regulation of digital space and even if they are allowed to ask the advice of the regulator about some cases. But if regulators cannot size the pole, to whom does it benefit except the legislator and a few officials?

It would therefore have been better for this pole of expertise to be placed under the direction of regulatory and supervisory bodies, which would have enabled it to be able to be consulted both by regulators and by judges, both of whom are key players in digital regulation.

Aug. 10, 2020

Newsletter MAFR - Law, Compliance, Regulation

Full reference : Frison-Roche, M.-A., The practical utility to have a firm definition of "Compliance", Newsletter MAFR - Law, Compliance, Regulation, 10th of August 2020.

Read by subscribing the other news in the Newsletter MAFR - Law, Compliance, Regulation

Summary of the news

Some says that defining Compliance is a theoretical and non useful exercice that should be left aside to tackle the study of concrete technical cases. However, to be able to use Compliance tools, it is first necessary to have a clear, firm and simple idea of what is Compliance. Moreover, the future of this new branch of law intensely depends on the definition we choose to use.

Compliance Law gives to some crucial private firms new responsibilities such as the one to fight against global dangers or the one of saving the planet. In this, Compliance Law can be perceived as a kind of new deal between the private sector and public authorities, with the only difference that this time the consent of the private sector is not required.

Some would say that the concretization of such projects is the duty of the State and that private firms, if they must respect the rules, do not have to find a way to concretize a "monumental goal". However, the world face new and systemic dangers in the face of which the State alone is powerless, technically or geographically, and against which crucial companies can act.

It is not about, as some advocate to put human being aside of Compliance Law by letting machines decide. It is about placing the human being and its protection at the heart of Compliance Law. In this, Compliance Law can become a new humanism.

To go further, read Marie-Anne Frison-Roche's working paper, The Dreamed Compliance Law

July 25, 2020

Thesaurus : Doctrine

Full reference: Thouret, T., Le pharmacien, un "opérateur crucial" pour prévenir une crise des opiacés en France, Actu-juridiques, Lextenso, 2020

Lire l'article (in French)

June 23, 2019

JoRC

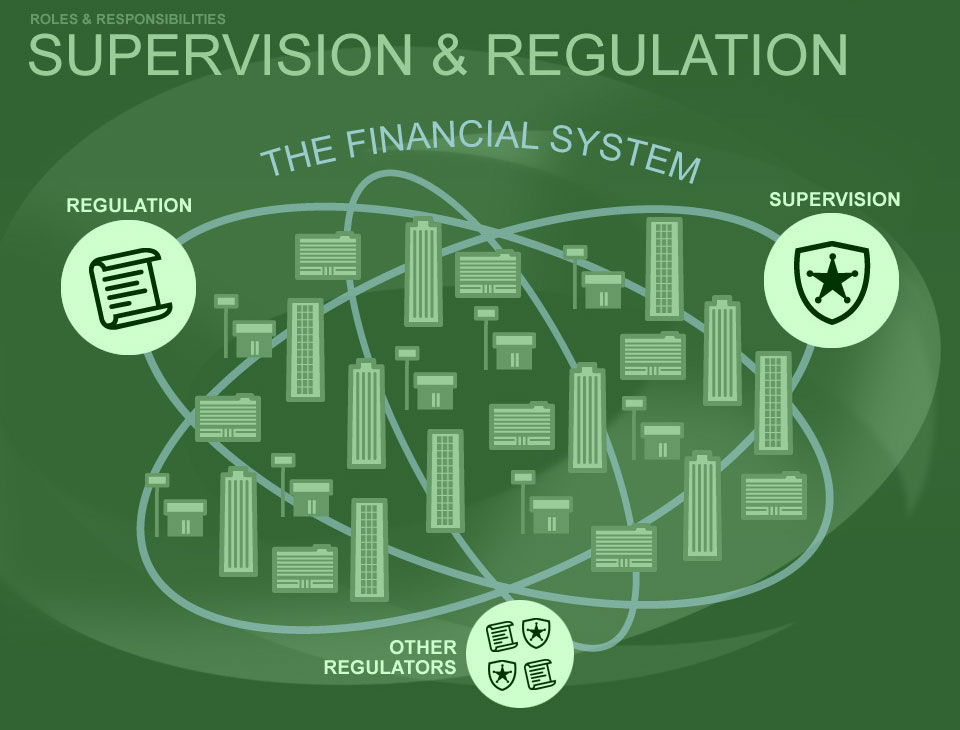

The European Banking Union is based on supervision as much as on regulation: it concerns the operators as much as the structures of the sector, because the operators "hold" the sector.

