Compliance and Regulation Law bilingual Dictionnary

The sector is the first historical reference for Regulation since, independently of the notion of market, it is a set of economic activities which have a technical object in common, for example the telephone, rail or banking. It is precisely because these objects have a particular technicality, for example conveying innovation or presenting a risk, or developing only in the long term, that definitive regulations are put in place, because there is a failure of market.

The breakdown by sector seems to be obvious, for example the post office on the one hand, the telephone on the other hand, and the media on the third. But the evolution of technology means that if one takes into consideration the transmission of information first, these sectors become interchangeable. This is why the primary criterion of technicality that justifies recourse to the sector to define the contours of regulation, the construction of a regulator and its powers, necessarily evolves over time with the technical modifications of the objects in question. This is why, for example, we have chosen to segment the telecommunications sector into around twenty markets, while the minds of the possible merger of regulators of the container and content in telecommunications and the media or that we hesitate between 'interregulation and the merger between banking, finance and insurance, while the entry into the digital "era" would give the idea of a new regulator, while it is difficult to say that the digital is a sector.

The question then arises as to whether the "sector" is an outdated benchmark. Internet and digital can make it think so. The sector, if it is not an outdated concept, is at least for regulation a changing concept, for example in that it must give way to the concept of sector.

Self-regulation refers to a system capable of defining its equilibrium by its own forces or, if there is a dysfunction in it, to restore them equally by its own forces. Self-regulation refers to a system capable of defining its equilibrium by its own forces or, if there is a dysfunction in it, to restore them equally by its own forces. Thus, the competitive market for ordinary goods and services is self-regulated. Indeed, since there are no barriers to entry and there is information on products and prices, coupled with mobility of atomized consumers, consumers permanently make functioning competition between offers, this elaborating the right price. If an agent fixes an abusive high price, a third party outside the market will enter it to offer consumers a lower price, the new entrant coveting that rent, and consumers, by nature unfaithful, thus changing supplier. Essential is therefore free trade, the absence of a barrier to entry and the absence of eviction from one undertaking to another, eviction being the most serious anticompetitive practice. Thus, competition law is based on the premise of a self-regulated market. In these circumstances, it is only on a case-by-case basis that anti-competitive conducts, agreements and abuses of dominant position can be found. They are then sanctioned ex post by the competition authority which, by appropriate sanctions, somehow "repairs" the market.

Today we live at the same time a certain despair in front of the pretension of the self-regulation ethics, because the banks pretended to do it and the information brought by the financial crisis lead to take some distance in relation to this moral discourse, while that at the same time we are called to a renewal of this moral sense in business and in capitalism. Social responsibility can constitute this renewal.

Finally, self-regulation can be sociological when a sector is composed of people who know each other, whether they work in companies, in the administration or in the regulatory body. The case is all the more widespread because it corresponds to the organization of the network society. This is actually a self-regulation by club effect. The danger of this self-regulation is no longer at the risk of a moralizing discourse that is more a matter of marketing, but of an almost unconscious compromise of the regulator, thus captured by habit or friendship. The regulatory system must also seek to break this self-regulation, which is dangerous for the impartiality of the regulator.

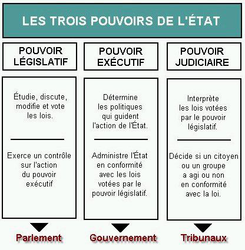

Montesquieu has written the theory of the political separation of powers. The French political model, by its Constitution and since the French Revolution, has separated the legislative power stemming from universal suffrage and, in France, the executive power, the head of state being directly elected. Formally, the judiciary is not a power but a mere "authority".

This last statement still corresponds to the letter of the texts, in particular to the letter of the French Constitution, but the evolution of the texts and especially the evolution of practices has led to the formation of a sort of "jurisdictional power", linking today to the existence of a judicial power, since the judicial power includes both the power of the administrative courts and the judicial courts. There are therefore three Powers which must be "separated": the legislative power, the executive power on the one hand and the jurisdictional power on the other hand.

Regulation does not correspond to this constitutional scheme of separation of powers on several fundamental points. In the first place, the Regulator combines the legislative power, of the quasi-legislative type, with the executive power notably when it adopts individual decisions, and the judicial power when sanctioning or resolving the disputes. This cumulation of all powers makes it a kind of "miniature State", or even a sort of "little king", referring to the phenomenon of reforodalisation of society. This has been strongly criticized in the name of the principle of separation of powers.