This is why the "regulator - supervisor" holds the operators by the supervision and is close to them.

He meets them officially and in "soft law" relations. This is all the more necessary since the distinction between the Ex Ante and the Ex Post must be nuanced, in that its application is too rigid, in that it involves a long time (first of all the rules, then to apply them, then to notice a gap between rules and behaviors, then to repair it) is not appropriate if the system aims at the prevention of systemic crises, whose source is inside the operators.

This is why the body in charge of solving the difficulties of the systemic banks for the salvation of the systeme meets the banking sector itself, to ensure that they are permanently "resolvable", so that the hypothesis of their resolution never arises. This is the challenge of this system: that it is always ready, for never be applying.

____

In the European Banking Union, the Single Resolution Board (SRB) is in charge of "resolve" the difficulties of European systemic banks in difficulty. It is the public body of the second pillar of the Banking Union. The first pillar is the prevention of these difficulties and the third is the guarantee of deposits. The resolution is therefore more like an Ex Post mechanism.

But in this continuum through these three pillars between the Ex Ante and the Ex Post, the SRB does not wait passively - as would a traditional judge do - that the file of the troubled bank reaches it. Like a supervisor - which brings it closer to the first public in the system (Single Supervisory Board -SSB), which supervises all the banks, it is in direct contact with all the banks, and it approaches the hypothesis of a bank in trouble by a systemic perspective: it is therefore to the entire banking system that the SRB addresses itself.

As such, it organizes meetings, where he is located: in Brussels.

To resolve in Ex Post the difficulties of a bank, it has to present a quality (a little known concept in Bankruptcy Law): "resolvability". How build it? Who build it ? In its very design and in its application, bank by bank.

For the resolution body vis-à-vis all players in the banking and financial sector, it's clear: "Working together" is crucial in building resolvability ".

In the projection that is made, it is affirmed that there can be a successful resolution only if the operator in difficulty is not deprived of access to what makes to stay it alive, that is to say the banking and financial system itself, and more specifically the "Financial Market Infrastructures", for example payment services.

Does the Single Resolution Board expect spontaneous commitments from the FMIs for such a "right of access"? In this case, as the Single Resolution Board says, this right of access corresponds to "critical functions" for a bank, the resolution situation can not justify the closure of the service.

By nature, these crucial operators are entities that report to regulators who oversee them. Who enforces - and immediately - this right of access? When one can think that it is everyone, it risks being nobody .... That is why the resolution body, relaying in this a concern of the Financial Stability Board, underlines that it is necessary to articulate the supervisors, regulators and "resolvers" between them.

_____

To read this program, since it is a proposed program of work for the banking sector, four observations can be made:

1. We are moving more and more towards a general "intermaillage" (which will perhaps replace the absence of a global State, but it is an similar nature because it is always to public authorities that it refers and not to self-regulation);

2. But as there is no political authority to keep these guardians, the entities that articulate all these various public structures, with different functions, located in different countries, acting according to different temporalities, these are the companies themselves that internalize the concern that animates those who built the system: here the prevention of systemic risk. This is the definition of Compliance, which brings back to companies, here more clearly those those which manage the Market Infrastructures, the obligations of Compliance (here the management of systemic risk through the obligation of giving access).

3. Even without a single systemic guard, there is always a recourse. That will be the judge. There are already many, there will probably be more in a system of this type, more and more complex, the articulation of disputes is sometimes called "dialogue". And it is undoubtedly "decisions of principle" that will set the principles common to all of these particular organisms.