Second, the regulator, an organ of the State, does not obey the executive, since by nature it must be independent. As such, the Regulator, if it most often belongs to the State taking the form of an Independent Administrative Authority (IAA), does not belong to any power. Should we consider that regulators, whose powers are extreme in economically and politically crucial sectors, constitute a kind of fourth political power, going beyond the traditional organization? Some think so.

Others also go very far, but in another direction. They believe that the Regulatory Law has destroyed the continental system of separation of powers to lead the countries concerned towards a more English or American political system of check and balance.

Classically, the People are sovereign and through the game of representation Parliament expresses its will, while a more Hegelian schema confers on the State, being superior, the power to express through the same channels, essentially Law, its general will.

The State therefore imposes its will without more justification than the very existence of its upstream legitimacy, since it is the People who have conferred its powers on it: the State is sovereign and is not accountable.

This is why Regulation is philosophically a "theory of suspicion", which refuses to grant relevance to these political presuppositions and rather sees in the situation of powers an arrangement of administrations and of particular persons who defend their particular interests, in inside and outside the country.

This is why Europe by liberalizing regulated sectors, those even where the State strongly claimed its sovereignty, for example through nuclear planning, by requiring regulatory authorities to attack incumbent operators from within through regulation. asymmetric, destroyed the ideology of sovereign states, reducing them to the ordinary.

This question remains open.

Legally, the State is a public law subject defined by territory, people and institutions. It acts in the international space and emits norms. Politically, it has the legitimacy required to express the will of the social body and to exercise the violence of which it deprives the other subjects of law. It is often recognizable by its power: its use of public force, its budgetary power, its jurisdictional power. These three powers, declining or being challenged by private, international and more satisfying mechanisms, some predicted the disappearance of the State, to deplore it or to dance on its corpse.

With such a background, in current theories of Regulation, primarily constructed by economic thought and at first sight one might say that the State is above all the enemy. And this for two main reasons. The first is theoretical and of a negative nature. The advocates of the theory of regulation deny the State the political qualities set out above. The State would not be a "person" but rather a group of individuals, civil servants, elected officials and other concrete human beings, expressing nothing but their particular interests, coming into conflict with other interests, and using their powers to serve the former rather than the latter as everyone else. The Regulation theory, adjoining the theory of the agency, is then aimed at controlling public agents and elected representatives in whom there is no reason to trust a priori.

The second reason is practical and positive. The State would not be a "person" but an organization. Here we find the same perspective as for the concept of enterprise, which classical lawyers conceive as a person or a group of people, while economists who conceive of the world through the market represent it as an organization. The state as an organization should be "efficient" or even "optimal". It is then the pragmatic function of the Regulation Law. When it is governed by traditional law, entangled by that it would be an almost religious illusions of the general interest, or even the social contract, it is suboptimal. The Regulation purpose is about making it more effective.

To this end, as an organization, the State is divided into independent regulatory agencies or independent administrative authorities that manage the subjects as close as possible, which is fortunate in reducing the asymmetry of information and in reviving trust in a direct link. The unitary, distant and arrogant State is abandoned for a flexible and pragmatic conception of a strategic state (without capital ...) that would finally have understood that it is an organization like any other ...

Competition law adopts this conception of the State, which it posed from the beginning that it was an economic operator like any other. This is how this conception which would be more "neutral" of the world is often presented.

Successive crises, whether sanitary or financial, have produced a pendulum effect.

Now, the notions of general interest or common goods are credited of an autonomous value, and the necessity of surpassing immediate interests and of finding persons to bear superior interests or to take charge of the interests of others, even a non-immediate one, emerged.

Thus, the State or the public authority, reappears in the globalization. The Compliance Law or the Corporal Social Responsibility of the crucial companies are converging towards a consideration of the State, which can not be reduced to a pure and simple organization receptacle of externalities.

In Europe, Community Law prohibits States from providing aid to companies, which are analyzed as means for the benefit of their country which the State cares about (and sometimes wrongly) having the effect and maybe the object of maintaining or constructing borders between peoples, thus contradicting the first European political project of a common area of peace and exchanges between the peoples of Europe. That is why this prohibition does not exist in the United States, since Antitrust Law is not intended to build such a space, which is already available to businesses and people.

This essential difference between the two zones changes industrial policies because the US federal Government can help sectors where Member States can not. The European prohibition of State Aid can not be called into question because it is associated with the political project of Europe. This seems to be an aporia since Europe is handicapped against the United States.

In any form it takes, Aid is prohibited because it distorts equality of opportunity in competition between operators in the markets and constitutes a fundamental obstacle to the construction of a unified European internal market. On the basis of this simple principle, a branch of technical and specific law has developed, because States continue to support their entreprises and sectors, and many rules and cases divide this principe of prohibition into as many exceptions and nuances. Is built over the years a probation system related to it. Thus, the concept of a public enterprise was able to remain despite this principle of prohibition.

But if there is a crisis of such a nature or magnitude that the market does not succeed by its own forces to overcome and / or the European Union itself pursues a-competitive objectives, exogenous Regulation, which can then take the form of legitimate State Aid. Thus a sort of synonymy exists between State Aid and Regulation.

For this reason, the European institutions have asserted that State Aid becomes lawful when it intervenes either in strategic sectors, such as energy production in which the State must retain its power over assets, or the defense sector. Far from diminishing, this hypothesis is increasing. European Union Law also allows the State to intervene by lending to financial operators threatened with default or already failing, the State whose function is to fight systemic risk, directly or through its Central Bank. The aid can come from the European Central Bank itself helping States in issuing sovereign debt, the Court of Justice having admitted in 2015 the non-conventional monetary policy programs compliance with the treaties. In 2010, the European Commissioner for Competition stressed that public aid is essential tools for States to deal with crises, before regulations come to the fore in 2014 to lay the foundations of the European Banking Union.

Look at the video defining the "subjective right"

Subsidiarity in the current sense is the idea that those closest to the action to be carried out must do so rather than the one who is far from it, because the latter is on the one hand less legitimate to do so and on the other hand less effective to do so. Subsidiarity is therefore a mechanism of both efficiency and legitimacy. In this respect, it constitutes both a political and a management principle: it is a principle of governance.

It is also found in the form of a legal principle in European Union law, with a strong impact in Regulatory Law.

Indeed, the principle of subsidiarity is a pillar of the European Union. Article 5 of the Treaty states that the power which enables public authorities to act legally by setting standards and by coercion is and remains with the Member States. But - and this is the very meaning of the Treaty which founded the Community, then the European Union - powers and objectives have been conferred on the European Union. In a first formulation, it was stated that within the "limits" of these "competences" and these "objectives", the European Union (as a legal person endowed with powers) and its institutions - in particular the Commission - can to act.

The first meaning of the principle of subsidiarity is therefore that which one could say of a "sovereignty retained" by the Member States: everything that is not vested in the European Union is retained by the Member States. But we can see that as much as it is easy enough to define the "limits of competences", the line is less certain concerning the "objectives". Indeed, the "objectives" conferred on the Union are so broad that, depending on the interpretation given by the Court of Justice of the European Union (CJEU), there may not be much left of the principle of subsidiarity. This is why the text was completed, a principle indicating more of a method.

Indeed, the Treaty firstly states that in certain matters the European Union has "exclusive competence". It is also exceptional, since it is vested in the Member States. This mainly concerns customs jurisdiction outside the Union, monetary jurisdiction outside the euro zone, competition law and common commercial policy. In this case, the European institutions exercise their full normative powers. When this transfer has not taken place, the European Union is no longer prima facie legitimate, that is to say its institutions cannot act since the Member States remain the legitimate authors of the standards. But if it turns out that the European Union is best placed to effectively achieve the desired objectives, even if there is no transfer of exclusive competence to the Union, then if the European institution can provide this proof that it is "better placed" to act effectively, it will be able to act.

Completed, Article 5 of the Treaty now provides: By virtue of the principle of subsidiarity, in areas which do not fall within its exclusive competence, the Union intervenes only if, and to the extent that, the objectives of the action envisaged cannot be sufficiently achieved by the Member States, both at central, regional and local level, but may be better achieved, due to the dimensions or effects of the envisaged action, at the level of the Union.

The end of Article 5 is above all methodological: the method of comparing the effectiveness of the action of a Member State - for example a law - and the action of a Union institution - for example a draft Regulation drawn up by the European Commission. When the two claim to be the most effective in achieving the Community objective - for example - energy security, then the question of the burden of proof arises.