4. We then see the emergence of Ex Ante mechanisms for the solidity of the systems, and the solidity of the players in the systems, and then the Ex Post resolution of the difficulties of the actors according to access to the solidity of the infrastructures of these systems, which ultimately depend on judges (throughout the West) facing areas where all of this depends much less on the judge: the rest of the world.

____

Oct. 4, 2017

Editorial responsibilities : Direction of the collection "Regulations & Compliance", JoRC & Dalloz

🌐follow Marie-Anne Frison-Roche on LinkedIn

🌐subscribe to the Newsletter MAFR Regulation, Compliance, Law

____

► Full Reference: M.-A. Frison-Roche (ed.), Régulation, Supervision, Compliance (Regulation, Supervision, Compliance), Dalloz, coll. "Thèmes & Commentaires", "Régulations" Serie, 2017, 148 p.

____

► General presentation of the book: Regulation. Supervision. Compliance. Three terms that until recently were virtually unknown in legal systems. Or at least considered to be peculiar to Anglo-American legal systems: Regulation, Supervision, Compliance. These terms are like Trojan horses through which Common Law is taking over our legal traditions to make European companies, especially banks, bend over backwards, take over institutions and impose methods.

Three words by which the invasion is carried out. Through the violence of repression and compliance penalties, through the mildness of codes of conduct and corporate social responsibility. By laws as new as they are strange, such as the French so-called "Sapin 2" law or the French law introducing a "duty of vigilance" for companies whose fault would be to have succeeded in expanding internationally.

One can have this defensive conception of Compliance, generating a "Compliance Law", produced by the internalisation of Regulatory Law in global economic operators, who are then subject to supervision by Regulators, even though these firms are not regulated, with Compliance extending beyond the supervised sectors (banks and insurance companies).

We can (and maybe must) have a more welcoming, and therefore more offensive, conception of Compliance. It can be the crucible of a relationship of trust on a supra-national scale between these operators and the regulators, the former being able to contribute, like the latter, to serving goals that go beyond them all, of which the fight against corruption and money laundering are but a few examples.

In this way, the issue is the construction of the European Compliance Law.

____

📝read the interview given by Marie-Anne Frison-Roche to the Petites Affiches, "We need to build a European compliance system - that's the future! ire l'entretien donné par Marie-Anne Frison-Roche aux Petites Affiches ,"Il faut construire un dispositif européen de compliance, voilà l'avenir !" ("We need to build a European Compliance System - that's the Future!"), about the publication of this book (in French)

____

____

This volume is the continuation of the books dedicated to Compliance in this collection.

📚Read the presentations of the other books on Compliance in this Serie:

- further books:

🕴️M.A. Frison-Roche (ed.), 📕Le système probatoire de la Compliance, 2025

🕴️M.A. Frison-Roche (ed.), 📕Compliance et Contrat, 2024

🕴️M.A. Frison-Roche (ed.), 📕L'obligation de Compliance, 2024

🕴️M.A. Frison-Roche et M. Boissavy (eds.), 📕Compliance et droits de la défense. Enquête interne - CJIP - CRPC, 2024

🕴️M.A. Frison-Roche (ed.), 📕La juridictionnalisation de la Compliance, 2023

🕴️M.A. Frison-Roche (ed.), 📕Les Buts Monumentaux de la Compliance, 2022

🕴️M.A. Frison-Roche (ed.), 📕Les outils de la Compliance, 2021

🕴️M.A. Frison-Roche (ed.), 📕Pour une Europe de la Compliance, 2019

🕴️N. Borga, 🕴️J.-Cl. Marin and 🕴️J-.Ch. Roda (eds.), 📕Compliance : l'Entreprise, le Régulateur et le Juge, 2018

- previous books:

🕴️M.A. Frison-Roche (ed.), 📕Internet, espace d'interrégulation, 2016

📚Read the presentations of the other titles of the Serie.

____

🏗️General construction of the book:

Consulter le sommaire de l'ouvrage.

____

► Understand the book through the Table of Contents and the summaries of each article:

🕴️M.-A. Frison-Roche, 📝Du droit de la régulation au droit de la compliance

I. AUTOUR DE LA NOTION DE COMPLIANCE (AROUND THE NOTION OF COMPLIANCE)

🕴️B. de Juvigny, 📝La compliance, bras armé de la régulation

🕴️I. Falque-Pierrotin, 📝L'Europe des données ou l'individu au coeur d'un système de compliance

🕴️B. Lasserre, 📝Concurrence et bien public

🕴️J.-M. Sauvé, 📝Compliance, droit public et juge administratif

🕴️J.-Cl. Marin, 📝Droit pénal et compliance

II. CHOCS ET ACCLIMATATION DE LA COMPLIANCE DANS LE SYSTÈME JURIDIQUE (SHOCKS AND ACCLIMATISATION OF COMPLIANCE IN THE LEGAL SYSTEM)

🕴️D. Migaud, 📝Le nouveau rapport entre l'État et les normes impliquées dans la compliance

🕴️A. C. Bénichou, 📝Nouvelles technologies : réflexions sur la compliance et l'éthique

🕴️J.-M. Darrois, 📝La loi Sapin II : un défi pour les avocats

🕴️Y. Perrier, 📝"Diplomatie" de la compliance et de sa régulation

III. LES DIALOGUES OUVERTS PAR LA COMPLIANCE (DIALOGUES OPENED UP BY COMPLIANCE)

🕴️J.-B. Auby, 📝Le dialogue de la norme étatique et de la compliance

🕴️L. Donnedieu De Vabres, 📝Pas de compliance sans confiance

🕴️J. Bédier, 📝La compliance, un outil actif de développement de l'entreprise

🕴️A. De La Cotardière, 📝Le rôle de l'avocat en matière de compliance

________

Dec. 11, 2014

Thesaurus : Doctrine

Référence complète : Roussel Galle, Ph. et Douaoui-Chamseddine, M., Les défaillances bancaires et financières : un droit spécial ?, Revue de droit bancaire et financier, déc. 2014, p.64-65.

Les étudiants de Sciences po peuvent lire l'article par le drive dans le dossier "MAFR - Régulation"

Aug. 31, 2014

Blog

L'ouvrage de Stéphane Voisard est très intéressant car il montre que des personnes privées sont intégrées par la puissance publique pour que le système de supervision des banques soit efficace. Il faut mais il suffit que ces personnes soient des experts fiables et crédibles.

L'ouvrage de Stéphane Voisard est très intéressant car il montre que des personnes privées sont intégrées par la puissance publique pour que le système de supervision des banques soit efficace. Il faut mais il suffit que ces personnes soient des experts fiables et crédibles.

Il montre tout à la fois que c'est une conception assez générale du droit administratif.

Son ouvrage démontre que cet état du droit et de sa pratique dépasse la distinction du droit public et du droit privé.

Oct. 15, 2013

Thesaurus : 06.1. Textes de l'Union Européenne

March 2, 2011

Thesaurus : Doctrine

Cet article est paru dans le numéro que la Revue d'Economie Financière a consacré à " La supervision" en 2011 que la crise financière conduit à repenser au regard du risque systémique.

La supervision" en 2011 que la crise financière conduit à repenser au regard du risque systémique.

Le numéro précédent de la Revue avait été consacré au thème de la Régulation.

Pourtant, cet article dans le numéro consacré à la supervision porte sur la régulation bancaire et financière. Cela tient au fait qu'ici le terme de "régulation" est utilisé dans le sens de "réglementation", l'article visant aussi bien les comportements de marché, les instruments de marché que les exigences de fonds propres.

March 2, 2011

Thesaurus : Doctrine

Paru en 2011, ce numéro thématique porte sur "La supervision" au regard du risque systémique, tandis que le précédent portait sur "La régulation" au regard de ce même thème.

Paru en 2011, ce numéro thématique porte sur "La supervision" au regard du risque systémique, tandis que le précédent portait sur "La régulation" au regard de ce même thème.

Il en ressort, pour éviter la prochaine crise, la volonté d'étendre la supervision, notamment aux "non-banques", comme les compagnies d'assurance, et de la renforcer, notamment quant aux moyens de contrôle, de surveillance et de sanction des Autorités de supervision.