This is where the principle of subsidiarity takes all its power, which is above all proof: it is indeed for the European Union, in the above example the European Commission - to demonstrate that it is proved its project for an instrument (here an energy security regulation) which will be more effective in serving the objective, which the Member State could not achieve alone. A very heavy burden of proof for the Union and numerous objects of proof: the inability of the Member State to achieve this objective and the capacity of the Union to achieve it. If the Union provides this proof, then, even if there has not been a transfer of exclusive competence to its benefit, it will be able to act and lay down the principle that in Europe the normative power remains in the Member States.

The legal principle of subsidiarity is essential in Regulatory Law. Indeed, because of its link with Politics, sectoral regulations are generally not transferred exclusively to the level of the European Union. This is why, strictly speaking, there are no "European regulators", but rather agencies which centralize information and its access. However and to take the most topical example, the need generated by the financial and banking situation in Europe justified the regulatory, supervisory and institutional mechanisms being brought to community level by the Banking Union, from 2010. But we do not find the same transfers, for example in energy, rail or telecommunications, which would undoubtedly contradict the legal principle of subsidiarity.

Market regulation is defined as the set of mechanisms that allow markets to establish and maintain long-term balances that they cannot establish and maintain in the long term by their own forces. It is therefore a set of institutions and rules that relate to the markets and against which they are "black boxes".

On the other hand, it may happen that certain companies, because they are "crucial operators", justify that a public authority looks in transparency and controls its structure and its functioning. It is then a supervisory function.

It may happen that this supervisory function is exercised by the Regulatory Authority, when it ensures the solidity of a crucial operator, which the sector absolutely needs, for example because it manages a monopoly network. natural. It also happens that it is a separate Supervisory Authority, as is often the case in banking matters, supervision being provided by central bankers.

Supervision then takes the form of prudential supervision, ensures the solidity of the operators, that is to say enters into the operators and thus controls the adequacy of equity and quasi-equity , the organization of the company (rule of "four eyes" for the, which assumes that they not only a Chairman but also a CEO), control of managers etc. Thus prudential standards are indifferent to the market context. Regulation is for the outside, prudential is for the inside.

This opposition has turned out to be catastrophic since precisely there is communication between the inside and the outside when it comes to financial markets, since the financial market is a market of and information is designed inside. companies issuing the securities. Therefore, there can only be effective regulation if there is a well-designed prudential framework, and the opposition itself does not make sense, which is why many countries first identified the internal organs. to companies as soon as they emit information, thus feeding the markets and influencing the behavior of investors and other operators, as falling under regulation. This was the case with banks or investment service providers which are fully subject to financial regulation. The 2008 law gave full awareness of this continuum between prudential and regulatory and justified the creation of the Autorité de Control Prudentiel, which later became the Autorité de Control Prudential et de Résolution (ACPR), the integrity of the markets implying that the control of the reliability of the internal organization of certain operators with regard to their organization, the confidence that one can have in them and their way of exercising power, being the pledge of the solidity of the market itself.

This is why the new reflections on financial regulation, then on Regulation in general, highlight the notion of “”, which we could also call “crucial operators”, and which sets apart operators whose weight is so important. important on the market (regulatory criterion) that their internal organization must be special or particularly supervised (prudential criterion). Thus, regulation and governance, which were opposed, have become inseparable. This is aimed at all operators that a sector cannot do without. They become transparent to the public authority which supervises them.

Systemic risk is defined as what threatens a sector when the behavior and more particularly the failure of a single economic agent leads to chain behaviors (domino effect), which can cause the entire sector to collapse.

Banking and financial systems are by their very nature and definitely subject to systemic risk since a financial institution bankruptcy causes depositors to panic and withdraw funds, a behavior that is generalized and causes the market to collapse. The self-fulfilling and inescapable effect of the process makes the prevention of systemic risk imperative, both by the financial regulator and by the central bank.

This is why this is the strongest hypothesis where the principle of competition, however very strong between banks, is weighed against the radically necessary prevention of systemic risk. The means to prevent a systemic risk in order to manage a systemic crisis of a realized risk or to get out of the crisis are today a primary concern, leaving the concern for competition far behind. This is why all countries are now seeking to rebuild banking and financial regulation which could not play its role since the financial crisis occurred in 2008.

The Banking Union is built in this spirit. The less advanced Capital Markets Union, too.